Report Overview

Get the current and valuable data and trend analysis you need.

-

Country data, product data, and quality market share

-

Construction spending indicators and pricing trends

-

Suppliers of components, replacement parts, and attachments

-

Transformative technological innovation

This Freedonia study analyzes the $237 billion global construction machinery market.  It provides supply and demand figures for 2012, 2017, and 2022, and forecasts for 2027 and 2032. We also offer annual data for the 2019-2026 period and historical construction equipment demand charts for the 2004-2022 period for all countries. Global Construction Machinery also presents product demand by type (excavators; loaders; cranes and draglines; dozers and off-highway trucks; mixing and paving equipment; grading and compaction equipment; and parts and attachments) for 18 countries. In addition, this Freedonia study offers a competitive analysis of industry leaders and provides market share for 23 major suppliers, such as Caterpillar, Deere, Hitachi Heavy Industries, Hyundai, JCB, Komatsu, Liebherr-International, SANY, Tadano, Terex, Volvo, Xuzhou Construction Machinery, and Zoomlion. We also present regional market share figures for 2022.

It provides supply and demand figures for 2012, 2017, and 2022, and forecasts for 2027 and 2032. We also offer annual data for the 2019-2026 period and historical construction equipment demand charts for the 2004-2022 period for all countries. Global Construction Machinery also presents product demand by type (excavators; loaders; cranes and draglines; dozers and off-highway trucks; mixing and paving equipment; grading and compaction equipment; and parts and attachments) for 18 countries. In addition, this Freedonia study offers a competitive analysis of industry leaders and provides market share for 23 major suppliers, such as Caterpillar, Deere, Hitachi Heavy Industries, Hyundai, JCB, Komatsu, Liebherr-International, SANY, Tadano, Terex, Volvo, Xuzhou Construction Machinery, and Zoomlion. We also present regional market share figures for 2022.

Featuring 199 tables and 108 figures – available in Excel and Powerpoint! Learn More

This report includes data from 2011-2031 in 5 year intervals and tables featuring year-by-year data for 2018-2025.

Global demand for construction machinery is forecast to expand 6.1% annually to $317 billion in 2027. Gains will be driven by a significant improvement in sales in China – the world’s largest construction machinery market – following a sharp, pandemic-related decline in 2022. In addition, growth will be supported by:

- the development of new construction equipment that features advanced technologies, such as state-of-the-art engines and data collection capabilities

-

intensification of global workforce issues (e.g., rising labor costs, skilled worker shortages) and the adoption of new regulations (e.g., emissions standards), which will drive investment in new construction equipment

Market Conditions in China to Improve Dramatically

Despite a sharp increase in construction equipment prices in 2022 that supported market value throughout much of the world, demand in China contracted by 26% because of the economic disruption that resulted from the government’s “Zero-COVID” policy, which included temporary lockdowns and significantly impeded construction activity. However, the government ended this policy in November 2022, and product sales going forward are expected to recover at a swift pace, as construction and mining activity accelerate. Additionally, the Chinese government will continue to expand and upgrade the country’s expansive public infrastructure and strengthen construction and mining sector regulations, which in some cases will require the use of more advanced, better performing equipment.

All-Electric Equipment & Smart Technology among Key Technological Improvements

In order to meet the needs of their customers and comply with a variety of regulations, suppliers have continue to focus on updating and improving their construction machinery with the latest technology. Among the most significant of these improvements are all-electric machines and the incorporation of smart technology:

-

Improvements to battery technology and greater familiarity with battery-powered motor vehicles have encouraged key suppliers such as Komatsu and Volvo Construction Equipment to introduce all-electric equipment to the marketplace. These vehicles feature much lower emissions than gas-powered equipment (an important factor in meeting environmental regulations in some countries), run more quietly, and feature fewer moving parts, thus making a breakdown less likely.

-

Major suppliers such as Deere and HD Hyundai Infracore have introduced smart technology to their vehicles to improve their performance. Smart systems collect and analyze data that allows the user to operate the machinery with better precision and control.

Historical Trends

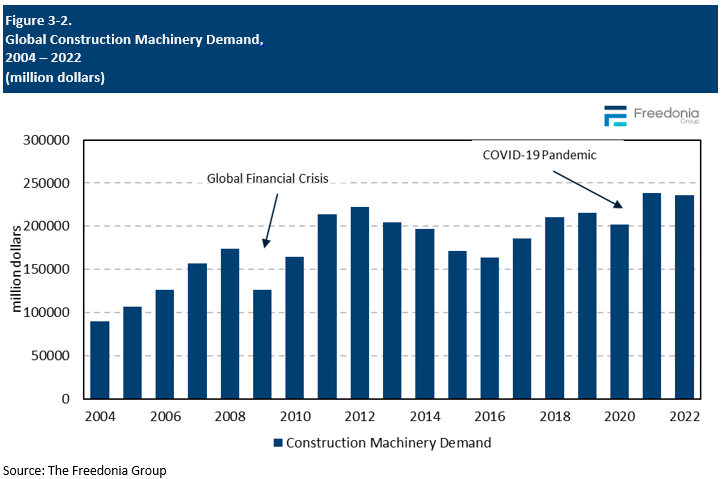

The mature global construction machinery market tend to be highly cyclical because of several related factors:

-

The construction sector is a critical component of every economy and among the first to develop.

