Report Overview

Learn more about important trends in this $481 billion market.

-

Current focus on technological developments

-

Best investments for the near and far future

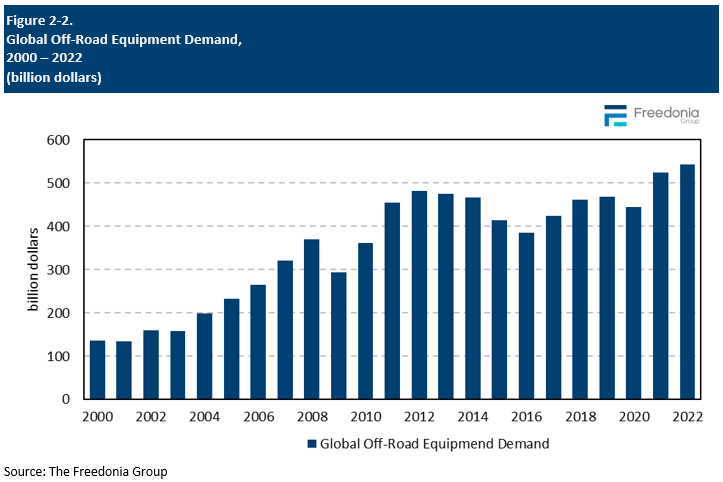

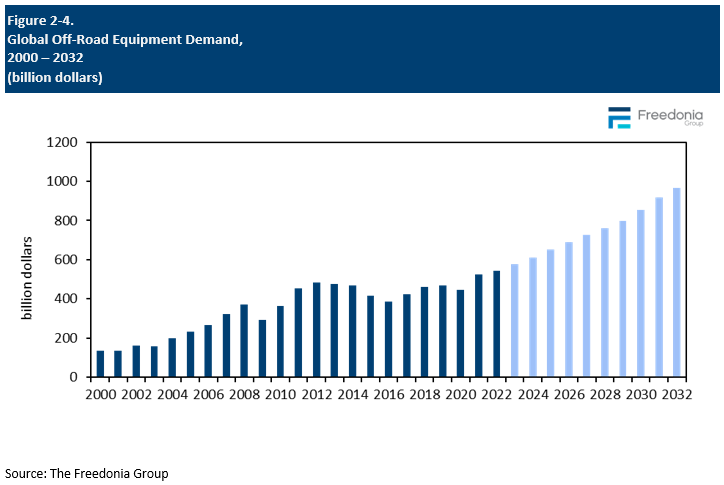

This Freedonia industry study analyzes the $543 billion Global Off-Road Equipment industry.  It presents historical demand data (2012, 2017 and 2022) and forecasts (2027 and 2032) by region (North America, Central and South America, Western Europe, Eastern Europe, Asia/Pacific, and Africa/Mideast), as well as historical demand data (2012, 2017 and 2022) and 2027 forecasts by market (Construction, Agriculture, Mining, and Forestry). The study also evaluates company sales and R&D spending on selected companies including AGCO, Caterpillar, CNH Industrial, Deere, Hitachi, Komatsu, Kubota, Liebherr International, Sandvik, Volvo, and Zoomlion.

It presents historical demand data (2012, 2017 and 2022) and forecasts (2027 and 2032) by region (North America, Central and South America, Western Europe, Eastern Europe, Asia/Pacific, and Africa/Mideast), as well as historical demand data (2012, 2017 and 2022) and 2027 forecasts by market (Construction, Agriculture, Mining, and Forestry). The study also evaluates company sales and R&D spending on selected companies including AGCO, Caterpillar, CNH Industrial, Deere, Hitachi, Komatsu, Kubota, Liebherr International, Sandvik, Volvo, and Zoomlion.

Featuring 44 tables and 58 figures – available in Excel and Powerpoint! Learn More

See the blog on Off-Road Technology Trends

Global demand for off-road equipment is forecast to climb 6.0% per year to $728 billion in 2027. Gains will be driven by expansion in the Asia/Pacific region as industrializing countries increase mechanization rates and China experiences a near-term recovery following a pandemic-related decline in 2022. In addition, growth will be supported by:

- development of new equipment featuring advanced technologies aimed at increasing production and efficiency, lowering emissions, and improving data connectivity capabilities

- rising demand for autonomous and electric equipment amid intensification of global workforce issues (e.g., rising labor costs, skilled worker shortages) and the adoption of new regulations (e.g., emissions standards)

Rising Demand for Advanced Smart Technologies Driving Value Gains

Advanced software, digital connectivity, and data analytics features in smart machinery are desirable to operators in all sectors looking to improve performance and will support demand for off-road equipment going forward. Operators are increasingly adopting smart technologies as they allow for better coordination, precision, and control of machines, and include systems that collect and analyze data to improve productivity, reduce downtime, and perform preventive maintenance. Demand for autonomous and semi-autonomous technologies is also expected to expand due to rising labor costs, increasing regulations, and a shortage in experienced, skilled operators.

All-Electric Equipment Important Focus for R&D Investment

Electric machinery has become a particular area of focus for many key suppliers. For instance, Volvo, one of the industry’s largest producers, has established a goal of at least 35% of its vehicles sold globally being electric by 2030. Electric equipment offers a variety of advantages over gas-powered models, including:

- reduced emissions, making it an ideal choice to comply with increasingly strict environmental regulations in developed countries and as a means of reducing ventilation costs and improving worker health in mining

- fewer defects and repairs as this equipment features a lower number of moving parts, which contributes to lower noise pollution and makes it more suitable for urban areas

The Asia/Pacific Region Will Account for Over Half of Global Demand Growth

High levels of growth are expected for developing countries in the Asia/Pacific region – most notably India, Indonesia, Malaysia, and Thailand – as mechanization rates climb due to increasing government support and foreign investment, and better financing options.

