Report Overview

LVT’s advanced rigid core segments like wood-plastic and stone-plastic composites are poised for sustained growth.

-

Superior resilience

-

Sound absorption

-

Dimensional stability

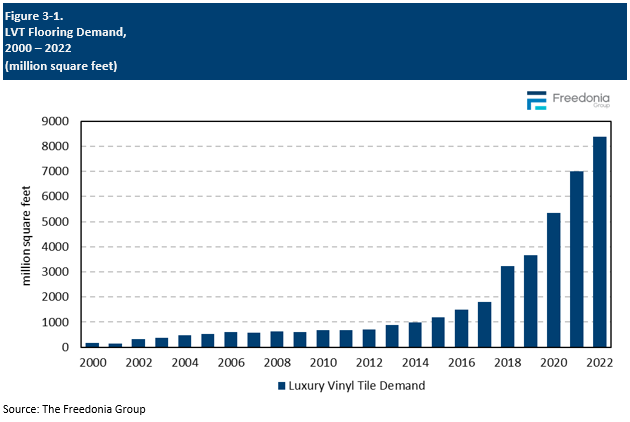

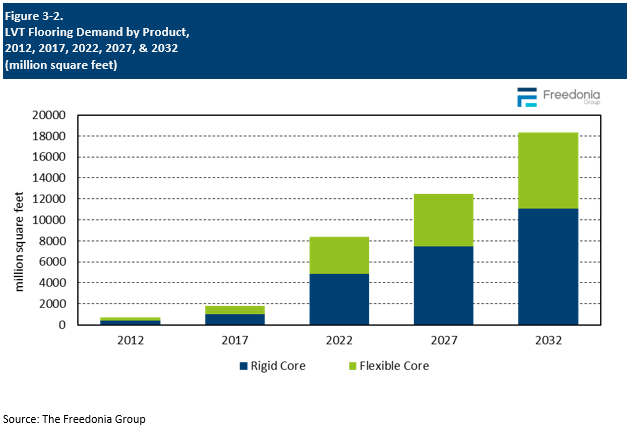

This Freedonia industry study analyzes the $12.4 billion luxury vinyl tile industry. It presents historical demand data (2012, 2017, and 2022) and forecasts (2027 and 2032) by product (rigid core and flexible core), market (residential, nonresidential) and application (new, remodeling). Annual historical data and forecasts are also provided from 2019 to 2026.

Featuring 80 tables and 18 figures – available in Excel and Powerpoint! Learn More

Demand for luxury vinyl tile (LVT) flooring in the US is forecast to increase 8.3% per year to 12.5 billion square feet in 2027, supported by:

-

a continuing shift in US consumer preferences away from carpet to LVT and other hard surface flooring products

-

rising residential remodeling activity in the US through 2027

-

LVT’s ability to improve a home’s market value

-

increasing usage in the commercial market, as flexible core products allow for the replacement of small sections or individual tiles rather than the entire floor

LVT to Become Most Popular Product in US, Ending Carpet’s Decades-Long Dominance

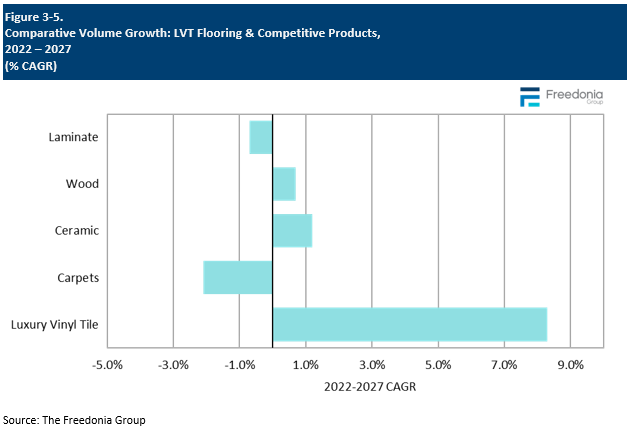

In 2024, LVT flooring is projected to surpass carpeting as the most popular flooring product in the US. Luxury vinyl tile has seen explosive growth over the past decade, ranking among the fastest growing products ever introduced to the US flooring market. Volume demand for LVT rose 28% per year from 2012 to 2022, increasing its share from 4% to 31% of the total market. Demand has and will continue to be supported by its favorable performance properties relative to carpet, such as ease of installation, superior aesthetics, and improved durability.

Wood Plastic Composite (WPC) to be Fastest Growing Flooring Product in the US

Demand for WPC flooring is expected to grow at a double-digit rate during the forecast period. Wood-plastic composite flooring products will not only be the fastest growing LVT type, but also the fastest growing flooring product in the US.

Although WPC is the most expensive type of LVT flooring, its usage will continue to rise at a rapid rate because of its product and performance properties, including:

-

better sound absorption and insulation

-

greater resiliency and underfoot comfort

-

lower environmental impact, as it uses less non-renewable resources

-

ease of installation over any type of subfloor, including concrete, plywood, tile, and existing flooring, without the need for extensive preparation or underlayment

Historical Market Trends

Annual flooring demand is most heavily influenced by trends in the construction industry. However, demand volume is somewhat insulated from economic variations in new construction activity because of the significant replacement need in residential and commercial buildings:

-

The large base of installed flooring is subject to high levels of wear and will require replacement at some point as a matter of course.

-

Flooring can be damaged beyond repair before the end of its lifespan (as in building fires or severe weather events), thereby requiring new installations.

-

Flooring also serves a decorative purpose, so it may be replaced before the end of its lifespan when a consumer wants to change a room or structure’s appearance.

