Report Overview

Get the new information on lawn and garden robots.

-

Product innovations will help lawn and garden robots further penetrate the US market

-

New companies, both established and start-ups, continue to enter the US

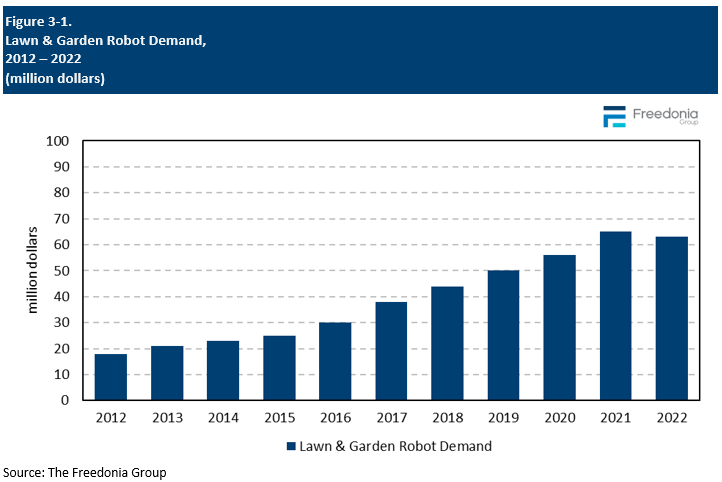

This Freedonia industry study analyzes the $63 million US lawn and garden robot  It presents historical sales data (2012 through 2022), forecasts (2027 and 2032) in value and unit terms by product (robotic lawn mowers and other lawn and garden robots, which include those used for snow blowing, weeding, and other gardening tasks) and market (consumer and commercial). Annual data and forecasts for 2019 to 2026 are also included. The study provides consumer survey data. The study also analyzes both industry competitors with commercialized products and up and coming companies, including FarmBot, Franklin Robotics, Honda Motor, Husqvarna, iRobot, Toro, LG Electronics, MTD Products, Positec Technology, STIHL, The Kobi Company, and Zucchetti Centro Sistemi."

It presents historical sales data (2012 through 2022), forecasts (2027 and 2032) in value and unit terms by product (robotic lawn mowers and other lawn and garden robots, which include those used for snow blowing, weeding, and other gardening tasks) and market (consumer and commercial). Annual data and forecasts for 2019 to 2026 are also included. The study provides consumer survey data. The study also analyzes both industry competitors with commercialized products and up and coming companies, including FarmBot, Franklin Robotics, Honda Motor, Husqvarna, iRobot, Toro, LG Electronics, MTD Products, Positec Technology, STIHL, The Kobi Company, and Zucchetti Centro Sistemi."

Featuring 37 tables and 17 figures – available in Excel and Powerpoint! Learn More

Read the blog: Futuristic Lawncare

US sales of lawn and garden robots are forecast to grow at an average rate of 24% per year to roughly 170,000 units in 2027 – valued at $207 million – due to:

- increased adoption in the commercial sector to mitigate labor shortages

- continued innovations that address common challenges in the US market

- a return to the “Do It for Me” (DIFM) lawn service trend following elevated levels of DIY activity during the initial years of the pandemic

Labor Shortages & High-Value Features Spur Rapid Adoption in Commercial Market

The consumer segment will remain the larger market for lawn and garden robots through 2027 as the technology continues to gain popularity among homeowners. However, the commercial market will become increasingly prominent and become the leading market for lawn care robots by 2032. This shift will result from a number of factors:

- Recent innovations, including the use of AI technology, advanced vision systems, and wireless boundaries make lawn and garden robots increasingly attractive to commercial landscapers looking to alleviate labor shortages.

- Although there are more units sold in the consumer segment than in the commercial market, professional users are more likely to purchase high-end, advanced models that carry a high price tag.

Return to “Do It for Me” Services to Boost Sales in All Sectors

The COVID-19 pandemic initially curbed consumer interest in hiring professional lawn care due to a combination of stay-at-home orders, telecommuting, and concerns over viral transmission, which created more free time to spend on maintaining their outdoor spaces. With the pandemic waning and conditions normalizing, many consumers with the disposable income to do so are transitioning away from DIY lawn maintenance.

Sales of lawn and garden robots in the consumer sector will be supported by those without the time or desire to maintain their own lawns but who do not want to employ a landscaper, especially consumers who have smaller lawns that can be easily maintained by a lawn mower robot. While the high price point of robot lawn mowers in general will limit sales in unit terms to those with enough disposable income to buy them, these products offer long-term cost savings over landscaping services and some traditional gas-powered models, even though the initial cost of the robotic mower may be higher:

- Charging a robotic mower costs less per year than paying for services or fuel.

