Report Overview

What shift should you watch in the market?

What shift should you watch in the market?

-

Aluminum cans will continue to take share from bottles.

This study examines the US market for beverage packaging, defined as primary and secondary packaging materials sold to beverage suppliers, primarily for products targeted at retail or foodservice markets. Historical data are provided for 2012, 2017, and 2022, with forecasts through 2027. Annual data is provided for 2019-2026. Data are provided in current dollar value and units. Also provided is an analysis of key industry players.

Featuring 263 tables and 113 figures – available in Excel and Powerpoint! Learn More

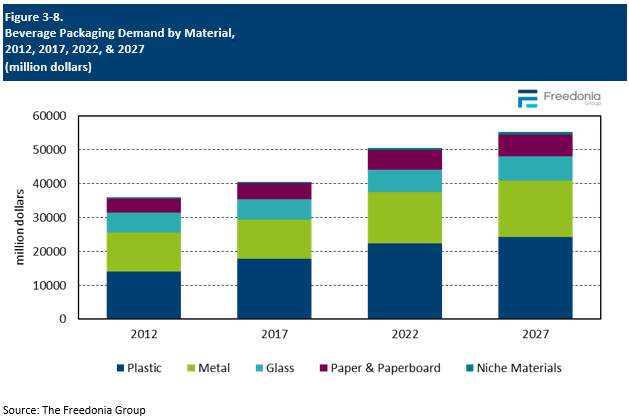

Demand for beverage packaging is forecast to increase 1.8% per year to $55.3 billion in 2027. Unit demand is expected to grow 1.0% per year to 837.6 billion. While unit gains will remain relatively steady, value growth will be limited by moderation in raw material costs and an easing of supply chain issues that caused pricing surges in 2021 and 2022. Beverage packaging must simultaneously be cost effective and fall in line with changing sustainability goals and consumer preferences:

-

Aseptic cartons will see fast value growth in all beverage markets except fruit beverages, owing to their performance benefits and product differentiation capabilities.

-

Bottled water will continue to see healthy gains, with sparkling water to experience especially fast growth.

-

Mature beverage categories (such as carbonated soft drinks, fruit beverages, and beer) will continue to see declines in real packaging demand, largely due to health concerns and increased competition from alternatives.

Sparkling Water, Energy Drinks, & RTD Coffee to Experience the Fastest Growth

Among beverage markets, sparkling water, energy drinks, and ready-to-drink (RTD) coffee are expected to post the fastest growth in beverage production and packaging demand, bolstered by strong advertising pushes targeting younger consumers. This stems, at least in part, from increasing consumer preferences for beverages with functional properties and those associated with specific activities and communities (e.g., extreme sports, e-celebrities, gaming, and university culture). These beverages also benefit from the availability of low-calorie options and the variety of new flavors and brands that appeal to different demographic groups.

Sustainability Remains Top Concern for Packaging & Beverage Suppliers, Drives Innovation

Sustainability continues to be among the highest profile concerns in the beverage packaging market, with producers of different formats and materials jockeying to be seen as the most eco-friendly. Actions taken to improve sustainability include greater focus onrecyclability, incorporation of recycled and post-consumer content into packaging, and lightweighting and source reduction.

Plastic is the leading target for sustainability conversions, but it remains the most used material because of its cost and performance. To address sustainability concerns, manufacturers have increasingly focused on plastic packaging that is both recyclable and incorporates recycled content.

Some beverage and packaging manufacturers have elected to focus on new packaging formats, particularly paperboard and molded fiber bottles, to address sustainability concerns. These bottles are typically composed of an outer paperboard or molded fiber shell married to a recyclable, separable inner pouch or lining. Molded fiber bottles currently have trouble withstanding the pressure exerted by carbonated beverages, though many leaders in the carbonated soft drink and beer markets continue to trial them and innovate their designs to meet sustainability goals.