Currency and pricing effects can yield significant volatility in value terms. For example, from 2020 to 2022, pandemic-related supply chain issues and high raw material costs precipitated flooring price increases that caused demand value to somewhat decouple from area for most flooring products. However, due to its rapid adoption as a newer material, LVT’s performance has not been as closely tied to these indicators as other more established flooring products.

Demand by Product

Luxury vinyl tile is composed of a vinyl base, a pattern layer, and a finish layer; it can be used in a wide variety of residential and commercial building applications.

The primary categories of luxury vinyl tile are:

-

rigid core, including wood-plastic composite and stone-plastic composite

-

flexible core, including glue down, loose lay, and flexible click

Demand for luxury vinyl tile is projected to advance 8.3% per year to 12.5 billion square feet in 2027, driven by manufacturer efforts to offer products with superior performance properties or more attractive surfaces.

Wood-plastic composite will gain share at the expense of all other product types; it is expected to grow at the fastest rate and account for the largest absolute gains in volume terms despite being the most expensive type, largely due to:

-

reduced risk of denting, cracking, or warping due to temperature changes or heavy furniture

-

ease of installation, as many come with interlocking tongue-and-groove systems that can float over the existing floor

-

homebuilders’ efforts to make their properties more desirable to potential purchasers, which can be accomplished by adding WPC flooring in parts of a home where it was not traditionally specified (such as living and family rooms)

- homeowners installing luxury vinyl tile flooring products that resemble natural wood looking to improve the appearance and value of their residences

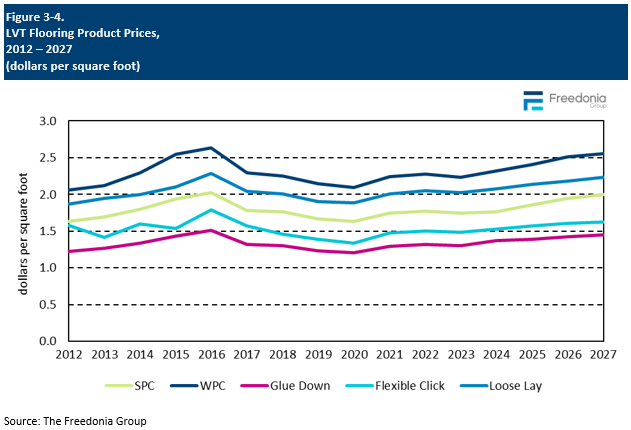

Pricing Trends

Average prices for LVT flooring are impacted by a variety of factors, including:

The LVT flooring industry experienced significant price increases in 2021, primarily brought on by the economic impact of COVID-19-related shutdowns in 2020 at many Chinese manufacturing facilities, which are the source of the vast majority of LVT imports to the US. As demand increased in 2021, the effects of these shutdowns were felt by these flooring producers; with supply not able to keep pace with demand.

The average price per square foot for LVT flooring in the US is forecast to rise 2.4% annually to $1.89 per square foot in 2027. Gains will be supported by stronger price growth for higher cost rigid core flooring. These gains will be supported by producers’ efforts to offer more aesthetically pleasing or better-performing materials, such as flooring products with more realistic woodgrains and surface textures. In addition, strong volume growth for WPC (the most expensive rigid core type) will bolster overall price increases.

Competitive Products

The main competition to LVT flooring in residential markets over the past decade has been wall-to-wall carpeting. The former has taken considerable share from the latter, which had been the longstanding leader in the US flooring market. By the end of 2024, LVT is projected to overtake carpet as the nation’s most widely used flooring product.

LVT competes with wood flooring in several key areas, offering advantages that make it an attractive alternative for many consumers.

-

While hardwood can warp, swell, or otherwise sustain damage when exposed to moisture, WPC LVT can withstand spills and humidity without being affected. This makes WPC a more suitable option for areas prone to moisture like kitchens, bathrooms and basements.

-

While wood floors are durable, they can scratch and dent more easily and may require refinishing over time to maintain their appearance. WPC is constructed in layers, including a wear layer for protection against stains, dents and scratches.

-

Though wood floors have the potential to add value to a home, WPC LVT is more cost effective in both initial purchase price and installation.

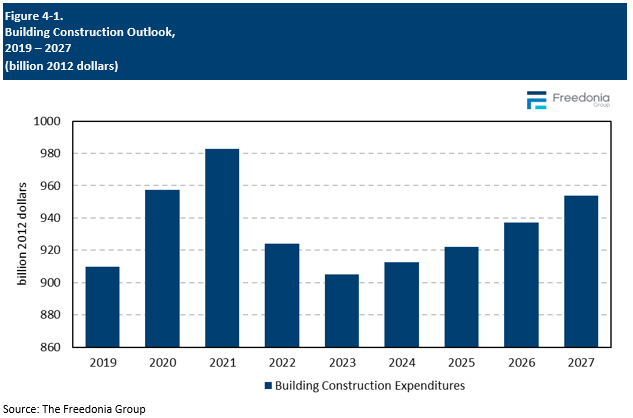

Building Construction Outlook

A key factor affecting demand for luxury vinyl tile flooring is the health and composition of the US building construction industry.

Real (i.e., inflation-adjusted) building construction expenditures are forecast to increase less than 1.0% annually during the 2022-2027 period. While commercial building construction will rebound following pandemic-related declines from 2020 to 2022, many of those gains will be offset by a sharp drop in residential building construction in 2023. Although residential construction will return to growth in 2024 and increase through the rest of the forecast period, levels in 2027 will remain below those in 2021 and 2022.