Report Overview

Featuring 66 tables and 34 figures – available in Excel and Powerpoint! Learn More

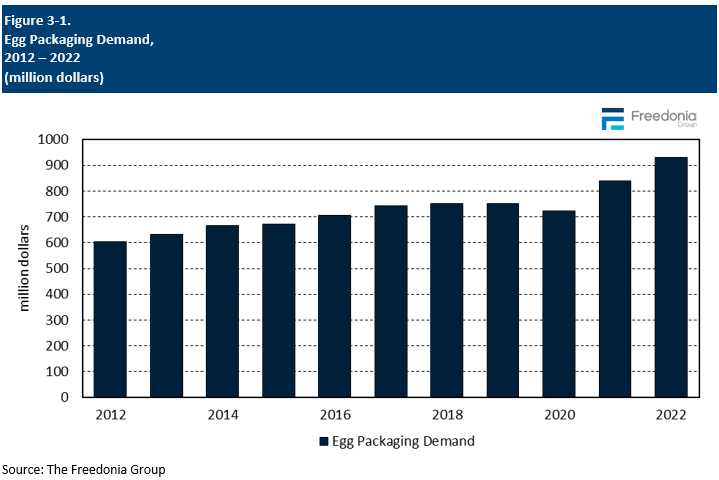

This Freedonia industry study analyzes the $930 million US egg packaging industry. It presents historical demand data (2012, 2017, and 2019 through 2022)  and forecasts (2023 through 2027 and 2032) by market (retail and foodservice), application (shell and processed eggs), and material (rigid plastic, flexible plastic, EPS foam, molded fiber, and paperboard). The study also evaluates company market share and competitive analysis on key industry competitors including Brødrene Hartmann, Pactiv Evergreen, Tekni-Plex, Sonoco Products, and Huhtamaki.

and forecasts (2023 through 2027 and 2032) by market (retail and foodservice), application (shell and processed eggs), and material (rigid plastic, flexible plastic, EPS foam, molded fiber, and paperboard). The study also evaluates company market share and competitive analysis on key industry competitors including Brødrene Hartmann, Pactiv Evergreen, Tekni-Plex, Sonoco Products, and Huhtamaki.

Packaging for eggs in the US is forecast to grow 1.3% per year to $991 million in 2027, with market value supported by the growing use of higher value materials for egg cartons in order to improve performance and address sustainability concerns. However, in unit terms, demand will remain stagnant due to overall market maturity and weaker demand for processed egg packaging, as consumption of this egg type slows following an uptick in 2022. However, an improved outlook for shell egg consumption will support demand gains for egg cartons.

Molded Fiber Strengthens Its Position in Egg Packaging Amid Sustainability Efforts

Egg cartons were among the first packaging products made with molded fiber and the material continues to account for the largest share of carton demand due to its low cost, protective properties, and favorable environmental profile compared to EPS foam and rigid plastic. Going forward, molded fiber is expected to see even greater use for shell egg applications, as environmental concerns influence the packaging industry toward more sustainable materials.

Additionally, new molded fiber materials, such as sugarcane, have begun entering the egg carton market. Unlike traditional molded pulp, which is derived from recycled paper, these new materials incorporate innovative production methods and raw materials to create better looking and performing products.

Industry Recovers from Avian Influenza Outbreaks, Supporting Egg Carton Demand

In 2022, a strain of highly pathogenic avian influenza ravaged poultry farms across the US, severely impacting shell egg production and pushed egg prices to all-time highs. Looking into 2023 and beyond, egg prices will continue to return closer to historical norms as shell egg production stabilizes. As a result, shell egg consumption will improve moderately at the expense of processed eggs, bolstering demand for egg cartons. Specifically, 6-count egg cartons are expected to see healthy gains as the number of single and small-family households in the US rises.

New Products Make Inroads in Processed Egg Packaging

Pouches and bag-in-box products continue to see above average growth in packaging of processed eggs, although this remains a relatively small part of the egg packaging market. These products benefit from their versatility, shelf life extension, and overall waste reduction.

Historical Market Trends

Yearly shifts in egg packaging demand are determined by a number of factors, primarily those related to the production and marketing of shell and processed eggs, as well as their end uses. These activities, in turn, are influenced by:

-

demographic trends like age, average household size, and disposable income

-

consumer spending on food and the balance between at-home and away from home cooking

-

consumer food preferences like enhanced convenience and “organic” labelling

-

restaurant and other foodservice industry revenues

In addition, a number of competitive variables determine the mix of packaging types used and their costs, including:

-

changes in the mix of the types of egg products being packaged

-

competition from other packaging formats

-

environmental and regulatory factors, including trends like source reduction, the use of recycled content, and recyclability

-

consumer preferences and concerns about quality and product safety

-

changes in packaging prices, which impacts trends in market value

Historically, egg packaging demand has experienced relatively steady, healthy growth in most market categories due to the continued popularity of eggs as an economical, nutritious, and easy-to-prepare food, as well as the popularity of processed eggs that are convenient to prepare or – in the case of egg whites – offer health benefits. Gains are often further supplemented by trends that promote eggs as a healthy protein choice, and by flexitarian diets such as “v-egg-an”, in which the individual maintains a plant-based lifestyle supplemented by eggs for additional protein.

Demand for total egg packaging declined in 2020 as the COVID-19 pandemic heavily impacted the foodservice industry, although demand for retail egg packaging remained steady due to an increase in at-home cooking.

