Report Overview

See Why Construction Chemical Demand is Forecast to Grow 3.4% Annually

-

accelerating construction activity in developing regions where urbanization and investment in public infrastructure is rising

-

the desire for more sustainable construction projects

This Freedonia industry study analyzes the $79.3 billion global construction chemicals industry. It presents historical demand data (2012, 2017, and 2022) and  forecasts (2027 and 2032) by product (protective coatings and sealers, caulks and adhesives, cement and concrete additives, polymer flooring, grouts and mortars, asphalt additives, spray polyurethan foam, cleaners and other construction chemicals) and market (building markets, infrastructure markets). The study also evaluates company market share and competitive analysis on industry competitors including Arkema, BASF, HB Fuller, Henkel, Mapei, Mohawk, Oriental Yuhong Waterproof Technology, and Sika.

forecasts (2027 and 2032) by product (protective coatings and sealers, caulks and adhesives, cement and concrete additives, polymer flooring, grouts and mortars, asphalt additives, spray polyurethan foam, cleaners and other construction chemicals) and market (building markets, infrastructure markets). The study also evaluates company market share and competitive analysis on industry competitors including Arkema, BASF, HB Fuller, Henkel, Mapei, Mohawk, Oriental Yuhong Waterproof Technology, and Sika.

Featuring 226 tables and 131 figures – available in Excel and Powerpoint! Learn More

Read our discussion on VOCs

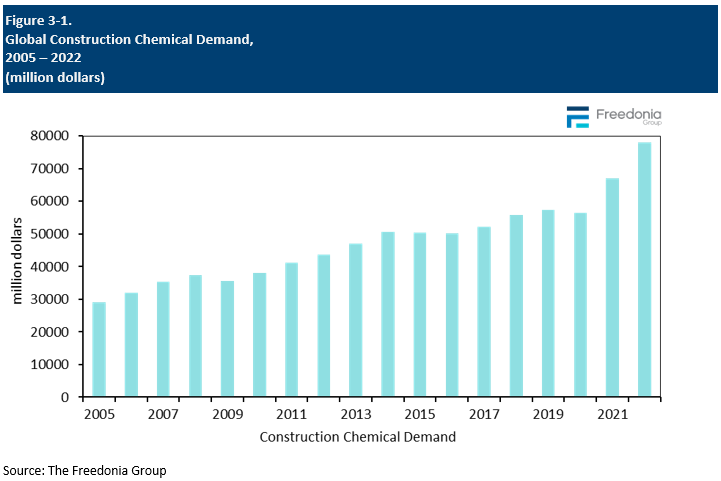

Global demand for construction chemicals is forecast to grow 3.4% annually to $92.2 billion in 2027. This will represent a significant deceleration from the pace seen during the 2017-2022 period, when supply chain issues and rising raw material costs caused construction chemical prices to surge in 2021 and 2022. However, real demand is expected to see solid growth due to:

-

accelerating construction activity – most notably among the residential building and nonbuilding segments – in developing regions where urbanization and investment in public infrastructure is rising

-

the desire for more sustainable construction projects, of which construction chemicals can be used to improve the energy efficiency of buildings

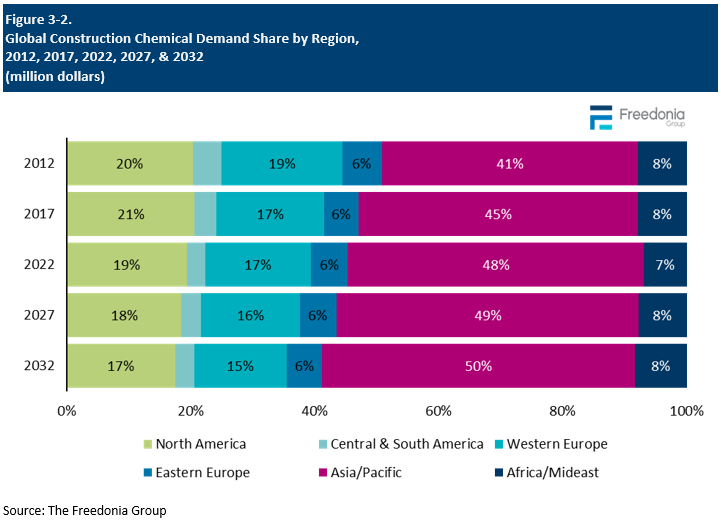

China & Western Nations Remain Biggest Markets; Industrializing Countries See Fast Growth

