Report Overview

We know data and expert analysis for this specialized market are impossible to find, so we have used our expertise to do it for you.

-

Your share of the market

-

Where to open factories and sales locations

-

Where to make investments in aftermarket operations

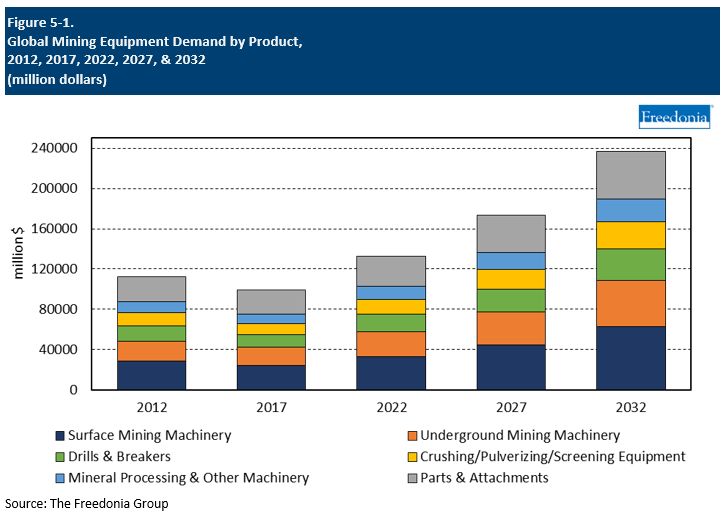

This Freedonia study analyzes the $133 billion global market for mining machinery.  It provides supply and demand figures for 2012, 2017, and 2022, and forecasts for 2027 and 2032. We also offer annual data for the 2019-2026 period and historical mining equipment demand charts for the 2002-2022 period for all countries. The Global Mining Equipment study also presents product demand by type (surface mining machinery; underground mining machinery; drills and breakers; crushing, pulverizing, and screening equipment; mineral processing and other mining machinery; and parts and attachments) for 18 nations. Additionally, it offers a competitive analysis of industry leaders and provides market share for 19 suppliers, such as Astec Industries, Caterpillar, China Coal Energy, Hyundai Heavy Industries, Epiroc, FLDSmidth, Hitachi, Komatsu, Liebherr-International, Metso Outotec, Sandvik, SANY Heavy Industry, and Tiandi Science and Technology.

It provides supply and demand figures for 2012, 2017, and 2022, and forecasts for 2027 and 2032. We also offer annual data for the 2019-2026 period and historical mining equipment demand charts for the 2002-2022 period for all countries. The Global Mining Equipment study also presents product demand by type (surface mining machinery; underground mining machinery; drills and breakers; crushing, pulverizing, and screening equipment; mineral processing and other mining machinery; and parts and attachments) for 18 nations. Additionally, it offers a competitive analysis of industry leaders and provides market share for 19 suppliers, such as Astec Industries, Caterpillar, China Coal Energy, Hyundai Heavy Industries, Epiroc, FLDSmidth, Hitachi, Komatsu, Liebherr-International, Metso Outotec, Sandvik, SANY Heavy Industry, and Tiandi Science and Technology.

Featuring 264 tables and 84 figures – available in Excel and Powerpoint! Learn More

This report includes data from 2011-2031 in 5 year intervals and tables featuring year-by-year data for 2018-2025.

See the blog about Advanced Technologies

Global demand for mining equipment is forecast to rise 5.5% per year to $174 billion in 2027. Growth will be driven by increasing metal and mineral mining output as the global construction and manufacturing industries that use these materials continue to rebound following the pandemic-related losses of 2020. In addition, demand will be supported by the introduction of newly developed, innovative models that feature multiple productivity and efficiency boosting technologies (e.g., automation software, advanced engines), which allow mine operators to address workforce issues and new mining regulations.

However, further growth will be constrained by:

- the ongoing shift away from coal – one of the key markets for mining equipment – in many parts of the world

- weaker market conditions in Europe in the first part of the forecast period because of the Russia-Ukraine conflict

China will Account for Nearly Half of Global Growth through 2027

In 2022, the Chinese market experienced a sharp deceleration in market value and a 6% decline in real terms due to the effects of the country’s Zero-COVID policy (which was rescinded in November 2022) on its economy. This was compounded by high rates of inflation at home and abroad as well as a global chip shortage. Going forward, China will register significant absolute gains in both market value and in real terms as it continues to extract from its immense mining resources. The ongoing government support for the mining sector and greater investment by foreign multinationals will also bolster demand, supporting purchases of both new and replacement equipment.

Metals Mining Segment to Record Above Average Growth

Demand for machinery used in metal mining is expected to expand at an above average rate, driven by rising metal prices, which will encourage the opening of new mines and increase spending on new equipment. In addition, because metal mining firms have immense financial resources and are intensive users of equipment, they will be among the first to adopt new technologies. Demand in the metal mining market will also be supported by rising demand for durable goods that utilize metals. For instance, lithium has become an increasingly important and valued metal as lithium-ion batteries come into greater use, most notably in electric vehicles, which are rapidly increasing their share of the motor vehicle market.

Demand by Type

Because mining tends to be a multi-stage process, a wide variety of heavy equipment is used in mining operations. Mining machinery falls into six broad product types:

- surface mining machinery

- underground mining machinery

- drills and breakers

- crushing, pulverizing, and screening equipment

- mineral processing and other machinery (such as feeders and dryers)

- parts and attachments

Because mining equipment is used in a wide range of applications, sales growth patterns among the various product types usually do not differ greatly over time. However, demand for complete mining machinery, due to its higher value nature, tends to be more volatile than sales of parts and attachments, growing faster in periods of strong demand for mining equipment in general and vice versa in weaker periods. Sales of parts and attachments, on the other hand, typically perform better in periods of market weakness, helping reduce the cyclicality of overall mining machinery demand.

Through 2027, global demand for the major types of mining equipment is forecast to expand 5.9% annually, while sales of parts and attachments climb 4.1% per year. Because a number of trends will fuel growth across-the-board – such as rising mining activity, price growth, high levels of replacement product sales globally, and technological innovation – all of the equipment segments have favorable growth prospects.

Furthermore, there is significant demand for all of the machinery machine types because each type of machine performs a specific task and/or is designed for specific applications. While a few product types compete with one another, many machines do not have significant functional competition.

As the global stock of mining machinery grows between 2022 and 2027, worldwide parts and attachments needs will expand.

Demand by Market

Global demand for mining equipment can be segmented into three markets:

-

coal mining

-

metals mining

-

minerals mining

All three comprise large markets when viewed on a global basis; however, sales patterns differ between countries depending on the amount and type of natural resources available in a given nation. Mineral mining is the largest end-use market for equipment (with a 42% share of 2022 sales), followed by metals (32%) and coal (26%).

Through 2027, global demand for mining equipment is projected to expand 5.5% annually to $173.6 billion. While the metals mining segment will register the fastest growth during this time, the minerals segment will post the largest gains:

-

Rising global manufacturing and construction activity will drive both metals and minerals mining production gains and associated equipment sales.

-

The minerals segment will also benefit from increased demand for these commodities in other key end use markets, such as agriculture.

-

Metals mining firms are intensive users of mining machinery and invest heavily in technological innovation because of their immense financial resources, and these will continue to be key drivers of growth through 2027.

The coal segment has more limited growth prospects for the 2022-2027 period because of the ongoing shift away from the use of coal-fired power plants around the world due to concerns about climate change and air pollution. In the near term, however, the use of coal will rise in some parts of the world because of the conflict in Ukraine, which has driven up natural gas and oil prices and distorted international trade of these products.