In 2021, egg packaging demand rebounded as restaurants reopened and egg consumption returned closer to historical norms. However, growing prices of plastic and paper led to increased egg packaging prices, which were pushed even higher in 2022. Additionally, egg consumption dipped in 2022 following a decline in the chicken population due to a bird flu outbreak, further increasing already elevated prices.

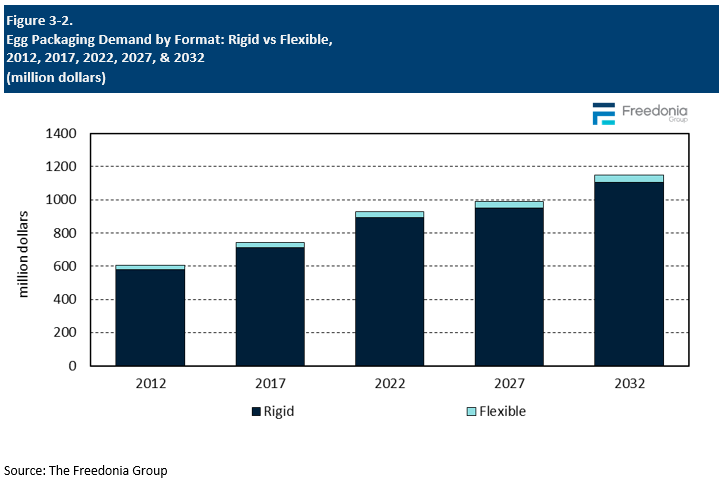

Packaging Formats (Rigid vs. Flexible)

Packaging for eggs is forecast to grow 1.3% per year to $991 million in 2027, though real demand will stagnate at 7.5 billion units. Growth in value terms will come almost entirely from a transition toward higher value materials and products, although a rebound in egg consumption after a low 2022 base that resulted from decreased production due to bird flu related issues will help support real and value demand for egg cartons. Further gains will be restrained by weaker demand for processed egg packaging, as consumption of this egg type slows following an uptick in 2022.

Packaging for eggs is dominated by rigid formats, which comprises 96% of total unit demand due to the need for sturdy packaging for fragile shell eggs. Rigid egg packaging, which will see average value growth during the forecast period, is mostly comprised of egg cartons and flats, but boxes and pails also see use.

Flexible packaging market value will experience above average growth throughout the forecast period, albeit from a low base. Flexible packaging is more prevalent in the smaller foodservice market due to its heavy use of processed eggs. Flexible formats are popular for packaging frozen, liquid, and dried egg products since they are lighter, easier to store, and have source reduction benefits. Flexible packaging (primarily pouches) is also used – albeit to a lesser extent – with retail products, particularly prepared hard-boiled eggs, liquid eggs, and dried egg powder.

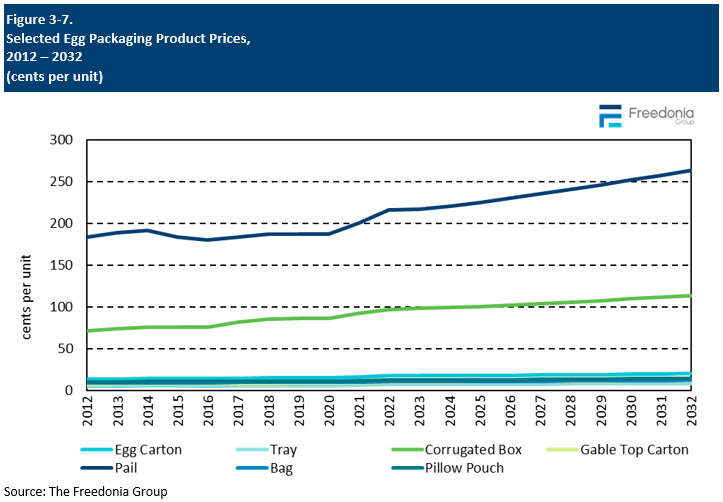

Pricing Trends

Pricing is an important factor in selecting packaging for a particular food application such as eggs. Price competition in the industry is intense, due to the prevalence of relatively low-technology, commodity-type products.

In 2021, the price of raw material inputs used in the production of food packaging, especially plastic, grew due to shortages caused by supply chain issues, leading to higher end pricing of egg packaging products, with a dramatic increase occurring in 2022 as these issues were compounded.

Going forward, price growth for most types of egg packaging is expected to moderate, with plastic products forecast to see price growth more in line with historical trends beginning in the latter part of the forecast period.

However, pricing of molded fiber – a popular material for egg cartons and flats – is expected to see slower price growth, reflecting diverging trends:

-

Advancements in manufacturing and tooling processes will decrease the price of production.

-

Increased focus on performance and aesthetic of molded fiber products will increase average price.

-

Growth in domestic production will initially increase pricing as manufacturers switch to newer manufacturing processes. However, this will lead to decreasing production costs and lower average prices over time.

Egg cartons and trays, which together comprise more than 87% of real egg packaging demand, will see slow price growth over the forecast period, due to the relatively slow price growth of molded fiber.

Among small volume egg packaging products:

-

Corrugated box pricing is largely driven by the price of paperboard, which is coming off an elevated 2022 base.

-

Gable top carton prices will grow at a faster rate than other products due to their occasional incorporation of layered aluminum, which has continued to increase in price into 2023.

- Pouch prices will largely track the price of plastic material inputs, which are expected to stagnate after a high 2022 base.