Report Overview

Featuring 63 tables and 77 figures – now available in Excel and Powerpoint! Learn More

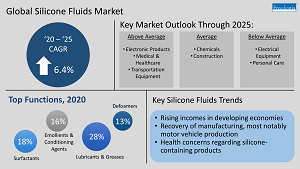

Through 2025, demand for silicone fluids is expected to grow 6.4% per year to $8.7 billion, with volume demand reaching 1.2 million metric tons. Demand will be boosted by:

- growing use of products containing silicone in developing economies, supported by rising personal incomes

- healthy growth in chemical manufacturing (particularly as high prices for gas prompt drilling) and construction markets

Though inflationary pressures are having some impact on the market, much growth in demand will be due to continued use of silicone fluids rather than to price spikes. Manufacturers of silicones are likely to avoid passing rising prices on to consumers as much as possible in order to keep silicones competitive with other inputs to finished goods.

Opportunities Exist for Silicone-Based Personal Care Products Despite Health Concerns

The personal care market will remain the largest market for silicone fluids in value terms, due primarily to increasing production of cosmetics and toiletries. Higher value personal care products made with silicones are already considered to be essential by many in developed countries and are continuing to be adopted by consumers in many developing areas, where they are increasingly available and affordable.

Although market growth will be restrained by the introduction of regulations limiting or outlawing the use of certain types of silicones in North America and Western Europe due to concerns about the safety of these products, opportunities exist. Manufacturers of silicone-based personal care products can meet increasing demand for “better-for-you” products by introducing hybrid formulations that include more natural ingredients and higher value silicones, many of which are allowable replacements for the D4 and D5 varieties under legal scrutiny.

Gains in Transportation Equipment Production Will Boost Growth for Lubricants & Greases

Demand for silicone fluid-containing lubricants and greases will grow at a healthy pace, offering the best opportunities for producers through 2025. Rising vehicle ownership rates in low- to mid-income countries will expand the number of vehicles that require regular maintenance, and more of these vehicles will use products containing silicone fluids as the parcs become more technologically advanced.

Additionally, silicone fluids have opportunities for increased sales of antifouling coatings as marine manufacturers respond to increasingly stringent regulations that require enhanced fuel efficiency and more environmentally friendly options. These concerns are of particular importance as supply chains are backed up and ports suffer from labor shortages that leave cargo vessels idling in harbors.

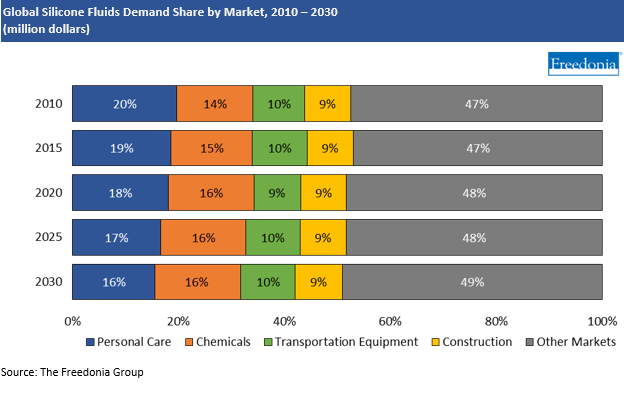

Demand by Market

Worldwide demand for silicone fluids is expected to expand 6.4% per year to $8.7 billion in 2025. The personal care market will remain the largest for silicone fluids; it will account for 17% of global demand in 2025. Although demand will be aided by a rise in cosmetics and toiletries production, other factors will restrain further growth:

- With restrictions on the use of D4, D5, and D6 in wash-off cosmetic and toiletry products in the EU as well as other proposed limitations on these chemicals, growth for certain silicone fluids may be limited.

- Some consumers choose to avoid shampoos, lotions, and other toiletries containing silicones because they can cause skin irritation.

The chemicals market will provide better opportunities for silicone fluids, with such products as mold release agents, water repellents, and urethane foam surfactants continuing to benefit the most due to their superior performance capabilities under wide ranges of conditions.

In the transportation market, such products as vehicle polishes and lubricants will continue to support demand increases, particularly in developing countries where market penetration is currently low. As a result, the transportation market is forecast to expand at the fastest pace, growing 9.7% per year through 2025.

Personal Care

Silicone fluid demand in the personal care market is expected to increase 4.7% annually to $1.4 billion in 2025, when volume demand will be 191,600 metric tons. Market growth will be fueled by factors like:

- recovery or acceleration in cosmetic and toiletry production in every region

- advances in personal care spending per capita in industrializing countries as incomes rise

The personal care products industry has reached maturity in most developed nations, where silicone-based products already see widespread use among a large portion of the population due to their high performance and cost effectiveness. In these areas, there are concerns regarding the safety of silicone-containing products that have led:

- the EU to restrict the use of siloxanes D4, D5, and D6 in personal care products

- consumers to increasingly prefer personal care products with all-natural ingredients

Producers of silicone-based personal care products are responding to these challenges by increasingly offering silicone hybrids that incorporate both silicones and natural ingredients. Additionally, the shift away from D4 and D5 can benefit silicone suppliers, as many of the possible replacements are higher value silicones.