Report Overview

Featuring 146 tables and 83 figures – now available in Excel and Powerpoint! Learn More

Global packaging equipment demand is forecast to expand 5.8% to $71.1 billion in 2026, supported by:

- advances in world durable and nondurable goods production, as well as the associated construction of new factories and expansion of existing sites

- the continuing shift away from manual packaging techniques by small- and mid-sized industrial enterprises around the world

- the more intensive use of packaging materials in developing nations, particularly as they increasingly export to other countries

- rising demand for state-of-the-art packaging technologies in most mature markets (and some developing ones, like Thailand) because of concerns about workforce issues and the desire to reduce costs

- the adoption of new product standards and health and safety regulations that will spur demand for new packaging materials and equipment

- the growing use of green packaging materials – which often require operators to purchase new equipment – in light of mounting concerns about pollution and waste

China & the US Continue to Dominate as Demand for Advanced Equipment Grows

Despite developed manufacturing industries, the US and China are expected to account for half of all packaging equipment sales growth through 2026:

- In the US, increased spending on advanced packaging technologies will boost productivity, reduce labor costs, and allow for greater customization of packaging. Strong interest in providing packaging that is viewed as sustainable will also encourage companies to invest in new machines.

- In China, greater mechanization of packaging processes and intensifying competition globally for a number of export-oriented industries will support sales of more advanced machinery.

Food Industry Will Remain Largest Market for Packaging Machinery

Food companies are among the most intensive users of packaging materials and machinery. The food end use market is expected to account for nearly one-third of global packaging machinery gains as industry output grows and manufacturers invest in new production and packaging capacity. Evolving consumer preferences and intensifying competition in the global food industry will also push operators to replace older machines with more capable models (e.g., those capable of shorter packaging runs or greater customization). Growth will be aided by the strengthening of regulatory frameworks in developing nations (e.g., food safety standards, improved labeling) and the adoption of more demanding product, safety, and environmental standards in more established markets.

Pharmaceuticals & Personal Care Products Market to Grow at the Fastest Rate

The pharmaceutical and personal care product segment is forecast to expand at the fastest rate of any market through 2026. Spending on pharmaceuticals and personal care products around the world will continue to rise because of population growth, improving living standards, increasing lifespans, and product development. Pharmaceutical companies will be among the first adopters of advanced packaging technologies because they have significant financial resources and are required to comply with countless regulations.

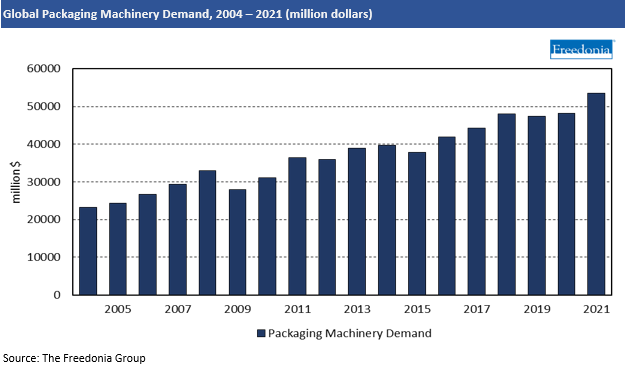

Historical Trends

Trends in the global packaging equipment market are affected by the following factors:

- The manufacturing sector is a critical component of every economy and among the first to develop.

- The US and China – by far the two largest packaging machinery markets – together account for about half of global demand and have an outsized effect on global trends.

- Replacement product sales are the primary driver of growth in most countries that have with established manufacturing industries.

- Packaging equipment – when properly maintained – has a long lifespan, though there is little aftermarket for used equipment, which is both commonly outdated and difficult to retrofit to other applications.

Other factors can have a positive or negative impact on the global packaging equipment market’s growth, including:

- economic conditions, levels of international trade and foreign investment, and fixed investment spending trends

- changes in the value of a country’s currency

- changes in manufacturing, with trends in the food, beverage, pharmaceuticals, and chemicals industries being of particular importance

- the increasing or decreasing availability of new packaging equipment and changes in equipment prices

- the introduction of new packaging technologies, which can spur both new and replacement machinery sales

- the adoption of new product, health, and safety standards, and environmental regulations (e.g., restrictions on the use of plastics)

Countries with developing manufacturing bases frequently see prolonged periods of growth as operators:

- continue to ramp up production

- begin to use the equipment more intensively

- shift toward more capable, pricier models

Replacement sales are a smaller driver of gains in these markets because their stocks of equipment are quite small and relatively new.

Demand by Region

Global demand for packaging equipment is forecast to expand 5.8% per year through 2026 to $71.1 billion because of multiple trends, including:

- advances in world durable and nondurable goods production, as well as the associated construction of new factories and expansion of existing sites

- the continuing shift away from manual packaging techniques by small- and mid-sized industrial enterprises around the world

- the more intensive use of packaging materials in developing nations, particularly as they increasing export to other countries

- rising demand for state-of-the-art packaging technologies in markets with established manufacturing industries because of concerns about workforce issues and the desire to reduce costs

- the adoption of new product standards and health and safety regulations that will spur demand for new packaging materials and equipment

- the growing use of green packaging materials – which often require operators to purchase new equipment – in light of mounting concerns about pollution and waste

This study analyzes global supply and demand for packaging machinery. Types of machinery within the scope of the study include:

- filling equipment (including stand-alone filling machines and integrated form-fill-seal equipment, which are available in both horizontal and vertical units)

- case forming, packing, and sealing machinery

- labeling and coding machinery

- wrapping equipment (including horizontal, vacuum, skin, and stretch film wrappers), bundling equipment, and palletizing equipment (including palletizing, depalletizing, and pallet unitizing machinery)

- other types of packaging machinery (such as accumulators, collators, and feeders; bottling and canning line equipment; cartoning machinery; thermoforming machinery; and inspecting, detecting, and checkweighing equipment)

- packaging machinery parts, including:

- bearings

- belts

- chains

- connectors

- feeders

- heating elements

- knives

- power units

- pulleys

- sensors

- temperature indicators

- wire

Machinery that is used to manufacture packaging products, rather than to package end use products, is excluded from the scope of this study.

Also excluded from the scope of the study are certain products sometimes considered to be packaging machinery, including converting equipment (like blow molders, can making machinery, extruders, and other equipment used to form packages – except where they are integral parts of packaging machines such as form-fill-seal equipment) and associated line equipment like conveyors. Used packaging machines of all types and related services such as equipment rebuilding, retrofitting, and systems integration are excluded from the scope.

For the purposes of this study, packaging equipment or packaging systems that perform multiple functions are classified by their primary function. For example, a form-fill-seal machine that also includes a labeling system is considered a form-fill-seal machine, with labeling considered a secondary function.

Demand is also analyzed by the following markets:

- food

- beverage

- pharmaceuticals and personal care products

- chemicals

- other markets (nondurable manufacturing industries, durable manufacturing industries, transportation and distribution companies, contract packagers, and other service providers)

Historical data for 2011, 2016, and 2021, and forecasts for 2026 and 2031 are provided for shipments, demand by product type, and net exports of new packaging machinery on a country-by-country basis, valued in millions of current US dollars, including inflation. The term “demand” refers to “apparent consumption” and is defined as production (also referred to as “shipments”, “output”, or “supply”) from a nation’s domestic packaging machinery manufacturing facilities, plus imports, minus exports. It is used interchangeably with the terms “market”, “sales”, and “consumption”.