Report Overview

-

Highlights video surveillance equipment

-

Details emerging segments and trends

-

Addresses effect of COVID-19 pandemic and related

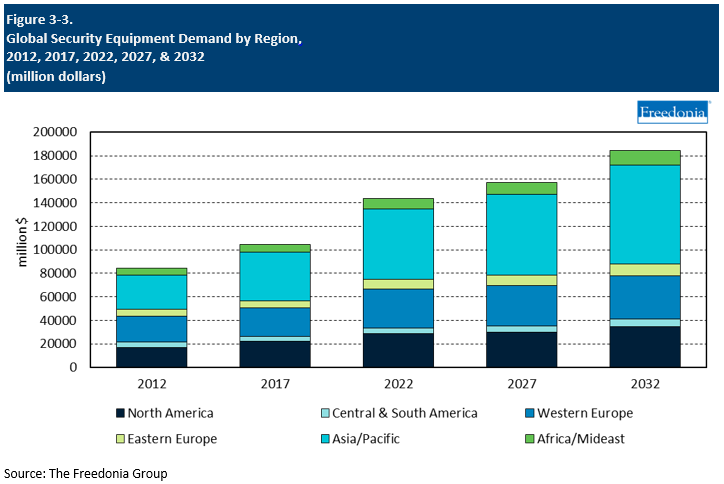

This Freedonia industry study analyzes the $144 billion global security equipment industry.

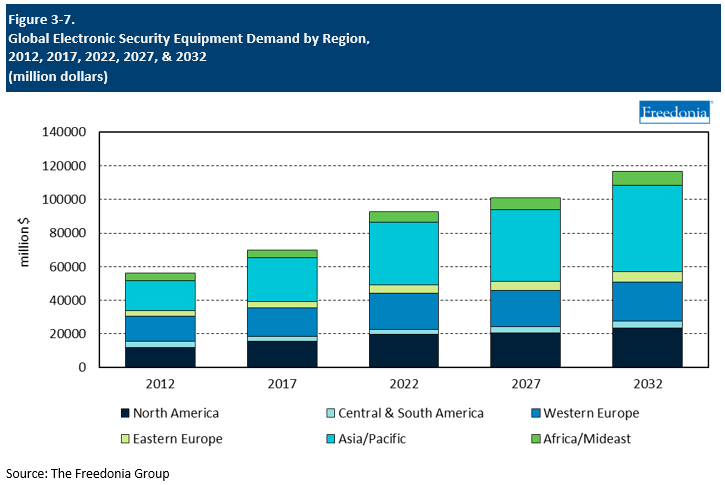

It presents historical demand data (2012, 2017, and 2022) and forecasts (2027 and 2032) by product (safety and security alarms, access controls, video surveillance equipment, contraband detection equipment, electronic article surveillance equipment, locks, other security equipment), market (commercial and industrial, government and institutional, residential and consumer), and region (North America, Central and South America, Western Europe, Eastern Europe, Asia/Pacific, Africa/Mideast). The study discusses the impact of the COVID-19 pandemic. The study also evaluates company market share and competitive analysis on industry competitors including ASSA ABLOY, Bosch, Dahua Technology, Dormakaba, Hangzhou Hikvision, and Johnson Controls.

Featuring 244 tables and 88 figures – available in Excel and Powerpoint! Learn More

This report includes data from 2011-2031 in 5 year intervals and tables featuring year-by-year data for 2018-2025.

See the discussion on Smart Home Security

Global demand for security equipment is forecast to increase 1.8% per year to $157 billion in 2027. An increase in unit sales will drive market value growth, as product prices are expected to decline from elevated 2022 levels as supply chain issues associated with the COVID-19 pandemic are resolved. Sales gains will also be supported by rising building construction activity and increased penetration of electronic security products.

Video Surveillance Equipment to Post Fastest Growth

Strong growth for video surveillance products is expected in both nonresidential and residential markets. For nonresidential users, increased adoption will be supported by the greater potential for video surveillance systems to provide value-added functionality via the use of predictive analytics and falling data costs.

Residential markets for video surveillance equipment have historically been under-penetrated, but have grown rapidly in recent years – particularly in higher income nations – with the introduction of consumer-oriented products like video doorbells. These products, which can be monitored and operated via typical smartphones and tablet computers, represent an important growth segment through the forecast period.

Historically, rising adoption of video surveillance products has been supported by an ongoing trend of declining prices. While this trend was interrupted during the COVID-19 pandemic, it is expected that price declines will resume and these products will continue to become more affordable going forward.

Broad Opportunities for Access Controls & Electromechanical Locks

Access control systems and electromechanical locks are commonly used in conjunction with each other and represent complementary products. These systems are expected to become increasingly popular, with sales of card-based access control systems posting significant absolute gains and penetration of biometric access controls expanding. Use of card-based access controls is being aided by their increasing ability to function via smartphone apps, which make granting, managing, and revoking access significantly easier.

