Matthew Hurley is an industry analyst at The Freedonia Group, where he writes studies focused on the global construction markets.

US ITC Ruling: US Countertop Industry Has Been Injured by Low Cost Imports from China

by Matthew Hurley

August 26, 2019

On May 31, 2018, the US International Trade Commission (ITC) announced that it had found reason to believe the US quartz countertop industry had been materially injured by imported Chinese products being sold at less than fair value. The ruling followed an investigation (launched the month before) into an antidumping and countervailing duty petition filed by Cambria, the largest US-based producer of quartz surfacing products.

The US Quartz Countertop Market: A Brief History

Since 2013, US imports of quartz slab have skyrocketed in response to rapid growth in the US engineered stone countertop market. During this time, Chinese producers took considerable market share away from the leading producers, which include Cambria, Cosentino, and Caesarstone.

A decade ago, engineered quartz countertop demand was limited in the US market, as the high price of these products impeded their market penetration. However, over the last five years, demand has risen nearly five-fold as distribution networks have expanded and products have become more affordable for middle-income consumers.

Tariffs: A Timeline

In the wake of the US ITC decision, initial tariffs of 34-178% were levied on quartz slabs imported from China on September 17, 2018. Additional increases took effect later that month, and then again in May 2019. Furthermore, on June 11, 2019, the USITC upheld its initial May 2018 ruling. As of July 2019, imports of quartz slabs from China were subject to antidumping and countervailing duties ranging from 311% to 528%.

This is a major disruptor for the US countertop industry, as China is a leading source of quartz slab used to fabricate engineered stone countertops. In 2018, the country accounted for about half of the total slabs used in the US.

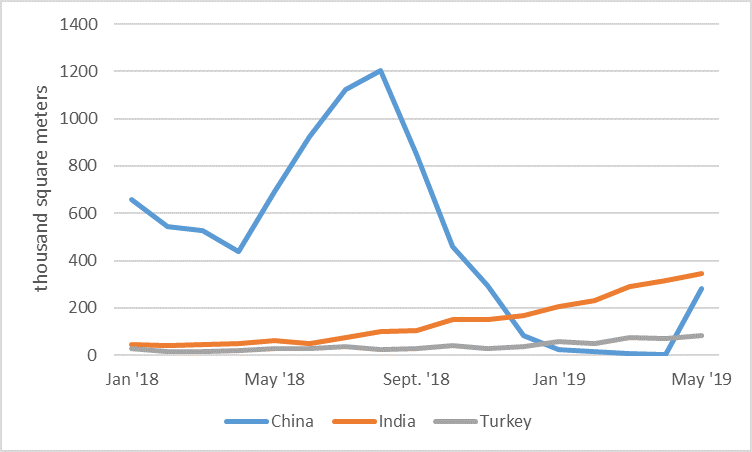

However, once the initial tariffs on Chinese quartz imports were enacted, imports from China began to fall significantly, due in part to a surge in imports that began after the investigation was launched in April.

Chinese Quartz Slab Imports Have Plummeted Since September 2018 USITC Ruling

India and Turkey Now Under Investigation

On May 8, 2019, Cambria filed another antidumping and countervailing duty petition against India and Turkey, claiming that these countries were also dumping quartz slabs into the US market at less than fair value. Seeking low-cost alternative sources for cheap quartz slab imports following the China tariffs, many quartz countertop producers and fabricators turned to India and Turkey.

Since September 2018, quartz imports from these two countries have soared (albeit from a relatively low base). In fact, from January 2018 to May 2019, these two countries have experienced the two largest rates of growth in terms of exporting quartz to the US.

A preliminary countervailing duty ruling for quartz slab imports from these countries is due in August 2019, with a subsequent preliminary antidumping duty ruling slated for October 2019.

Predicting the Impact of Tariffs on the Countertops Market

The recently imposed antidumping and countervailing duties have had an immediate impact on average quartz slab prices in the US. Imports from China have become more expensive, and US demand for quartz slabs produced by higher cost alternative sources of supply – including US plants – has grown, raising average price levels.

Going forward, this spike in material costs will make engineered quartz a less attractive alternative to competing countertop products and temper future sales gains, especially among the middle-income consumers who’ve spurred market growth in recent years.

Nevertheless, engineered quartz is projected to remain the fastest growing countertop surface material through 2023 in both the US and other parts of the world, according to Global Countertops, a recent study from The Freedonia Group. This will be due to its favorable aesthetic qualities, durability, and easy maintenance relative to natural stone, in addition to expanding global output, which will put downward pressure on prices.

Want To Learn More?

For more information on the countertops market, check out Global Countertops, a recent study from The Freedonia Group.

For more information on the countertops market, check out Global Countertops, a recent study from The Freedonia Group.

This study analyzes the global market for residential and nonresidential countertops (also called benchtops or worktops in some parts of the world) for the new construction and remodeling markets, including kitchen, bathroom, and other (e.g. laundry and bar) countertops. The report also includes the following breakouts by material:

- engineered quartz

- granite, marble, and other natural stone

- laminate

- solid surface

About the Author:

Have unique research needs?

Freedonia Custom Research listens intently to your needs and objectives. Then we work diligently to define and deliver a service to meet them.Subscribe to Our Blog

Stay up to date with the latest information about new market research and news in areas relevant to your business from our analysts and team members.Freedonia Group Blog Subscription

Provide the following details to subscribe.