China will remain the largest market for construction chemicals, accounting for 30% of global demand in 2027. Although the country’s construction industry is not expanding as rapidly as it did during the 2000s, it continues to grow, and its already massive size allows for significant use of construction chemicals for both building and infrastructure construction. North America and Western Europe, while mature markets, also represent large outlets for construction chemicals. Gains in these regions will be supported by increasingly stringent environmental regulations and growing demand for “green” buildings, which necessitate the use of better performing (and more expensive) products.

Countries that are still industrializing, such as India and several Southeast Asian nations, are expected to see the fastest growth in construction chemical sales. Demand in these areas will be supported by both an increase in construction activity and greater uptake of chemicals as the quality of construction improves.

Sustainability Will Continue to Impact the Global Construction Chemicals Industry

Sustainability will impact all aspects of construction; consumer interest in eco-friendly structures continues to rise, and governments are implementing increasingly strict environmental regulations. Construction chemicals can, in many ways, also be used to improve the sustainability of construction projects:

-

Cement and concrete additives can be used to reduce the energy and water requirements for – and the amount of carbon emissions released during – cement and concrete production.

-

Protective coatings with lower levels of volatile organic compounds (VOCs) can improve the “health” of structures by reducing harmful emissions.

- Caulks, spray polyurethane foam, and other construction chemicals are used to limit heat transfer and improve the energy efficiency of structures.

Historical Market Trends

Construction chemicals are employed in a wide variety of construction, such as residential and nonresidential buildings, roads, bridges, and infrastructure including:

Global demand for construction chemicals is at its most basic level determined by underlying trends in the construction industry, primarily levels of new construction and repair and improvement activity. However, a variety of other factors also have a strong impact on the volume of construction chemicals used and the market’s value.

Real demand for construction chemicals depends on the following trends:

-

the type and size of buildings being constructed

-

preferences in the materials used to construct buildings or infrastructure

-

the location of construction and local climate and storm activity

-

economic conditions and political considerations affecting the commencement and completion of construction projects

In addition to trends in the volume of chemicals used in construction, the value of the construction chemicals market is also influenced by changes in product pricing and the impact of changing raw material, energy, and labor costs. Average prices are also impacted by changes in the overall product mix toward higher or lower cost products.

While demand for construction chemicals fell in 2020 due to the impact of the COVID-19 pandemic, demand skyrocketed in 2021 and 2022, due primarily to a surge in prices related to supply chain issues and rising raw material costs. Growth in volume terms was more restrained.

Demand by Region

Global demand for construction chemicals is expected to increase 3.4% per year to $92.3 billion in 2027. While market value will decelerate significantly due to moderation in construction chemicals pricing, real demand will grow steadily alongside ongoing increases in construction activity throughout the world.

In the developing countries of the Africa/Mideast, Central and South America, and Asia/Pacific regions, construction chemical demand will be driven by:

-

growing urbanization and investment in public infrastructure

-

more frequent use of construction chemicals

-

shifts to more advanced and more expensive products

In North America, Western Europe, and Japan, the maturity of those markets will restrain faster advances; however, the preference for more advanced formulations will support notable levels of demand.

The Asia/Pacific region will account for the largest absolute gains due to the presence of China, which will represent 30% of new global construction chemical demand. Demand in China will be boosted by moderate gains in construction activity, most notably residential building construction and nonbuilding construction, boosting demand for protective coatings and sealers and caulks and adhesives.

