Report Overview

Building Envelope Products Forecast: Prices to Moderate, Growth to Resume Later in the Forecast Period. Read more...

This Freedonia study analyzes the North American (US & Canada) building envelope industry. It presents historical demand data (2012, 2017 and 2022) and forecasts (2027 and 2032) by country (US, Canada), product (windows & exterior doors, roofing, siding, insulation, air & water barriers – including flashing, roof underlayment, exterior wall water-resistive barriers and air barriers, and below-grade waterproofing), market (residential, commercial), and by various product materials. Demand for all products is measured in US$ value terms and in unit terms (except air & water barriers). The study also evaluates factors that will influence building envelope demand in North America and profiles key industry participants, such as Carlisle Companies, Owens Corning, and CertainTeed.

Featuring 69 tables and 86 figures – available in Excel and Powerpoint! Learn More

This report includes data from 2011-2031 in 5 year intervals and tables featuring year-by-year data for 2018-2025.

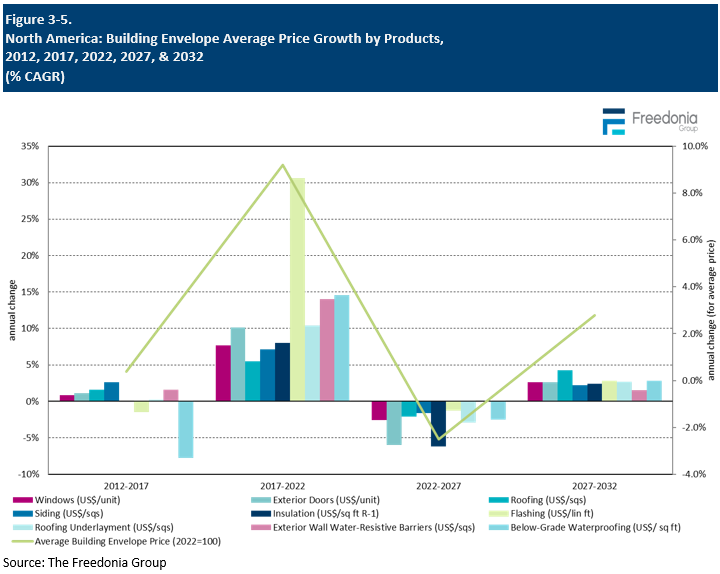

Demand for building envelope products in North America is forecast to decline at an annual average rate of 2.1% to US$92.8 billion in 2027. This represents a major reversal from the rapid growth of the 2017-2022 period, due in part to surging prices in 2021 and 2022. Going forward, prices are expected to moderate significantly from their peak in 2022, although they will remain above pre-pandemic levels.

While market value will decline significantly in the near term as prices moderate, growth in real terms will resume later in the forecast period due to expected rebounds in commercial building construction and housing starts in the large US market.

Rebounding US Commercial Building Construction Will Bolster Demand for Some Products

Commercial building construction in the US is expected to rebound following three straight years of declines, a result of the pandemic’s detrimental effect on in-office work, travel, entertainment, and in-person shopping. As most of the population returns to pre-pandemic behaviors, building owners are expected to engage in renovations that had been delayed during the previous years, while greater investment in new commercial buildings such as hotels will also occur. This growth will in turn boost demand for products used primarily in the commercial building market. For instance, exterior wall water-resistant barriers (WRBs) will be the only air and water barrier product forecast to experience demand growth due to the frequent use of fluid-applied barriers for commercial buildings, where high performance, continuous seals are important.

Regional Building Codes Will Lead to Rapid Adoption of Solar Roofing

While the outlook for most major roofing materials will be hampered by the high levels of reroofing activity that occurred in 2020 and 2021 (the result of both high levels of storm activity in those years and the pandemic-related surge in home renovations) some small volume roofing products will experience healthy gains as they are increasingly adopted by homeowners and building owners. The most notable of these products is solar roofing, demand for which is anticipated to rise at a fast rate. Demand will be driven by current and future adoption of “green” building codes in various parts of the region.

California’s CALGreen building code, for instance, is the first statewide “green” building code in the US, and more states are expected to follow suit in the future. California’s adoption of the building codes requires nearly all newly built and substantially renovated structures to meet zero net energy criteria (meaning that a building must generate as much energy as it uses). Installing solar roofing can allow home or building owners the ability to generate enough electricity to satisfy the structure’s energy consumption.

Historical Demand & Market Volatility

Shifts in demand for building envelope products can vary from year to year and are determined by numerous factors, primarily those related to building construction activity. They include:

- levels of housing starts, particularly in the single-family housing segment

- the size and age of the US and Canadian housing stock

- interest rates – low interest rates may encourage home and business owners to take out lines of credit often used to fund repair and replacement projects

- the number and type of commercial buildings erected or repaired in any given year

- the types of building envelope materials most often specified by contractors and other consumers in a particular region of the US or Canada

- building envelope materials originally installed on the surface

Multiple other variables can additionally affect demand for building envelope products in a particular year or over a short period of time. Among these are:

- weather conditions, especially outbreaks of severe weather that can cause widespread damage to building structures, especially roofs (e.g., hurricanes and tropical storms, tornadoes, hailstorms, and winter storms)

- modifications to state and local building codes

- changes in the price of raw materials (e.g., asphalt, metal, acrylics, plastics) that can cause the per-square foot or linear foot cost of air and water barrier materials to increase or decrease sharply

