Read the Blog: Analysis of Implications of Executive Order 14072 on the Forestry Sector and Associated Equipment Spending

The US & Canada to Register the Largest Market Gains through 2027

The US and Canada will account for 31% of absolute gains through 2027, the largest share of any region. Forestry operations in the area will boost output in response to improving conditions in the manufacturing and construction sectors and high e-commerce activity. They will also continue to benefit from sanctions imposed on Russia and counter-sanctions imposed by Russia in the near term. Finally, forestry companies in the US and Canada will increase their use of newly developed, state-of-the-art forestry equipment as they confront a variety of workforce issues and cope with increasing competition from abroad and the adoption of new regulations. However, they will have to cope with a variety of challenges, such as infestations, climate change, wildfires, and mill closures.

Eastern Europe Outlook Will Improve Following Near-Term Declines Due to Ukraine Conflict

Market conditions in Eastern Europe deteriorated sharply in 2022 because of the conflict in Ukraine, which led to economic turmoil, a drop in regional forestry activity, deteriorating conditions in key end use markets, rising energy costs, and supply chain disruptions. As many US, Canadian, and West European suppliers pulled out of the Russian and Belarussian markets, equipment availability decreased dramatically and the region experienced delivery delays. However, suppliers in Russia, Belarus, and China began to develop new models to replace equipment from foreign multinationals that withdrew. The conflict continued to restrain forestry equipment sales growth in Eastern Europe in 2023.

Market conditions are expected to improve significantly during the second half of the forecast period as the conflict stabilizes, the regional economy grows, manufacturers gradually return to the Russian and Belarussian markets, and forestry activity in Eastern Europe rises. Foreign investment in the regional forestry sector will rebound, helping to drive technological innovation.

Study Description

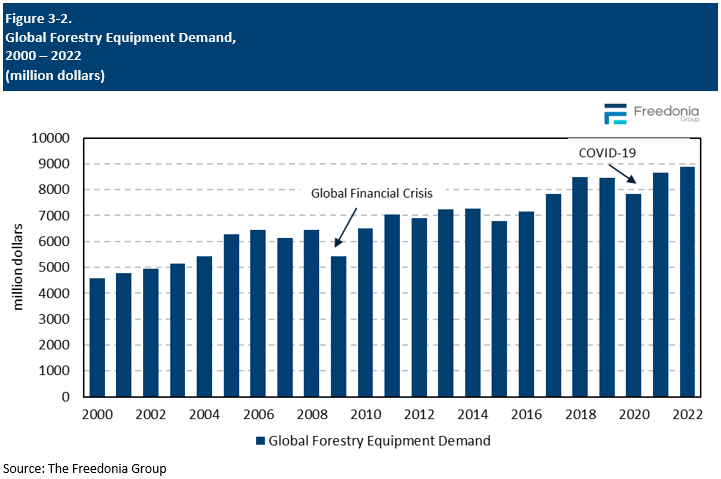

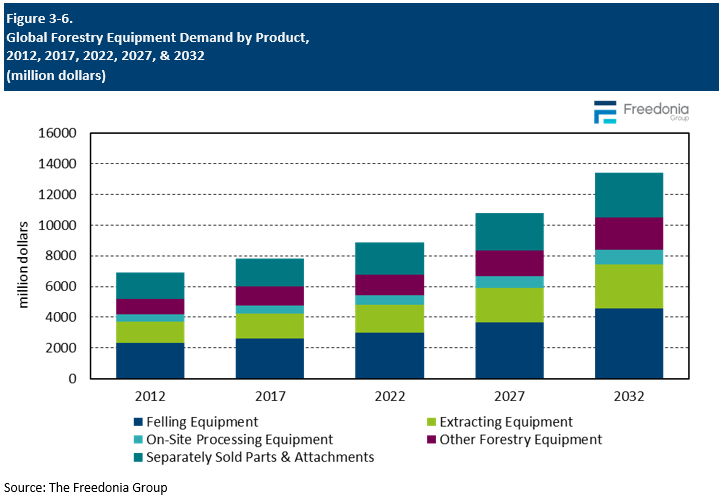

This Freedonia study analyzes the $9 billion global forestry equipment market. It provides supply and demand figures for 2012, 2017, and 2022, and forecasts for 2027 and 2032, as well as annual data for the 2019-2026 period and historical forestry equipment demand charts for the 2000-2022 period for all countries. Global Forestry Equipment also presents product demand by type for 14 countries: Felling Equipment (Chainsaws, Harvesters, and Feller Bunchers & Other Felling Equipment); Extracting Equipment (Forwarders, Skidders, and Other Extracting Equipment); On-Site Processing Equipment (Chippers & Grinders, Delimbers, Slashers, & Other On-Site Equip); Other Forestry Equipment (Loaders, Mulchers & All Other Forestry Equip); and Separately Sold Parts & Attachments (Saw Chains, Guide Bars, Blades, & Teeth; Harvesting & Other Cutting Heads; and Other Parts & Attachments).

