Report Overview

Roofing demand is growing fastest in what countries?

This Freedonia industry study analyzes the $130 billion global roofing industry.  It presents historical demand data (2012, 2017, and 2022), forecasts (2027 and 2032), and annual historical and forecast data from 2019 to 2026 by market and application (new residential, residential reroofing, new nonresidential, and nonresidential reroofing) and product (tile, bituminous, asphalt shingles, metal, plastic single-ply, rubber single-ply, fiber cement, and small volume roofing products). The study discusses the impact of the COVID-19 pandemic. The study also evaluates company market share and competitive analysis on such industry players as including Beijing Oriental Yuhong Waterproof Technology, Berkshire Hathaway (Johns Manville), BlueScope Steel, Carlisle, Etex, Holcim Group, IKO Group, Owens Corning, Saint-Gobain, Siam Cement, Sika, Standard Industries (Braas Monier, Icopal, GAF Materials), and Wienerberger Baustoffindustrie.

It presents historical demand data (2012, 2017, and 2022), forecasts (2027 and 2032), and annual historical and forecast data from 2019 to 2026 by market and application (new residential, residential reroofing, new nonresidential, and nonresidential reroofing) and product (tile, bituminous, asphalt shingles, metal, plastic single-ply, rubber single-ply, fiber cement, and small volume roofing products). The study discusses the impact of the COVID-19 pandemic. The study also evaluates company market share and competitive analysis on such industry players as including Beijing Oriental Yuhong Waterproof Technology, Berkshire Hathaway (Johns Manville), BlueScope Steel, Carlisle, Etex, Holcim Group, IKO Group, Owens Corning, Saint-Gobain, Siam Cement, Sika, Standard Industries (Braas Monier, Icopal, GAF Materials), and Wienerberger Baustoffindustrie.

Featuring 300 tables and 95 figures – available in Excel and Powerpoint! Learn More

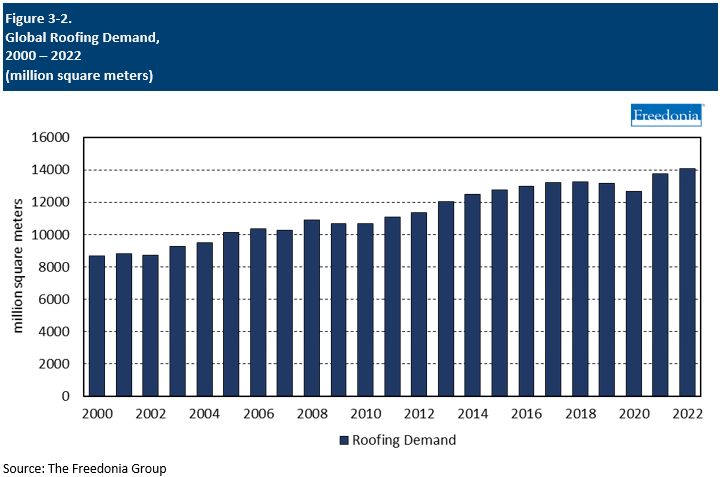

Global demand for roofing products is forecast to increase 2.1% per year to 15.6 billion square meters in 2027, driven by:

- significant growth in building construction activity in the Asia/Pacific and Africa/Mideast regions

- homeowners and building owners preemptively replacing their roofs with more environmentally friendly products and cool roofing in order to reduce energy use or meet regulations, which will result in increased use of solar, green, and single-ply roofing products

However, market value growth will see a sharp deceleration from a high 2022 base that resulted from inflationary pressures and pandemic-related supply chain issues. Going forward, roofing prices will experience a major correction in 2023 and moderate through 2027 with the prices of several roofing materials seeing aggregate declines in prices.

Single-Ply Roofing Products to Gain Market Share

Both plastic and rubber single-ply roofing products are expected to gain share in the global roofing market through 2027, mostly at the expense of bituminous membranes. The favorable performance properties of most single-ply products relative to bituminous roofing will be the primary drivers of this trend. Demand for plastic single-ply roofing membranes will be promoted by:

- rising use of self-adhesive single-ply membranes because of their ease of installation – an important consideration for time-pressed contractors often dealing with less experienced crews

- their ability to be used as cool roofing

- manufacturer efforts to offer products with thicker scrims that impart enhanced resistance to impacts and tears

Solar & Green Roofing Products to Post Robust Gains

Although they will continue to account for a small share of global roofing, demand for solar and green roofing products will rise at a rapid rate, supported by an ongoing shift to more energy-efficient roofing products in both residential and nonresidential structures throughout the world:

- Demand for solar roofing is expected to increase greatly through 2027, fueled by efforts in the US and Western Europe to improve energy efficiency and combat climate change. For instance, California has instituted building codes that encourage, or in some cases require, the installation of solar power on buildings. Sales will also be boosted by falling prices for solar roofing, making this product increasingly attractive to homeowners and building owners looking to reduce their utility bills and carbon footprint.

- Green roofing will also experience sizable growth through 2027, bolstered by their increasing use in a number of high-income countries and building code requirements in some countries (e.g., Canada and China) that mandate their use on certain types of buildings.