Historical Market Trends

The US beverage packaging industry is heavily dependent upon general trends in beverage consumption and production. The prospects for the beverage industry are impacted by a range of variables, many of which are beyond the control of industry participants. These include:

- macroeconomic shifts, as in levels of consumer spending and disposable income or overall economic growth and inflation

- demographic factors like the size of the resident population, age distribution patterns, ethnic diversity, geographic distribution, and immigration

The beverage industry is also influenced by less predictable factors – weather patterns, crop harvests, raw material prices, technological innovations, medical and health related research, governmental regulations, foreign trade, and changes in consumer preferences and tastes – that are beyond the control of beverage manufacturers. What those companies do have control over are things like advertising, marketing, and new product introductions, which all typically have a greater impact on the beverage product mix than total beverage demand; they can also impact the level and type of packaging used.

Beverage packaging demand is also influenced by overall trends in the packaging industry. Among the factors included here are environmental and regulatory issues such as sustainability initiatives, which can spur demand for packaging that is perceived to be environmentally friendly. Other key considerations that affect consumer preferences for beverage packaging include convenience, size (e.g., single-serving, multipacks), image, and technological developments (e.g., smart packaging, materials innovations).

Markets Overview

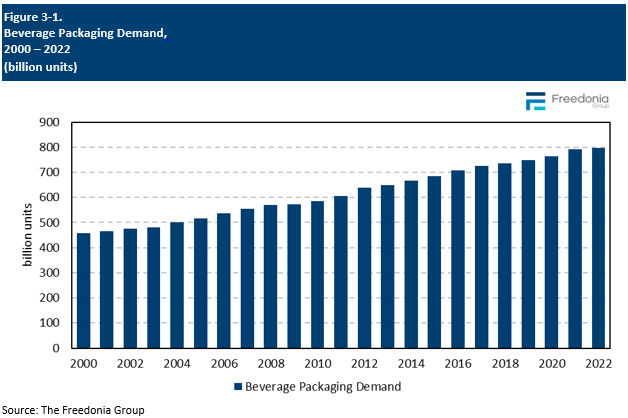

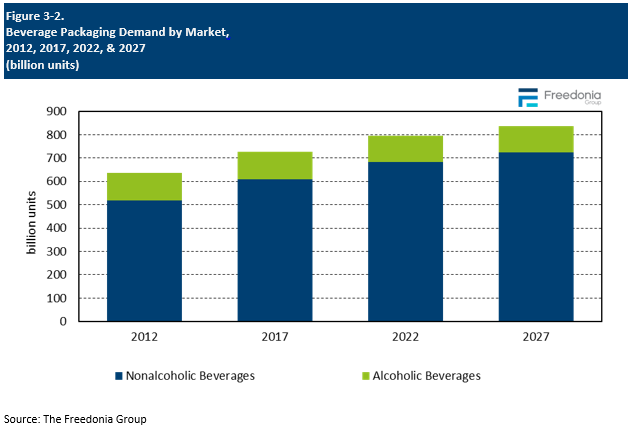

Beverage packaging demand – including primary packaging containers, multipack packaging, and packaging accessories – is expected to grow 1.0% per year to 837.6 billion units in 2027; this is slightly faster than packaged beverage production growth because the average container and multipack sizes continue to decrease. Faster growth will come in nonalcoholic beverage applications.

Although demand for larger single-serving containers (e.g., half-liter, 20- and 24 ounce) will continue to account for a large portion of the market, demand for smaller (12 ounce or less) containers will advance at a faster pace. This will largely be a result of greater consumer interest in packaging that enables easy portion control, particularly for beverages with a high sugar content (such as carbonated soft drinks and fruit beverages).

In value terms, beverage packaging demand is expected to increase 1.8% per year to $55.3 billion in 2027; with gains deriving from real growth and a shift toward higher value bottles and cans, as well as the continued penetration of high-value aseptic cartons to various beverage markets.

Nonalcoholic beverage packaging demand will comprise the majority of overall growth as consumers continue to focus on healthier products such as still and sparkling waters, sports drinks, and energy drinks, plus certain niche functional beverages (such as kombucha).