- Maintenance costs are lower than gas- or electric-powered units, as robotic mowers require less care than traditional models.

Buyers who fall into this category will also likely prefer the convenience of high-end wireless models because of their advanced features, such as improved batteries, better mowing patterns, and computer visions systems, thus increasing sales in value terms.

The return to DIFM has created an increased demand for professional landscapers. This increasing use of landscaping services, especially amid the current labor shortage, will boost unit sales in the commercial sector, as landscaping businesses and turf management companies turn to robotic equipment to meet the needs of their customers.

Historical Market Trends

The market for lawn and garden robots is dependent on key factors that affect both the consumer and commercial markets, such as the health of the economy and construction activity. With regard to consumer applications – which account for the majority of lawn and garden robot demand – sales of these products are sensitive to fluctuations in:

- personal income levels

- consumer spending

- housing completions

Demand in the commercial market is also impacted by personal income levels, as consumers may be less likely to spend funds on professional landscaping if budgets are constrained. Additionally, commercial users are impacted by trends in construction activity. More housing construction leads to more opportunities for residential landscaping and, similarly, more commercial building activity leads to opportunities in that sector.

In addition to economic factors, demand for lawn and garden robots can also be significantly impacted by weather patterns and climate change. For example:

- Snow blowers see higher market penetration in regions with colder weather.

- Regions that experience less rainfall and/or see adoption of water-saving landscaping techniques, such as xeriscaping, are less likely to require lawn mowers to maintain grass.

For most of the study period, demand for lawn and garden robots has grown rapidly from a small base as they become more readily available and consumers realized their labor-saving benefits. Overall, gains in the industry have mostly come from the consumer market.

In 2020, demand remained consistent with prior years despite the pandemic, as consumers focused their time, energy, and funds on improving their outdoor spaces, supporting demand gains in the consumer market. In 2021, consumers continued to purchase lawn robots, whether to upgrade existing equipment or buy their first robotic mower as part of the surge in home sales during this time. The commercial segment also saw strong gains as a full year of more normal operations spurred demand from consumers wanting better looking yards.

Pricing Trends

The growing availability of lawn and garden robots and increased competition among suppliers will continue to depress prices. Additionally, manufacturers will continue to look for efficiencies in order to reach competitive price points that can pull customers away from more traditional power lawn and garden equipment.

However, the average prices of lawn and garden robots will remain high compared to traditional lawn and garden equipment due to a number of factors, including:

- innovations in navigation technology, such as units that do not require a boundary wire to function

- the implementation of high-value, crossover technologies from developments in other sectors that use autonomous sensors and equipment, such as home appliances (e.g., vacuums) and self-driving automobiles

- continued development of high-value smart features and robots that have increased connectivity

- advances in battery life and energy efficiency, which increase the range of robotic lawn mowers

Looking beyond 2022, these same factors will help expand the market for lawn and garden robots by solving the problems inherent to current models. Development of technologically advanced units that can navigate without boundary wires, are multifunctional or modular, or are designed specifically for commercial applications will support price growth and market gains in the long term.

Benefits of Lawn & Garden Robots

Considering the current state of technology employed by lawn and garden robots, the products available today have a number of benefits that help distinguish them from competing products.

Most importantly, once lawn and garden robot units are installed, they function autonomously, with little human interaction required in most cases. This is beneficial to consumers, like those with a DIFM mentality, who prefer not to spend significant amounts of time or effort on yardwork and, typically, have additional money to spend on helping with these tasks. The ease of use provided by lawn and garden robots is particularly beneficial to older populations and those with busy schedules. Furthermore, as many lawn and garden robots are weatherproof, they can work while the consumer remains dry indoors.

Long-term cost savings is another benefit of lawn and garden robots over more traditional lawn equipment. For example, while the price tag on a robotic mower may be higher than an electric- or gas-powered unit, there are no fuel costs associated with a robotic model. Maintenance costs are also quite a bit lower, and for homeowners, there is no recurring cost for landscaping services.

Moreover, a number of innovations in lawn and garden robots are providing additional benefits, including:

- connectivity to smartphones and other devices, allowing the robots to be controlled and monitored remotely

- rain sensors and weather monitoring that allow the unit to only mow during ideal conditions, avoiding potential jams from wet grass or mowing during periods of low grass growth

- grass sensors that can detect if grass needs to be mowed or if an adjustment to the mowing pattern is needed, saving energy and improving mow quality

Furthermore, the use of electric power in most lawn and garden robots provides benefits over competing engine-driven units, including:

- better environmental profile, including reduced air emissions and the elimination of yard clippings

- lower operating costs

- ease of use

- lighter weight