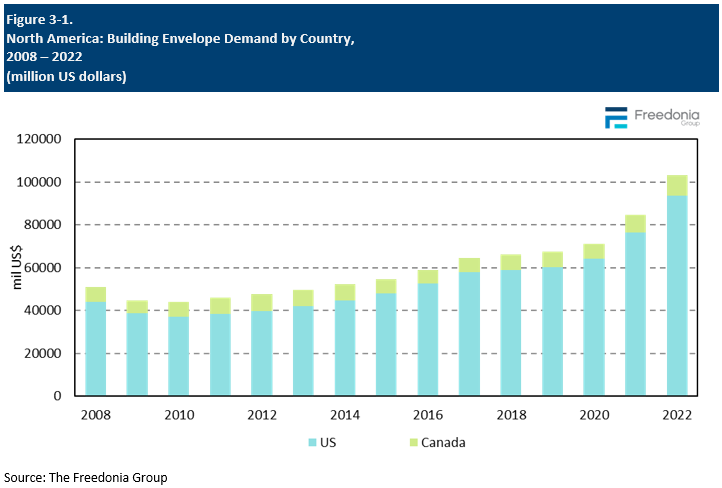

North American building envelope demand advanced in 2020; this growth was spurred by multiple outbreaks of severe weather across the US and an increase in residential renovation and repair demand precipitated by the COVID-19 pandemic. Market value surged in 2021 as new housing construction and home renovation remained strong and supply chain disruptions and increasing inflation caused prices to rise. In 2022, ongoing inflation caused prices to continue rising rapidly; this contributed to double-digit market growth in 2022 for both the US and Canada, despite a decline in housing starts and weakness in commercial building construction.

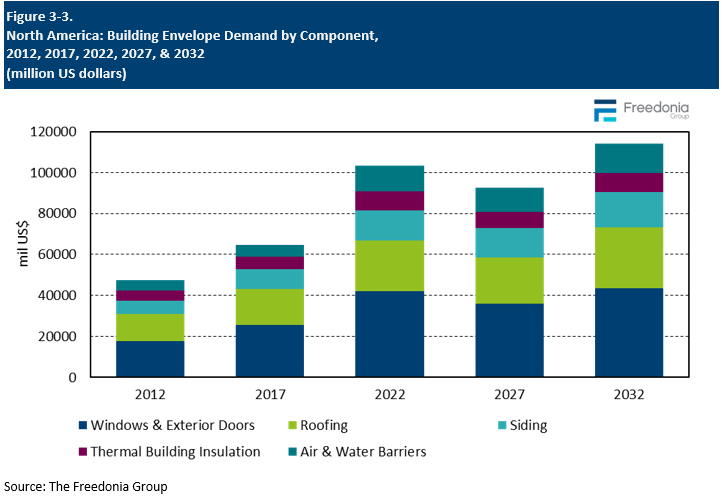

Demand by Component

Among the major building envelope product categories, windows and doors account for the largest share of sales. This market position is supported by:

- the high average costs per window and door unit

- ongoing spending to upgrade and replace these products for energy efficiency or aesthetic purposes

Primary roofing materials and siding are the next leading building envelope components by sales value:

- Due to their exposure to the elements – including rain, ice and snow, and high winds – roofing and siding materials are more frequently replaced than the other types of building envelope products.

- Roofing and siding materials are also higher cost products to install than materials such as insulation or building wrap, which contributes to their shares in value terms.

The other major building envelope products – including insulation, and air and water barriers (including flashing, roof underlayment, below-grade waterproofing, and exterior wall WRBs) – accounted for a combined 21% of sales in 2022. These materials are less expensive than windows and exterior doors, roofing, or siding, and are often intended to last the lifetime of a building without replacement.

Materials Competition

Material choice is critical for determining the strength and performance of a building envelope, as well as for such factors as cost, ease of installation, and product longevity. While each building envelope comprises a very diverse range of products, there are some common trends in the material categories for these products:

- Plastic products have experienced healthy growth over the historic period because of advantages such as low cost and energy efficiency. Plastic products are also popular due to easy maintenance and ease of installation, attributable to their lighter weight in comparison to other building envelope products.

- Metal has historically been the largest material category because of its use in highly durable and long-lasting windows and doors, roofing panels, and siding for industrial and prefabricated buildings However, it is anticipated that metal’s share will decline slightly in the future, due to ongoing competition from alternative materials like vinyl and plastic.

- Wood products – such as wood windows and doors and shingles and shake siding – typically see lower usage that is attributable their higher costs and maintenance requirements compared to competitive materials.

Other materials consist of commonly used products such asphalt shingles, bituminous roofing, and fiber cement and brick siding, as well as smaller volume (and typically faster growing) products such as stucco siding and mineral wool insulation.

Pricing Trends

Building envelope product price levels differ greatly. Factors impacting the price of building envelope products in general include:

- the prices of key raw materials (e.g., asphalt, metal, plastic resins, lumber, vinyl, fiberglass)

- production costs (manufacturing equipment, energy)

- transportation and distribution expenses for finished products

- labor, as many industries have trouble finding trained skilled workers to operate and maintain production equipment

In 2022, pricing continued to be affected by the significant supply chain issues – mostly related to the shipping of goods – that plagued numerous industries. Product shortages and higher raw material costs continued to elevate building envelope product prices, especially for products that require crude oil. However, many of these issues have begun to ease in 2023, and pricing should begin to normalize.

Through 2027, the average price of building envelope products is forecast to decline at an annual average rate of 2.5%. While prices are expected to moderate following spikes in 2022, suppliers are unlikely to reduce prices to their pre-pandemic levels despite the easing of inflationary pressures.

In general, average prices will be supported by manufacturers offering products with enhanced performance and aesthetic properties that justify higher price points. These often use raw materials more intensively, boosting the unit price of the finished product. Examples include:

- polymer-modified bituminous membranes

- fiber cement siding, as products become better suited for high-end residential applications

- vinyl siding, attributable to better durability and aesthetic appeal

- plastic and rubber roofing membranes with thicker backings

- self-adhered air and water barrier products