In addition, this Freedonia study offers a competitive analysis of industry leaders and provides market share for 23 key manufacturers including Caterpillar, CNH Industrial, Deere, Eco Log Sweden, Hitachi Construction Machinery, Kesla, Komatsu, Makita, Minsk Tractor Works, Oregon Tool, Ponsse, Rottne Industri, SENNEBOGEN, STIHL, Sumitomo Heavy Industries, Tigercat Industries, Volvo, Weiler Forestry, and Yamabiko.

Historical Market Trends

Global demand for forestry equipment tends to be quite cyclical because of multiple factors, including:

-

the large amount of forestry equipment in use worldwide

-

product demand being heavily concentrated in mature markets, such as Australia, Canada, New Zealand, the US, and Western Europe

-

the high forestry sector mechanization rates of Brazil and Russia relative to other developing nations

-

the intensive use of forestry equipment (often exacerbated by difficult conditions and/or climates) by logging operations, meaning these machines must be regularly replaced

Myriad factors impact spending on forestry machines, attachments, and parts around the world. Among the most important are changes in the incomes of forestry operations, which directly affects their expenditures. This is particularly important for small and mid-sized operations that are unable to finance major equipment purchases and technology investments. The financial positions of forestry companies are largely determined by levels of output, wood prices, labor and material costs, borrowing costs, and related factors. New government regulations targeting forestry activity can also influence the profitability of logging operations, as can government programs designed to bolster the forestry sector.

At the macro level, forestry activity in a given country is impacted by:

-

macroeconomic factors such as GDP and fixed investment spending

-

availability of large amounts of forested land (that is also concentrated enough to make logging profitable)

-

a shift from manual to machinery-intensive logging techniques and degree of forestry sector mechanization

-

fires, weather (including extreme weather events such as drought), flooding and cyclones, and pests targeting trees

-

the nation’s regulatory framework for the forestry sector and enforcement practices

-

environmental concerns and those involving illegal logging and the destruction of forests (e.g., Brazil) at home and abroad

-

access to capital

-

government support for forestry activities and regulatory changes

Demand by Product

Individual countries tend to differ, often quite significantly, in their respective forestry equipment needs, as well as their ability to support domestic forestry machinery manufacturing industries. Differences are largely determined by the size and the mechanization of their forestry industry.

Global forestry equipment demand is projected to expand 4.0% annually to $10.8 billion in 2027, an improvement over the 2017-2022 performance. Demand in unit terms (excluding parts and attachments) is expected to climb 1.1% per year to 3.1 million units in 2027. Because the global forestry equipment market experienced significant volatility between 2019 and 2023, most product segments have favorable growth prospects through 2027. A number of trends – such as technological innovation and the growing use of more mechanized logging techniques in developing markets – will fuel growth in multiple segments.

Mechanization affects demand globally and varies from country to country. While mechanization is an ongoing and accelerating process in the developing world, a sizable share of the global logging industry uses manual logging methods. Mechanization is a major opportunity for growth, especially in the developing world where equipment sales rise from a low base. However, lack of financial resources and knowledge about higher value logging will continue to prevent more widespread adoption of higher value machinery to an extent.

Within individual categories, rising demand for newer and increasingly sophisticated models that cost more is consistent among all products. However, some segments will benefit to a somewhat lesser extent, most notably chainsaws, which feature less room for improvement and which tend to be a commodity-like product. Furthermore, demand for all products will be supported by new regulations (e.g., emissions regulations, technical standards) that mandate the purchase of new equipment to meet these requirements. The growing use of most types of forestry equipment will stimulate sales of numerous attachments and parts worldwide.

Global Roundwood Production

Roundwood production levels also impact forestry equipment demand, since changes in output levels can have an impact on the amount of equipment needed in harvesting operations. Additionally, as roundwood output increases, the financial resources of logging firms and related companies grow, allowing them to increase spending on equipment.

Roundwood is felled wood in its natural state, with or without bark. There are two types of roundwood produced: wood fuel (or fuelwood) and industrial. Wood fuel is wood harvested for use as a fuel in cooking, heating, and power production, and it includes wood utilized in the manufacture of charcoal, wood pellets, and other agglomerates.

Although forestry equipment is used in the production of both types of roundwood, industrial roundwood forestry operations account for the vast majority of the equipment demand. Industrial roundwood is composed of:

-

saw logs (wood that will be sawn or chipped lengthways to produce sawn wood or railroad ties)

-

veneer logs (wood that will be peeled or sliced to manufacture veneer)

-

pulpwood (wood harvested for use in the production of pulp, particleboard, or fiberboard)

-

all other non-wood fuel roundwood

Much of the wood fuel produced globally is harvested for use as a household fuel source in poor, underdeveloped countries, and as such the wood harvesting process for wood fuel tends to be much less machine intensive. In 2022, wood fuel accounted for about half of all roundwood produced worldwide, with developing nations in the Asia/Pacific region, Africa/Mideast region, and Latin America responsible for nearly 90% of all output.