Report Overview

Featuring 63 tables and 68 figures – now available in Excel and Powerpoint! Learn More

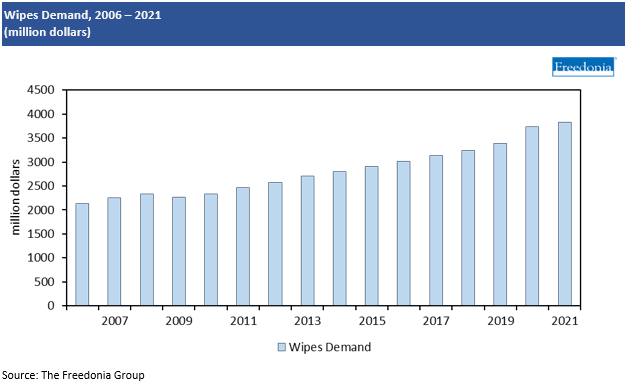

Demand for wipes is expected to advance 2.3% per year off a relatively high base to $4.3 billion in 2026. While this growth rate is relatively slow compared to historical norms, it stems from elevated market levels, as pandemic-related sales spikes for various wipes (notably disinfectant wipes in 2020), supply chain challenges, and higher raw material costs led prices for wipes to jump in 2020 and 2021, inflating market value in those years.

In unit terms, wipe demand growth will accelerate, supported by:

- consistent increases in the industrial and institutional market, with major submarkets like healthcare and foodservice returning to pre-pandemic levels of operation

- product development that improves the functionality and environmental profile of available personal care wipes, thereby increasing adoption among consumers

Demand for Surface Disinfectant Wipes to Remain Elevated

While demand for surface disinfectant wipes fell in 2021 from the pandemic-induced spikes of 2020, it remained well above pre-COVID-19 levels; consumers and nonresidential end users continued to purchase these products to protect themselves from potential viral exposure. Major wipes suppliers have invested significantly in expanding their domestic production capacities for surface disinfectant wipes, in some cases enlisting contract manufacturers to help supplement their own lines.

It is expected that demand for surface disinfectant wipes will remain elevated as cleaning regimens in industrial and institutional settings that address healthcare associated infections (HAIs), foodborne illnesses, and other potential viruses continue to be rigorous. While consumer demand for these wipes will decline as households reorient their approach to reducing viral transmission, an expanded base of users will help demand remain above pre-pandemic levels.

Product Development Continues to Create More Sustainable Options

Suppliers of baby, personal hygiene, and household wipe products continue developing items that appeal to consumer desires for sustainability and environmental safety. Consumers increasingly want their products to have ingredient transparency, be biodegradable, and be derived from natural sources. These trends – coupled with regulatory actions to influence the development of products that have improved flushability or less plastic content – will encourage greater use of these products going forward.

Growth in the Industrial & Institutional Market Supports Overall Gains

The market for industrial and institutional wipes rebounded in 2021 following a depressed 2020 that was attributable to the COVID-19 pandemic, as the foodservice market was negatively impacted by restaurant closures, and hospitals saw the cancellation of non-emergency procedures and focused more on telehealth. Going forward, both markets will continue to grow as:

- foodservice revenues rise and the number of restaurants and other foodservice establishments increases

- healthcare spending increases due to an aging population and an uptick in surgical procedures

Historical Trends

Sales of wipes depend on a variety of market trends, as well as on macroeconomic and demographic factors. For example:

- Consumer wipes markets rely on economic growth, as it can either encourage or inhibit consumers’ spending on wipes, which are often considered discretionary alternatives to other products on the market.

- Industrial and institutional wipes markets also rely on economic growth, as it supports the revenues of businesses and other operations and can affect their investment in wipes over alternative products.

Demand for wipes also depends on trends among certain key demographics. Most notably, changes in the infant population have a significant effect on wipes sales since baby wipes account for about 33% of the wipes market. During the 2016-2021 period, the infant population in the US declined. While this trend limited gains in volume terms, strong sales in 2020 and strong price gains helped keep growth solid in value terms.

Overall, 2020 and 2021 were volatile years for the wipes industry. On one hand, the consumer market surged in 2020, but it fell back from those highs in 2021. Consumer demand for certain personal care and household wipes – most notably disinfectant wipes – drove the consumer wipes market up over 20% from 2019 to 2020. Individuals stockpiled products like baby and personal hygiene wipes, and more people used disinfectant wipes regularly to clean their homes.

On the other hand, industrial and institutional wipes declined in 2020 and rebounded in 2021. Industrial and institutional wipes were hampered by shutdowns in early 2020 and decreased economic output overall. Demand then rose as manufacturing rebounded in tandem with the economy in 2021 to erase losses. In addition, non-consumer outlets also increased their usage of wipes in disinfecting and cleaning operations.

Products Overview

Demand for wipes is projected to increase 2.3% annually to $4.3 billion in 2026:

- Wet wipes comprised 75% of US wipes demand in 2021 and are expected to account for 67% of demand growth through the five-year forecast. Value demand growth will decelerate due to a high price base in 2021. In unit terms, demand will accelerate due to a return to pre-pandemic usage patterns, most notably for personal care wipes. Less stringent cleaning regimens will cause a decline in household cleaning wipes - including disinfectant wipes – limiting further wet wipe growth in 2026.