Report Overview

Get all the new information in this new edition.

-

Solar energy is a big and fast-growing market that wasn’t previously broken out.

-

A detailed discussion of price volatility.

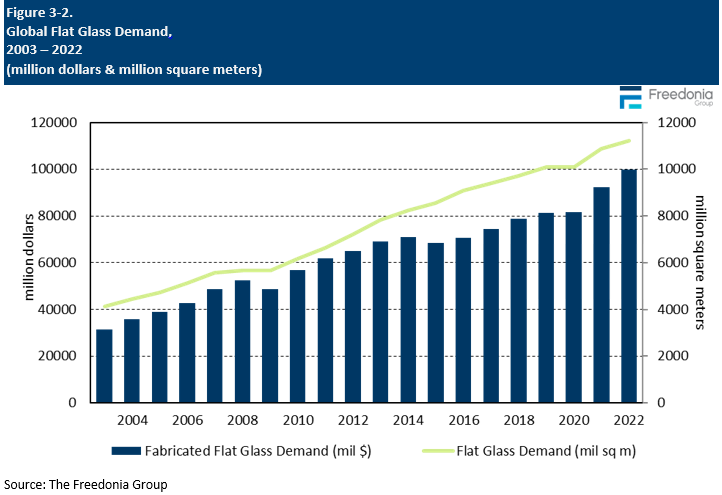

This Freedonia industry study analyzes the 11.2 billion square meter global flat glass industry.

It presents historical demand data (2012, 2017, and 2022) and forecasts (2027 and 2032) by market (architectural, motor vehicle, solar energy, other markets), and region (North America, Central and South America, Western Europe, Eastern Europe, Asia/Pacific, Africa/Mideast). The study discusses the impact of the COVID-19 pandemic. The study also evaluates company market share and competitive analysis on industry competitors including AGC, Fuyao Glass Industry Group, Guardian Industries, Nippon Sheet Glass, Saint-Gobain, and Xinyi Glass.

Featuring 220 tables and 94 figures – available in Excel and Powerpoint! Learn More

This report includes data from 2011-2031 in 5 year intervals and tables featuring year-by-year data for 2018-2025.

Global demand for flat glass is forecast to increase 4.9% per year to 14.3 billion square meters in 2027, while fabricated flat glass demand is expected to rise 7.7% per year to $145 billion. Growth will be driven by the emerging solar energy market, as more countries expand their production capabilities for solar modules.

Demand for Solar Modules Booming Worldwide

Global manufacturing of solar modules and other solar components grew rapidly between 2017 and 2022, a trend that is expected to continue throughout the 2020s. Solar energy is a key component of efforts to improve sustainability and combat climate change, and governments worldwide are attempting to support and stimulate industry development.

The Asia/Pacific region dominated solar module production in 2021, hosting nine of the world’s ten largest manufacturers of such products. China is the region’s and world’s dominant producer, though Vietnam and Malaysia are also important centers of production. Due to the Asia/Pacific region’s comparatively developed industry, it will account for the bulk of global solar energy glass demand gains. However, many other countries – particularly the US – are poised to expand production as they attempt to develop domestic supply chains and reduce reliance on imports.

Flat glass is a key component of solar modules in that it acts as a transparent and sturdy cover for fragile solar cells – and significant development is occurring for more advanced solar glass products/applications. Transparent window glass that can generate solar power has yet to achieve large-scale commercialization, but it could be a transformative technology for building construction industries.

Motor Vehicle Market to Rebound Following COVID-19 Pandemic

The motor vehicle market for flat glass represents a particularly lucrative outlet for sales because the high degree of fabrication supports very high average product prices. This market was especially impacted by the COVID-19 pandemic, shrinking in 2020 and facing challenges to recovery in 2021 and 2022. Sales of flat glass to the motor vehicle market were constrained by global supply chain issues; an automotive chip shortage prevented automakers from fully meeting the rebounding demand. Strong growth is expected in 2023 and 2024, attributable to a resolution of the chip shortage allowing automakers to clear order backlogs and meet pent-up demand.

High Production Costs Continuing to Impact Market

The inflationary environment associated with the COVID-19 pandemic challenged flat glass producers with high costs of energy, raw materials, and logistics. As a result, prices rose significantly in 2021 and 2022; some leading firms imposed particularly large price hikes midway through 2022, affecting price levels in 2023. These increases contributed to disruption of downstream markets, the effects of which have likely not yet been fully realized. Persistent high costs could adversely affect flat glass demand by driving builders to embrace architectural styles with smaller glass areas. Glass also faces a degree of competition from plastic products, as some firms are exploring solar panels with lightweight plastic covers in place of glass.

Historical Market Cyclicality & Growth Factors

Flat glass is an essential component in a variety of industries, and demand tends to be closely tied to levels of activity in these industries. Historically, the most important drivers of demand have been:

- building construction activity

- motor vehicle manufacturing and maintenance

- manufacturing of various types of durable goods, such as appliances, furniture, and consumer electronics

Use of flat glass in these applications tends to be mature, although industries may adjust their usage based on economic conditions. For example, builders may choose to emphasize designs with larger or smaller window areas based on the cost of glass relative to other materials.

The market for fabricated flat glass is also influenced by technological developments, which offer greater opportunities for sales growth in value terms compared to basic, highly commoditized float glass. Value-added fabrication technologies include laminating, tempering, and coating, with the increasing emphasis on energy efficiency and environmental friendliness driving the adoption of these features.

