Report Overview

China to account for 44% of global drywall gains.

China to account for 44% of global drywall gains.

This Freedonia industry study analyzes the 11.1 billion square meters global drywall industry, valued at $23.3 billion. It presents historical demand data (2012, 2017, and 2022) and forecasts (2027 and 2032) by market (residential and nonresidential construction) and application (new construction, improvement and repair construction). The study also evaluates company market share and competitive analysis on industry competitors including Beijing New Building Materials, Eagle Materials, Georgia-Pacific, Knauf, and Saint-Gobain.

Featuring 184 tables and 113 figures – available in Excel and Powerpoint! Learn More

Global demand for drywall – also known as plasterboard, wallboard, or gypsum board – is forecast to grow 1.8% per year to 12.2 billion square meters in 2027. Growth will be supported by:

-

an acceleration in growth in the massive Chinese market, as demand recovers from a weak 2022 performance

-

rising nonresidential building construction, boosted in part by a rebound in the US, the second largest global drywall market

In value terms, demand is expected to fall from an elevated 2022 base to $22.7 billion in 2027. Supply chain problems and high raw material costs caused drywall prices to surge in 2021 and 2022 and remain high in 2023. Prices will begin to moderate in 2024 as these issues are mostly resolved.

Growth Acceleration in the Chinese Market Will Be Major Driver of Global Demand

The best opportunities for drywall producers will be found in China, which will account for 44% of global absolute gains through 2027. Growth is expected to accelerate from the 2017-2022 pace, which was restrained by the:

-

country’s Zero-COVID policy, which led to temporary shutdowns of businesses and factories throughout the country in 2022

-

introduction of price caps and other financial regulations by the Chinese government in the latter part of the historical period to address the high levels of speculation in the real estate market

Gains will mostly derive from the nonresidential market due to increasing demand in urban areas for offices and other structures that use more modern construction techniques, including the use of drywall instead of other materials such as plaster or concrete.

Nonresidential Buildings to Remain Larger Market for Drywall

The nonresidential market will remain the larger market for drywall and will grow at a much faster rate than the residential market due to:

-

gains in nonresidential building construction globally, boosted by federal investment in municipal and public buildings as a means to further drive economic recovery post-pandemic

-

growing technological advancement of construction industries in developing economies

-

increasing urbanization in the Asia/Pacific and Africa/Mideast regions, increasing demand for a variety of institutional, office, and retail structures

Gains in the nonresidential market will also be supported by a rebound in nonresidential building construction in the US, the second largest drywall market in the world. Greater numbers of employees returning to in-office work and ongoing increases in travel will encourage greater spending on the construction or renovation of office spaces and hotels, investment in which lagged throughout the pandemic.

Historical Market Trends

Drywall is employed in residential and nonresidential buildings, including:

-

single-family, multifamily, and manufactured homes

-

office buildings

-

commercial establishments, including shops and restaurants

-

manufacturing facilities

-

community buildings, such as schools, churches, and municipal offices

Global demand for drywall is at its most basic level determined by underlying trends in the construction industry, primarily levels of new construction and repair and improvement activity. However, a variety of other factors also have a strong impact on both volume and volume demand of drywall used.

The factors that impact real drywall demand include:

-

the type and size of buildings being constructed

-

preferences in the materials used to construct buildings

-

the location of construction and local climate and storm activity

-

economic conditions and political considerations affecting the commencement and completion of construction projects

In terms of value demand, the drywall market is influenced by:

-

changes in product pricing, which is impacted by the intensity of gypsum mining and the opening or closure of mines

-

the impact of changing raw material, energy, and labor costs

Both real and value demand for drywall fell in 2020 because of the COVID-19 pandemic. Demand rebounded in 2021, driven partly by healthy gains in nonresidential construction activity. Construction activity slowed across the globe in 2022, limited by contractions in the US residential market and in China.