Nonalcoholic Beverages Outlook

Unit Demand

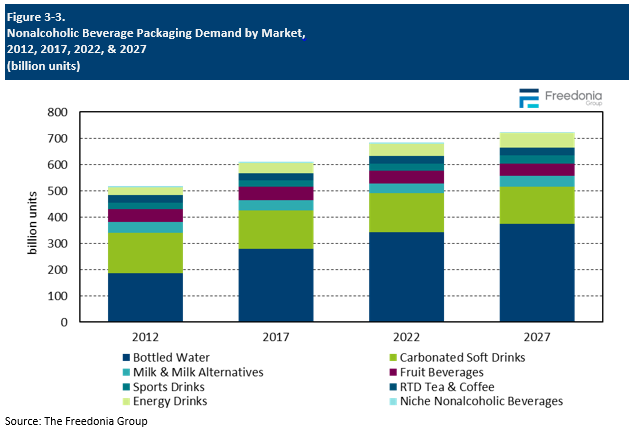

Demand for packaging used with nonalcoholic beverages is forecast to grow 1.2% per year to 724 billion units. Bottled water, the largest category, will still be the greatest contributor to growth based on good gains in sparkling water consumption. However, this will be muted by continued weakness in the carbonated soft drink market.

Bottled water will remain the leading beverage packaging market, with a unit share of 43% in 2027. However, the market for bottled water is maturing, especially still bottled water. Faster growth is expected in energy drinks, RTD coffee, sports drinks, and probiotic drinks, as these beverages appeal to consumer desire for beverages that provide functional benefits.

The use of packaging for carbonated soft drinks, the next largest beverage packaging market, will continue to lag due to decreased consumption rates owing to health concerns regarding sugar and sweetener content, as well as increased competition from sparkling water.

Market Value

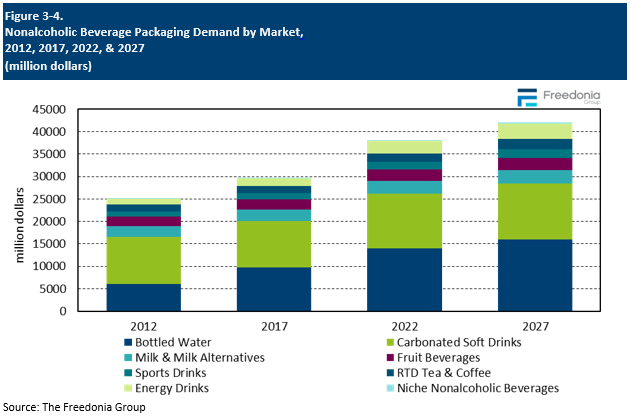

Demand for nonalcoholic beverage packaging in value terms is forecast to grow 2.0% per year to $42.1 billion, slowing noticeably due to a moderation in prices from high 2022 levels. However, growth will be supported by a shift to higher value packaging in key markets. While much of the growth in higher cost packaging is due to sustainability considerations, growth is also coming from efforts to provide an upscale image or to differentiate products in a crowded marketplace.

While low-cost plastic bottles continue to weigh down average prices and market value, faster growth is coming from higher priced containers such as aseptic cartons, aluminum bottles, and paperboard/molded fiber bottles, supporting market value gains.

Materials Competition

Market Value

Beverage packaging demand is expected to grow 1.8% per year to $55.3 billion in 2027. In addition to gains in real demand, with growth primarily tracking that of plastic and metal, by far the two largest material segments in terms of value. Market value growth will be somewhat supported by the continued penetration of higher-cost paperboard-based aseptic cartons in all beverage markets except fruit beverages, generally at the expense of lower-value plastic bottles. Among other products:

-

Weak prospects for glass bottles – among the highest cost packaging options – will restrain overall value gains.

-

Though currently very niche, aluminum bottles are expected to see strong growth in the sports drink, CSD, and energy drink markets, generally at the expense of lower cost plastic bottles or metal cans, somewhat supporting value growth.

-

Though aseptic cartons seeing strong growth, growth in paperboard overall will be restrained by weak prospects for folding cartons and paper labels.

-

Though comprising nearly negligible demand currently, paperboard and molded fiber bottles are expected to see strong growth soon following numerous trials and rollouts by companies looking to improve the sustainability of the packaging. Due to their niche nature, the bottles are currently higher cost than most conventional beverage packaging options. However, they are currently too niche to impact overall market value growth.