Report Overview

Featuring 311 tables and 87 figures – available in Excel and Powerpoint! Learn More

This report includes data from 2011-2031 in 5 year intervals and tables featuring year-by-year data for 2018-2025.

Global demand for batteries is forecast to rise 12% per year to $234 billion in 2026, with growth coming primarily from real unit increases as pricing for primary and lead-acid batteries moderates from high 2021 levels, and lithium-ion battery prices continue to decline. Growth will be driven by the expansion of the electric vehicle market, which will fuel sharp increases in sales of lithium-ion batteries. Rising use of battery power in consumer devices will also boost demand.

Electric Vehicle Market Spurring Dramatic Gains

Global production of electric vehicles is projected to more than quadruple through 2026, and massive increases in battery output will be required to support this industry. Lithium-ion batteries will be the primary near-term technology for EVs, as nickel-metal hydride batteries are less competitive and new alternative chemistries require more development.

While the Asia/Pacific region is expected to account for the largest share of automotive battery demand growth, the fastest gains will occur in Western Europe. Many European nations have adopted ambitious targets for ending the sales of cars powered by internal combustion engines, and these countries will be required to rapidly transition their local industries to EV production to meet these targets. Growth for the short term will be concentrated in the OEM segment, with aftermarket demand for EV batteries likely to take off in the 2030s as EVs produced in the 2020s begin to age.

Lead-Acid Batteries Continuing to Find Use

Lead-acid batteries accounted for the largest share of the global market in 2021, and – although they will be overtaken by lithium-ion batteries by the end of 2022 – will remain a major source of sales going forward. While the rise of electric cars could threaten the automotive market for lead-acid batteries, which are traditionally the largest driver of demand, current EVs still make use of lead-acid batteries for startup and auxiliary power systems. EV producers are increasingly experimenting with designs that exclude lead-acid batteries, but most suppliers believe that these products’ ease of use and cost-competitiveness will make them standard in automobile designs for the foreseeable future.

Supply Issues Driving Development of Alternative Chemistries

The expected fast growth in demand for lithium-ion batteries has called into question the ability of materials producers to provide sufficient supply. As a result, battery manufacturers are investing heavily in the development of alternative chemistries – both new formulations of lithium-ion batteries and more exotic technologies.

Potentially the most significant development in the near term is the proliferation of lithium-iron phosphate (LFP) batteries in place of ternary lithium chemistries. LFP batteries are preferable because they require neither cobalt nor nickel, both of which have significant supply concerns. The weaker performance characteristics of LFP batteries have largely limited them to use in lower-end Chinese EVs, but Tesla has begun to employ them in higher-value models, which signals an important milestone for the use of this technology.

Historical Trends

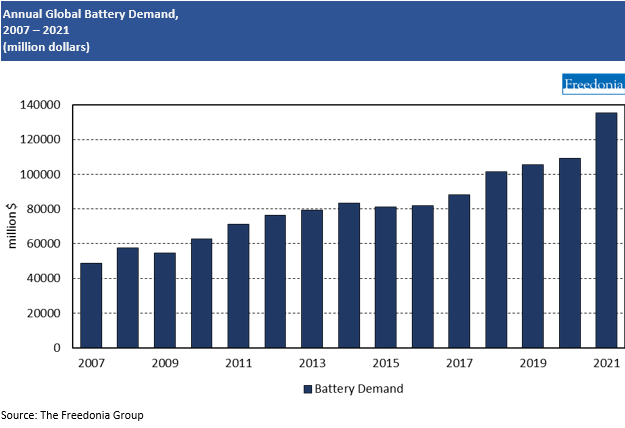

Key factors impacting annual battery demand include:

- manufacturing activity

- consumer spending levels

- broad levels of investment in construction and industry

The largest OEM applications for batteries are motor vehicles, electrical and electronic equipment, and motive power equipment. The motor vehicle market has become increasingly important as HEVs using high-value batteries has grown more common. This has dialed up the volatility in the battery industry, which has historically depended on equally volatile motor vehicle production.

A large share of battery demand is also accounted for by aftermarket or replacement applications. The automotive aftermarket is particularly large, and it tends to be a relatively steady source of demand due to the ongoing need for replacement batteries. This market – as well as those for batteries used in consumer products – tends to be tied to levels of economic development, and it will expand as global income levels rise.

Batteries are also used as backup power supplies in a wide variety of buildings and industrial environments. Growth in these applications is tied to the level of nonresidential construction activity and broad trends in industrialization.

Demand by Region

Global battery demand is forecast to rise 12% per year to $234 billion in 2026, with all regions enjoying healthy gains:

- Battery sales will be driven by the rapid penetration of HEVs in the global motor vehicle industry, with particularly strong gains for full electric vehicles since they typically use the highest-value batteries. Strong penetration of HEVs in high-income nations will aid sales growth in these countries.

- Demand will be bolstered by rising use of battery technology substituting for gas or plug-in electric power in applications like power tools and power lawn and garden equipment. Proliferation of drones will further boost sales.

- Grid-scale energy storage represents an emerging market with massive growth potential, although this segment remains in the early stages of development.