Historical Market Trends

Shifts in demand for roofing can vary from year to year, determined by a number of factors – primarily related to building construction activity. These factors include:

- levels of housing starts, particularly in the single-family housing segment

- the size and age of a country’s housing stock

- interest rates – low interest rates may encourage home and business owners to take out lines of credit often used to fund roof repair and replacement projects

- the number and types of commercial buildings erected or repaired in any given year

- the type of roof (e.g., steep-slope or low-slope) installed on a structure that will be repaired or replaced

- the types of roofing materials most often specified by contractors and other consumers in a particular region of the world

- the roofing materials originally installed on the structure

In addition, a number of other variables can affect demand for roofing in a particular year or over a short period of time, such as:

- weather conditions, especially outbreaks of severe weather that can cause widespread damage to roofs (e.g., hurricanes and tropical storms, tornadoes, hailstorms, and winter storms)

- changes and modifications to local building codes

- the adoption of legislation that causes a temporary increase in reroofing activity

- insurers requiring homeowners to replace older or worn roofs with newer materials that better resist severe weather on condition of maintaining coverage

- changes in the price of raw materials (e.g., asphalt, metal, lumber) that can cause the per-square cost of roofing materials to increase or decrease sharply

International Trade

International Trade

In any given year, foreign trade in roofing accounts for only 3% to 4% of total supply and demand. Trade in these products is limited because the weight and bulk of many roofing materials makes transportation costs too high relative to their value. As such, it is important for manufacturers to locate factories fairly close to construction sites in order to reduce transportation charges, particularly with heavier materials such as clay and concrete tile. For example, it is generally uneconomical to ship clay roofing tiles more than 80 kilometers from the production facility.

Another hurdle to trade in roofing is regional variations in the product mix. For instance, in Central and South America, Europe, and the Asia/Pacific region, clay, concrete, and metal roofing products are much more commonly used in steep-slope applications than are asphalt shingles, which dominate the US and Canadian markets. As such, the majority of roofing trade for the US tends to be with Canada. Differing building codes and product standards can also serve as a barrier to trade, as roofing producers in one country might be required to apply for certification in a foreign market before they are able to sell products there.

In 2022, the Asia/Pacific region maintained the largest regional trade surplus in roofing products at $650 million. However, export sales accounted for only a modest portion of the region’s total production. The largest exporters of roofing materials in the region are China, Japan, Indonesia, India, and South Korea.

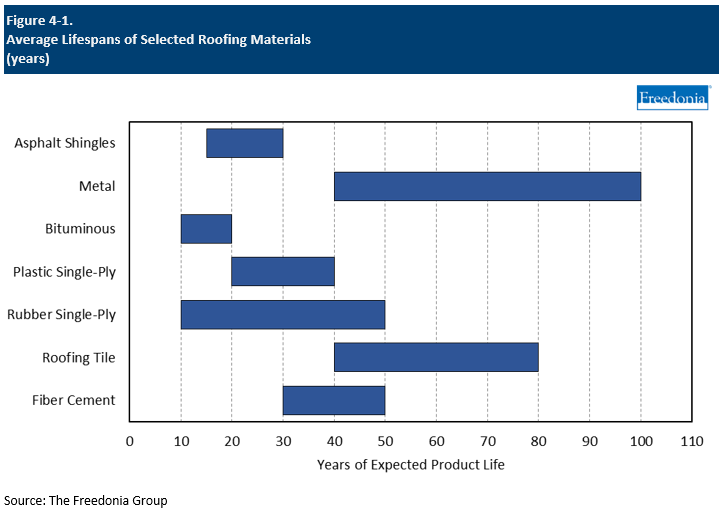

Product Lifespans

Manufacturers of roofing continually look for ways to make their materials more durable as consumers – trying to avoid the expense and hassle of roof repairs and replacement – are generally willing to pay more for products that have longer lifespans. Key methods of extending the lifespan of roofing products include:

- the use of laminated asphalt shingles – with multiple layers of asphalt and fiberglass – that better resist leaks, uplift, and impacts

- the addition of chemical modifiers (such as styrene-butadiene-styrene and atactic polypropylene) to bituminous membranes to enhance their resistance to environmental degradation

- the use of thicker scrims on bituminous, single-ply plastic, and rubber roofing membranes to enhance puncture and tear resistance

- the application of specially designed mineral and ceramic granules to a wide range of steep- and low-slope roofing materials to better deflect sunlight that can cause premature product degradation

Another way the lifespan of low-slope roofing materials can be extended is by applying a liquid-applied roof coating – which can be made from acrylic, asphaltic, silicone, or urethane compounds – on top of existing roofing materials to:

- rejuvenate a worn or lightly damaged surface by sealing cracks and filling gaps between materials

- completely cover an existing roof to form a new surface material

While these roof coatings are used as cool roofing products (most are light-colored compounds that deflect sunlight and minimize heat transfer), in many cases these materials can extend the lifespan of a roof by several years, either by repairing a damaged surface or by protecting an existing roof material from further damage caused by exposure to the elements.