-

Roughly 75% of global demand for construction machinery is concentrated in a dozen countries, the majority of which feature markets that are at a later stage of development.

-

Replacement product sales – which are highly cyclical – are the primary driver of growth in most mature markets and play a key role a number of large developing markets (e.g., China).

-

The leading end-use markets for equipment – construction, mining, forestry, agriculture and energy production – also exhibit cyclicality.

- Construction machines have a long lifespan.

Because of these factors, periods of strong growth – during which operators replace outdated machines and invest in new models – are often followed by significant weakness.

Other factors can have a positive or negative impact on the global construction machinery market’s growth cycles, including:

-

economic conditions, levels of international trade and foreign investment, and fixed investment spending trends

-

changes in the value of a country’s currency

-

changes in construction activity, government infrastructure spending, and to a lesser extent, mining, forestry, and agricultural activity, and energy production

-

the increasing or decreasing availability of construction machinery and changes in the cost of equipment

-

the introduction of new construction equipment technologies, which can spur both new and replacement machinery sales

Typically, a growth cycle lasts three to seven years for mature markets, although this range varies from country to country. Developing nations frequently see prolonged periods of growth as operators begin to use the equipment more intensively and shift toward more capable, higher priced models. Replacement sales are a smaller driver of gains in these markets because their stocks of equipment are quite small and relatively new.

Global Construction Outlook

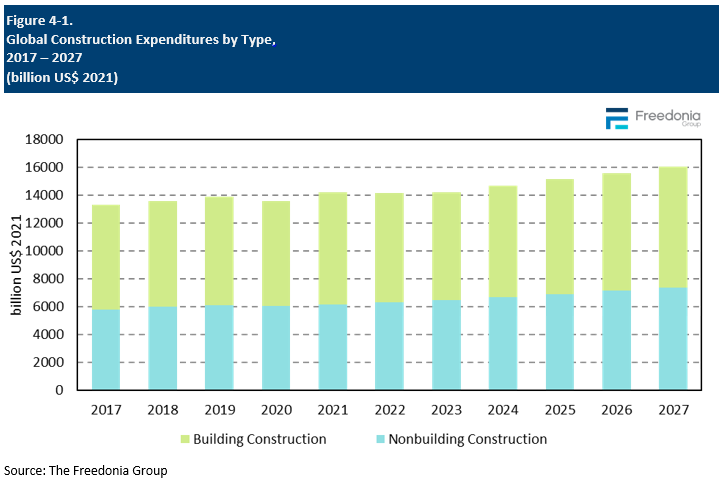

Trends in building and nonbuilding construction activity can have a profound impact on construction machinery demand:

-

As new buildings and structures are built and old ones are improved and repaired, a country’s machinery needs grow.

-

In addition to investing in new equipment to handle additional projects, firms must also replace machines in their fleets more frequently during period of increased wear.

-

New projects may require the purchase of a new piece of machinery or new attachments.

However, in countries where equipment-intensive construction techniques are not used extensively, changes in overall construction activity may have a more limited impact on machinery demand.

The mix of construction activity between residential buildings, nonresidential buildings, and infrastructure construction also influences machinery demand, as different types of projects require different types of machinery. For example, major infrastructure projects require expensive heavy-duty equipment and specialty models. On the other hand, smaller residential building projects tend to be less machinery-intensive and often rely on smaller, less expensive equipment.

Technology & Innovation

Technological innovation plays an important role in the global construction machinery industry’s development because it allows manufacturers to:

-

comply with new regulations

-

improve equipment performance

-

reduce emissions

-

enhance operator safety and comfort

-

improve their competitive position

-

expand their product portfolios

Most leading producers have invested heavily in R&D, particularly over the last decade, due to intensifying competition and the adoption of new regulations. Improved technologies can give a supplier a critical advantage in the marketplace.

To reduce the environmental impact of construction machinery and to comply with more demanding emissions standards, manufacturers have introduced new emissions control systems and have attempted to improve efficiency through innovation. New designs commonly feature increased fuel efficiency and reduced emissions. In addition, the number of manufacturers that offer hybrid or alternative fuel models has increased considerably, and this trend is expected to continue.

All-electric zero emission equipment captures an increasingly large presence in the construction machinery market. Leading companies such as JCB, Komatsu, and Volvo Construction Equipment have recently unveiled all-electric equipment. Benefits of electric equipment include:

-

vastly reduced noise (useful if working on a site in a populated area or on one with noise restrictions)

-

fewer moving parts and therefore a lower likelihood of a mechanical breakdown

-

a reduced impact on the environment

A number of manufacturers are working on introducing emissions free trucks. In July 2022, for instance, Komatsu and Cummins agreed to develop zero-emissions haulage trucks utilizing hydrogen fuel cell technology. Although initially targeting the mining sector, such trucks are expected to find use in construction applications.

he development of smart technology is made possible by advances in the industrial internet of things (IIoT), which consists of a network of connected industrial devices, including systems that can collect, store, monitor, and analyze information. Producers such as Deere, HD Hyundai Infracore, and Komatsu are increasingly offering information technology that gives the operator more control and precision, as well as information about the machine and the task it is performing. The latest excavator models from each of these companies incorporate this type of technology.