Flat glass is also an important component of solar energy systems, which represent a particularly strong driver of growth in this otherwise-mature industry. This market has been heavily reliant on regulatory support in the form of subsidies and incentives, which have contributed to a level of volatility. However, the solar energy market holds massive growth potential going forward.

Float glass is highly commoditized, and the costs of manufacturing these products are sensitive to the price of inputs like raw materials and energy. As a result, the market size is influenced by trends in the costs of these inputs, and demand in value terms rose considerably during the high-inflation period associated with the COVID-19 pandemic.

International Trade

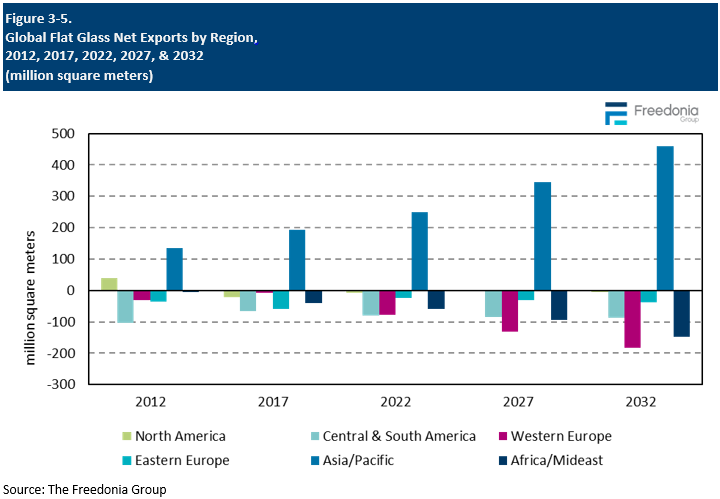

Flat glass is expensive to ship over long distances because of its weight and fragility; thus, flat glass plants tend to be situated as close as possible to the final market. Flat glass plants are also quite capital intensive to build and to operate, so it does not make economic sense to build a plant unless there is a growing and relatively stable local market for its output. For this reason, many developing countries with small markets for flat glass often import their needs, generally from neighboring countries.

China is by far the world’s largest net exporter of flat glass, meeting much of the flat glass demand of the Asia/Pacific region. Other important exporters of flat glass include:

- Germany

- the US

- Indonesia

- Iran

- Thailand

- Poland

Malaysia became one of the world’s largest net exporters of flat glass between 2017 and 2022, thanks to high levels of investment in offshore production by Chinese firms.

Canada, which had no operational float plants in 2022, was tied with Japan as the world’s largest net importer of flat glass. Other countries with significant trade deficits include South Korea and the UK.

The Asia/Pacific region is expected to account for an increased share of the global market through 2027, while Western Europe will see its trade deficit expand considerably. Several float glass production facilities in the region were shut down in the years following the COVID-19 pandemic, and low levels of investment in the local industry will lead to a greater need for imports as demand grows.

Pricing Patterns & Inflation

While there is very little differentiation in raw flat glass produced by different suppliers, local prices for raw flat glass in US dollar terms can still vary widely based on factors such as:

- energy costs

- fluctuating currency valuations

- intensity of demand

- local availability of supplies

- local inflation

In addition, fabrication processes can have a major impact on the final value of fabricated flat glass, with some products valued at well over 10 times the price of raw flat glass:

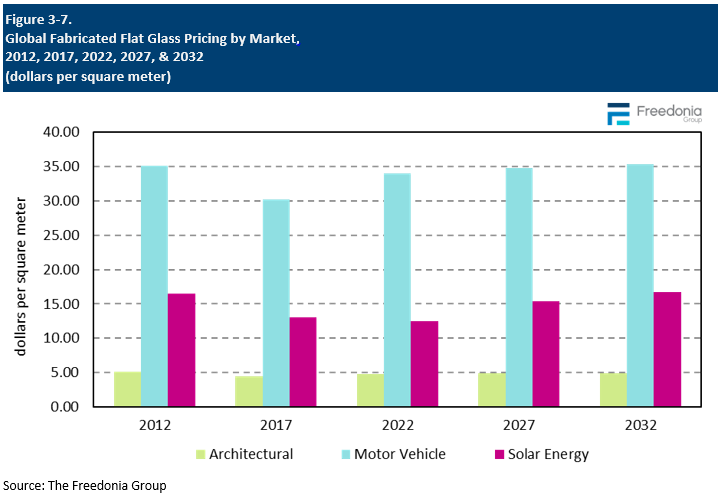

- Architectural products tend to be the least expensive, as architectural glass (particularly in the residential market) typically requires less extensive fabrication.

- Motor vehicle glass is significantly more expensive, as windshields require lamination and side windows are usually tempered.

- Aftermarket motor vehicle glass is more expensive on average than OEM glass, due to higher replacement rates for laminated windshields relative to side windows.

- Glass for the solar energy market typically has value added from tempering.

- Prices in other markets can vary significantly, with applications such as furniture glass on the low end and applications such as touchscreen glass for electronic products on the high end.

Global average flat glass prices in US dollar terms increased 2.3% per year between 2017 and 2022, with most of the price growth occurring over the last two years of this period. Like in many other industries, flat glass producers faced rising costs associated with the disruptions caused by the COVID-19 pandemic. Factors driving above average price increases in 2021 and 2022 were:

- rising raw materials costs

- high energy costs

- logistics challenges stemming from disrupted supply chains