International Trade

International trade in drywall is somewhat limited due to:

-

the high cost of transportation relative to product value

-

the presence of substantial natural gypsum deposits, synthetic gypsum operations, and drywall production facilities throughout the world

-

the need to expeditiously transport drywall from factories or warehouses to construction sites

However, some neighboring countries do engage in notable levels of trade. This generally occurs when one of the countries in question is a large consumer or producer of drywall. Examples of such trade flows include:

-

Mexico exporting large amounts of drywall to the US

-

Germany supplying drywall to European countries like Austria, Belgium, France, Italy, the Netherlands, and Switzerland

-

Poland exporting drywall to other European countries

-

Thailand sending drywall to many Asia/Pacific countries, including India and Indonesia

North America maintained the largest trade surplus in drywall in 2022, with significant net exports in Mexico. Africa/Mideast also posted a significant trade surplus in 2022 due to sales originating from Saudi Arabia and Turkey.

The Asia/Pacific region posted a large trade deficit in drywall in 2022, despite Thailand being one of the world’s leading net exporters of drywall. China and Japan also maintained trade surpluses, but many other countries in the region imported drywall to meet demand. Central and South America also maintained a trade deficit in drywall.

Market Trends

Demand by Market

Demand for drywall is forecast to expand 1.8% per year to 12.2 billion square meters. In broad terms, the use of drywall is more common in nonresidential construction.

Drywall demand in residential building construction is forecast to remain flat through 2027 at 5.4 billion square meters. Stagnant housing construction in Western Europe and the United States will limit stronger gains.

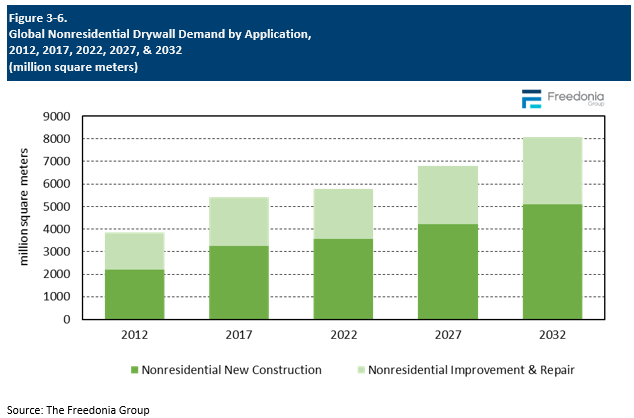

Nonresidential applications are expected to grow 3.4% yearly to 6.8 billion square meters, with growth supported by a rebound in nonresidential building construction in the large US market.

Nonresidential

Through 2027, sales of drywall in nonresidential building applications are projected to rise 3.4% per year to 6.8 billion square meters, with gains will be driven by:

-

an acceleration in nonresidential drywall demand in China – the largest global market

-

a rebound in nonresidential building construction in the US, which will account for the second largest absolute gains globally

In low-income countries, drywall tends to be much more prevalent in the nonresidential market than residential. New nonresidential buildings in major urban areas are often built by multinational contractors using modern construction techniques and materials, including drywall. Residential markets, on the other hand, are slower to adopt it over less expensive products such as building plaster and a lack of domestic drywall production.

New construction accounts for most of the nonresidential drywall market – over 60% of demand in 2022 – as the material is increasingly employed in such construction around the world. Demand will also benefit from an acceleration in new nonresidential construction globally.

Global Building Construction Outlook

Although the use of drywall around the world varies considerably by region, building construction activity is the primary driver of demand within a given country.

For drywall, new construction-related demand is much more important than aftermarket. Additionally, while drywall is used extensively in both residential and nonresidential structures, in lower-income countries it tends to be adopted more rapidly for the latter applications.

Improvement and repair construction spending is less influenced by swings in overall business conditions, but new construction activity (which accounts for the bulk of drywall demand) is highly cyclical – particularly in mature, industrialized world markets. However, the construction cycle often trails the general economy because of the significant time that passes between a project’s conception and completion. In lower-income countries, growth in building construction activity is largely dependent on increases in economic output, fixed capital investment, and personal income levels.

Through 2027, real (i.e., inflation-adjusted) building construction expenditures are expected to rise 2.3% per year to $16.4 billion. Africa/Mideast and lower- and middle-income countries across the globe are expected to experience solid growth. Construction expenditures in Central and South America will accelerate through 2027 after incurring losses between 2018 and 2020.