Report Overview

Learn more with this accurate assessment of shifts and determine which aspects of the market will revert to pre-pandemic trends and which ones will remain in place.

-

How much sustainability is impacting the materials used for disposables

-

Use of disposables at restaurants and other establishments

This study examines the US market for packaging wrap.

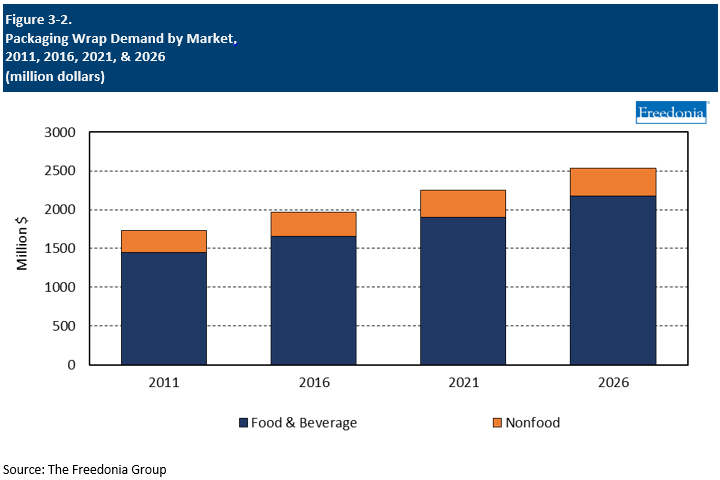

Historical data are provided for 2011, 2016, and 2021, with forecasts through 2026. Also provided is an analysis of key industry players.

Featuring 56 tables and 9 figures – available in Excel and Powerpoint! Learn More

This report includes data from 2011-2031 in 5 year intervals and tables featuring year-by-year data for 2018-2025.

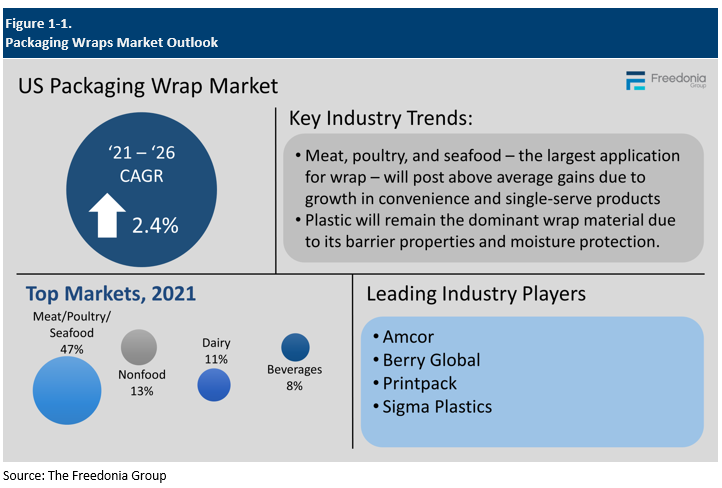

Demand for packaging wrap in the US is projected to increase 2.4% per year to $2.5 billion in 2026. The inflationary pressures on raw material costs that drove prices upward in 2021 and 2022 are expected to recede somewhat in the coming years, which will slow growth in value terms. Real demand growth will be supported by the ongoing shift away from rigid packaging and the increasing popularity of case-ready and pre-wrapped meats and other fresh products, the largest outlets for packaging wrap.

Sustainability Efforts Have Strong Influence on Demand for Wrap

Both suppliers and end users of packaging wrap have sustainability goals, which have a complicated effect on demand for wrap. On one hand, the general shift favoring flexible packaging will be beneficial to wrap demand, as will food waste reduction efforts achieved by using wrap to package meat and other fresh foods in smaller portion-sized amounts. At the same time, efforts to reduce secondary and other inessential packaging – such as film overwrap of beverage containers or pharmaceutical products – will serve to curb packaging wrap demand in those applications.

Performance Characteristics Ensures Plastic Retains Market Share

Plastic is expected to remain the dominant material used to produce packaging wrap. While paper wrap will retain much of its market presence (due in part to its image as an environmentally preferable material), it is not expected to take market share from plastic wrap as it has for pouches. Instead, plastic wrap will actually increase in popularity as it offers better barrier properties and moisture protection in food packaging and other applications where such attributes are required.

Major Food Applications to Lead Growth

The market for packaging wrap is fairly mature, and the prospects for wrap demand are primarily determined by the outlook for the major markets in which they are used. Wrap markets that will have the biggest impact on wrap demand are meat, poultry, and seafood; and fresh produce:

- Growth in the meat, poultry, and seafood market – by far the largest market for packaging wrap – will be driven by increased packaging of products into single portions, and the growing popularity of case-ready fresh meat and ready-to-cook meal items such as specialty ready-to-cook cheeseburgers.

- Gains in the produce market will result mainly from the increased share of fresh produce being packaged rather than being sold unpackaged in retail stores.

Demand by Market

Demand for packaging wrap is expected to grow 2.4% per year to $2.5 billion in 2026. Though wrap faces strong competition from lidding and skin packaging, it will still benefit from a general shift away from rigid packaging. Wrap will also continue to benefit from light weight and low cost, which are especially important for meat products sold at big-box stores and discount grocers.

Food and beverage applications represented 85% of the US wrap market in 2021, and they will remain dominant based on continued demand for product transparency and material use reductions; these trends favor all-film packaging:

- Meat, poultry, and seafood products will remain the most significant applications for wrap, due to wrap’s low cost and adequate barrier properties.

- Dairy products, beverages, and candy and confections also represent significant demand.

Paper and textile products represent the largest nonfood market. However, demand in this market will decline due to poor overall prospects for paper products. Pharmaceuticals, medical products, and health and beauty products also represent notable nonfood markets for wrap.

Competition from Rigid Packaging

Wrap is often used in tandem with other flexible and rigid packaging products to provide complete product protection, allow for easier dispensing of contents, and enhance the shelf appeal of products. However, source reduction efforts (by both packaging manufacturers and end users) are discouraging the use of extra product packaging,

Overall, sustainability and performance continue to be the top drivers of change in the packaging industry. Continued market presence for wrap greatly depends on how consumers’ perceptions of plastic packaging, as well as the durability of trends focused on eliminating single-use plastics.

Plastic is the dominant material used to produce wrap, with paper, foil, and cellophane limited to differing extents by performance constraints. Therefore, improving recycling rates and recycled content usage are key competitive factors in wrap maintaining or increasing its share of the overall packaging market.

Sustainability Initiatives

Sustainability has become one of the top trends in the packaging industry. Customers and consumers increasingly demand packaging products that are better for the environment, and regulators continue to make single-use packaging the target of restrictions and bans. Key ways that packaging producers are becoming more sustainable include:

- Increasing recycling rates and using more recycled content

- Source reduction, or reducing the volume of packaging waste through actions like downgauging or otherwise reducing packaging weight and eliminating secondary packaging

- Developing biodegradable and/or compostable products

Plastic packaging remains a significant environmental concern since most of it is single-use and frequently ends up in landfills or waterways. Consumer unease over packaging waste has been amplified by the rise of e-commerce and direct-to-consumer shipments, which has made them more aware of the packaging they use. In turn, consumers have vocalized greater desire for more sustainable packaging. To address these concerns, suppliers have tried to reduce the amount of material used in packaging (i.e. source reduction) and employ more recyclable materials in production.