In the short term, regional gains will also be supported by a rebound in the massive Chinese market, which experienced an 8% contraction in 2022. The country’s “Zero-COVID” policy caused economic disruption with temporary lockdowns and a severe contraction in construction activity. With the end of this policy in late 2022, product sales are expected to expand at a fast pace in 2023, and growth will continue through 2027 as construction and mining activity accelerate, mechanization levels improve in the agriculture sector, and China continues to invest in expanding public infrastructure.

Off-Road Equipment Market Size & Growth Factors

Global demand for off-road equipment generally depends on a number of important trends:

- the amount of construction, farming, forestry, and mining activity in a region and country

- changes in commodity prices for metals and minerals

- rising prices will improve the financial standing of mine operators and make mining equipment purchases more viable

- falling prices may lead mine operators to put off purchasing new equipment

- changing mechanization rates in developing countries, as rising mechanization spurs demand for new equipment

- the introduction of more technologically advanced machinery, which can spur replacement sales and increase market value in mature markets

- regulatory activity, which often leads to the use of more expensive machinery to meet the new standards, including:

- more stringent emissions regulations, such as the US Environmental Protection Agency’s (EPA) Tier 4 Final standards and the European Union’s Stage V requirements

- worker safety regulations that encourage more intensive use of better engineered off-road equipment that provides improved control, maneuverability, comfort and visibility.

Demand for off-road equipment varies by region in terms of the types of equipment used, overall market size, and growth outlook:

- All countries use agricultural equipment to some degree. However, agricultural machinery demand and market value depend highly on the level of mechanization in a country’s agricultural sector as well as the share of agricultural output held by corporate farms, which are more likely to be focused on efficiency and profitability and thus more likely to spend on more and higher priced equipment.

- Construction machinery is used extensively in most countries to build and improve basic infrastructure as well as in other similar applications:

- Developed countries use a broader variety of both basic and specialized equipment to expand and improve their existing building stock and infrastructure.

- Developing countries are generally in the process of mechanizing their construction sectors and increasing the stock of machinery in use. Equipment is often more basic in nature, but equipment sales growth in units is often above the global average.

- Demand for mining and forestry machinery is more geographically concentrated in countries with significant natural resources and/or a high level of forestation and wood processing activity.

Long-Term Off-Road Equipment Market Outlook

The global off-road equipment industry can be segmented into four main categories:

- construction machinery

- agricultural equipment

- mining machinery

- forestry equipment

Demand in each market segment tends to be highly cyclical because large existing machinery stocks in dominant countries contribute to market maturity.

Global demand for off-road equipment is forecast to rise 6.0% annually to $728 billion in 2027. In all four off-road equipment markets, market advances will be bolstered by the purchase of high-value, state-of-the-art machinery that improves productivity and efficiency. The growing availability of hybrid and electric zero-emissions equipment will also boost value demand in countries with strict environmental policies.

Several factors will support demand growth through the forecast period, including:

- expansion and strengthening of off-road equipment markets

- price growth due to innovation rather than inflation

- intensification of workforce issues such as rising labor cost and skilled worker shortage

- rising personal incomes worldwide

Off-Road Equipment Outlook by Region

2023 Forecast

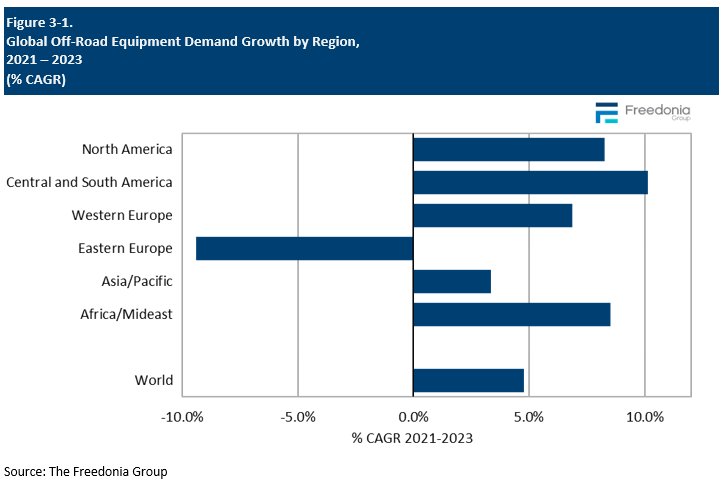

Global demand for off-road equipment is forecast to rise 6.0% to $575 billion in 2023. Demand growth will be largely attributable to recovery in the massive Chinese market following the end of its “Zero-COVID” policy in late 2022. Although pricing growth is forecast to slow in 2023, it will continue to rise due to the ongoing global chip shortage that, while easing, is expected to persist until 2024 or 2025.

High levels of replacement equipment sales and investment in new technology will support both unit sales and market value growth for the North American and West European regions, as large sales of equipment in these regions during 2022 were primarily the result of significant price increases.

The largest and fastest advances will be registered by the Asia/Pacific region largely due to recovery in capital investment in the massive Chinese market, which registered a sharp decline in 2022 caused by slower growth in economic activity combined with restrictions and lockdowns related to the country’s “Zero-COVID” policy. Growth will also be supported by increasing levels of mechanization in developing countries in the region.

Developing markets such as the Africa/Mideast region and Central and South America will grow at a healthy rate due to an increase in foreign investment, government support, and improved financing opportunities fueling demand for mechanization in these regions.

Demand in Eastern Europe is expected to decline as a result of the Russia-Ukraine conflict, which poses such difficulties for growth as restriction of foreign investment in the region, disruption of the supply chain, loss of markets, high energy prices, and higher borrowing costs.