Other countries in the region, including India and smaller markets such as Vietnam and Thailand, will see above average gains. Growth in the region will reflect not only increasing construction activity but also increasing construction chemical usage rates, which remain well below the usage rates seen in more developed countries such as Australia and Japan.

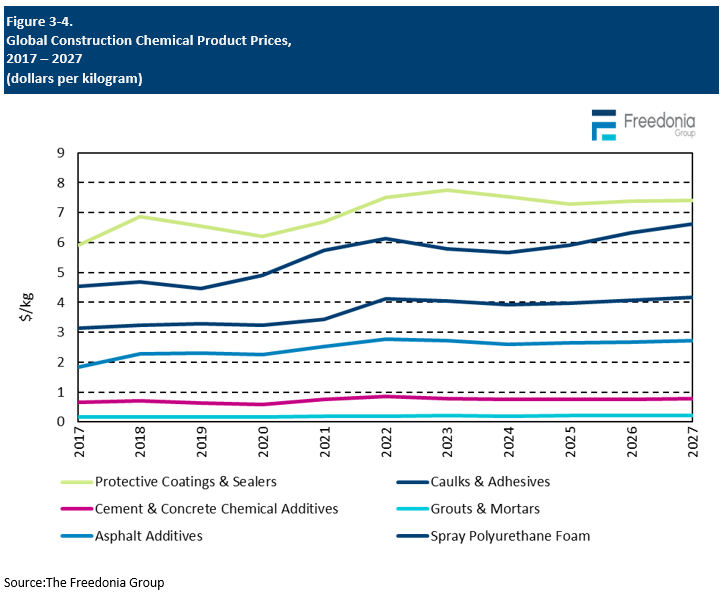

Pricing Patterns

The pricing of construction chemicals primarily depends on the:

-

supply-demand balance and cost of raw materials

-

mix of formulations and grades

-

intended application and construction location

-

level of other input costs, including labor, electricity, and fuel

Construction chemical prices vary widely depending on product type, with further differentiation within each product segment. For example, the pricing of chemical cement and concrete additives ranges from several dollars per kilogram for specialty products to less than $1 per kilogram for commodity products. Chemical additive effectiveness is dosage-dependent – which can increase costs – although most chemical additives can be applied in dosages small enough to make their use economical while adding value to the finished concrete.

Regional differences in pricing are largely determined by variations in the product mix:

-

Low-income countries – such as Brazil, India, and those in the Africa/Mideast region – tend to rely more heavily on natural and other generally lower priced, less high-performance products.

-

Comparatively low prices in emerging economies also weigh on growth in average global prices, as these countries – especially China – account for a growing share of the world market for construction chemicals. Nevertheless, rapid expansion of manufacturing facilities in developing nations are boosting requirements for better performing construction chemicals, contributing to gains in average price levels.

-

Rising demand for high-performance products is also expected to benefit from price gains in high-income areas such as the US, Japan, and Western Europe.

In general, prices rose over the historical period as end users increasingly employed higher-value construction chemicals and governmental regulations put further scrutiny on the use of certain raw materials such as solvents with high volatile organic compound (VOC) content. In 2021 and 2022, most construction chemicals experienced significant price increases, with gains driven by:

-

severe weather, most notably in Texas, which caused the shuttering of oil refineries and chemical manufacturing plants

-

rebounding economies worldwide, which drove increases in raw material purchases to meet pent-up demand and boosted inflation rates

-

uncertainty surrounding import markets, which may face enhanced scrutiny for safety and environmental impact

-

supply chain bottlenecks arising from both raw materials shortages and transportation issues

Going forward, prices will moderate significantly following easing of or resolution of many of these supply chain and raw material issues. Price growth has already slowed, and in some instances declined, in 2023, a trend that will continue in 2024. Pressure from customers will force companies to limit further price increases.