Access controls and electromechanical locks also find relatively intensive use in some important growth segments, such as short-term rentals (e.g., Airbnbs) and flexible and shared workspaces, which are becoming increasingly common in the wake of the COVID-19 pandemic.

Building Automation & Smart Home Trends Providing Expanded Opportunities

A key driver of demand for security equipment across segments is the expanding ability of these products to integrate and interact with other building management systems. Increasingly, security systems are required to incorporate advanced analytics technology and operate in conjunction with other building systems, such as HVAC. In addition to driving greater sales of higher value equipment, these trends are providing opportunities for security equipment manufacturers to derive revenues from related functions, including software, systems integration, and “security as a service” programs. As a result, suppliers of security equipment are highly incentivized to develop and expand their technological competencies.

Reginal Trends

Demand by Region

Market expansion in value terms will be restrained by falling prices, as the market size in 2022 was elevated due to inflation and ongoing supply chain issues associated with the COVID-19 pandemic.

The Asia/Pacific region is projected to account for the largest share of demand gains, supported by solid growth in the massive Chinese market – especially in building construction. Increased industrialization and urbanization in India and various Southeast Asian countries will also fuel sales gains.

Economic development in lower and middle-income nations will likewise contribute to market growth in the Africa/Mideast region and in Central and South America. Solid growth in building construction activity is also expected in Eastern Europe, although population declines will temper the pace of gains in the region.

Markets for conventional security products in North America and Western Europe are highly saturated and tend to be mature. However, high income levels in these regions create opportunities for adoption of app-integrated electronic security products targeted at the residential market, which still holds considerable potential for growth.

Intrnational Trade

Intrnational Trade

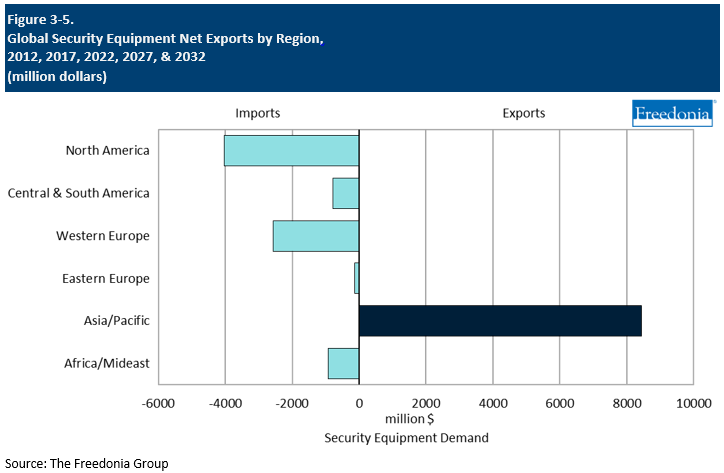

Foreign trade in security equipment is substantial, accounting for roughly 20% of total supply and demand in any given year. A number of suppliers concentrate their marketing efforts in one or a few countries, but many leading manufacturers sell their products on a worldwide basis.

The Asia/Pacific region was the only region with a trade surplus in security equipment in 2022:

- China is by far the world’s largest exporter of these products, with Taiwan and Vietnam also representing major global exporters.

- The region is expected to further expand its trade position through 2027, aided by continued cost advantages that will allow producers to capture market share in lower income markets worldwide.

Despite the fact that the US is the world’s second largest security equipment producer, the country is a sizable net importer of these products, and North America posted the world’s largest trade deficit in 2022. The US will continue to import these products intensively both from Asian producers and from Mexico.

Eastern Europe’s trade deficit in security equipment has been shrinking for some time, and the region is trending toward becoming a net exporter of these products, although this is not projected to occur in the immediate future. A number of countries in the region – including the Czech Republic, Hungary, Poland, and Romania – are becoming increasingly important exporters of these products to Western Europe.

Electronic Security Products

Electronic security products can be segmented into five major categories:

- access controls

- video surveillance equipment

- alarms (e.g., intrusion and smoke detection alarms)

- electronic article surveillance (EAS)

- contraband detection equipment

The market also includes a variety of low-volume niche products, such as handheld guard tour scanners and security robots.

The rise of integrated building management and smart home systems represents one of the most important drivers of electronic security equipment sales. Modern security equipment offers an increasing variety of value-added functions, including:

- predictive analytics that can increasingly detect suspicious behavior while minimizing false alarms

- the ability to be operated and monitored via robust smartphone apps

- the ability to integrate and interact with other building systems, such as HVAC systems

The growing complexity of electronic surveillance equipment and the systems it interacts with also offers widespread opportunities for equipment manufacturers to derive revenues from software, systems integration, and “security as a service” programs.