Report Overview

What does the future hold for the HVAC Equipment industry?

What does the future hold for the HVAC Equipment industry?

-

Penetration of artificial intelligence and IoT applications

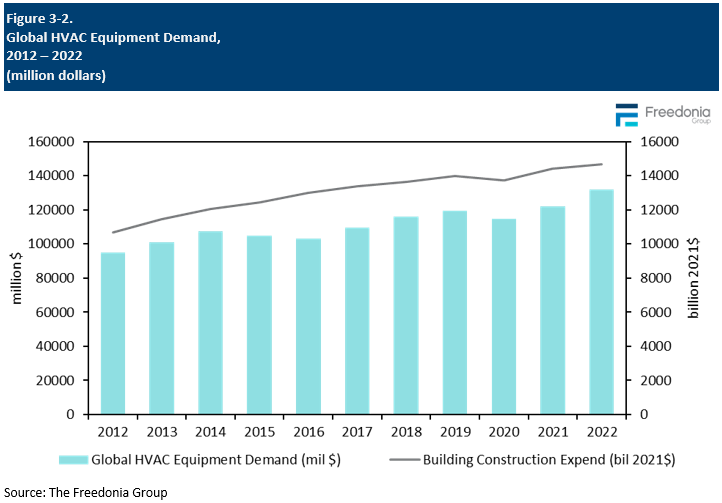

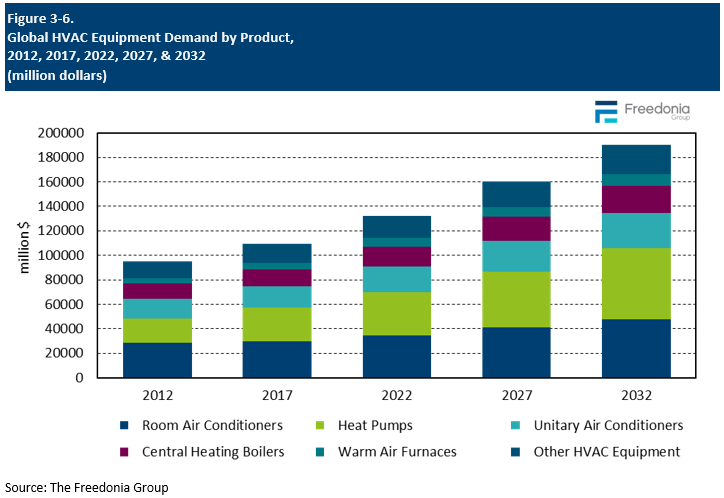

This Freedonia study analyzes the $131.9 billion global HVAC equipment industry. It provides historical demand data (2012, 2017, and 2022) and forecasts (2027 and 2032) by product (room air conditioners, heat pumps, unitary air conditioners, central heating boilers, warm air furnaces, other types of HVAC equipment) and region (North America, South and Central America, Western Europe, Eastern Europe, Asia/Pacific and Africa/Mideast). Demand, production, and net exports are provided in US dollar terms. This study also evaluates the company market share of key industry players.

Featuring 258 tables and 98 figures – available in Excel and Powerpoint! Learn More

Global demand for heating, ventilation, and air conditioning (HVAC) equipment is forecast to rise 4.0% annually to $160 billion in 2027, driven by:

-

rising unit sales due to ongoing replacement demand in mature markets and greater uptake of cooling systems in developing HVAC markets

-

increasing demand for higher value energy-efficient HVAC systems

-

growing awareness of environmental issues, resulting in more regulations and subsidies for HVAC equipment

Growing Economies, Urbanization, & Populations Spur HVAC Demand in Asia/Pacific Region

The Asia/Pacific region is expected to dominate the global HVAC market in revenue and unit sales. A number of countries in the region, such as India and Indonesia, are experiencing rapid urbanization, industrialization, and population growth, boosting demand for heating and cooling solutions for both residential and nonresidential buildings. Regional demand will also be supported by steady growth in China, the world’s largest HVAC market, and healthy gains in the large, mature Japanese market.

Climate Change & Environmental Sustainability Will Influence Government Regulations

With increasing awareness of climate change, there is a growing demand for HVAC systems that are both sustainable and effective at mitigating the most severe impacts of rising temperatures. The market is being shaped by various regulations and efficiency norms, especially in key regions like Western Europe and North America. These regulations are pushing for more energy-efficient and environmentally friendly HVAC systems, which can already be seen in:

-

a shift in market preference to heat pumps

-

further technological innovation, such as the integration of solar power into HVAC equipment

Heat Pumps to Lead Global HVAC Market Growth

Heat pumps are expected to capture the largest demand share of the global HVAC equipment market through 2027 due to their energy efficiency, cost-effectiveness, and environmental benefits. These systems are increasingly preferred over traditional HVAC solutions for their ability to provide both heating and cooling efficiently. They reduce electricity consumption and lower greenhouse gas emissions, aligning with global efforts to transition to sustainable energy sources. Sales of heat pumps are especially prevalent in China and Japan. They are seeing increasing unit sales in Western Europe due to regulatory support and cost incentives which encourage the adoption of heat pumps, measures which are part of broader initiatives to achieve carbon neutrality and energy independence.

Historical Trends

Demand for HVAC equipment tends to track activity in building construction as this equipment is used in nearly all residential and nonresidential buildings. As such, demand has a tendency to be cyclical, especially in the new construction sector.

The repair and replacement market for HVAC equipment tends to be steadier, as building owners generally only have limited options to address equipment failure. While the replacement of HVAC equipment can be postponed temporarily, especially during times of economic uncertainty, it is an essential item in most cases, ensuring continuing demand. More cyclicality can be seen in repair and replacement activity when significant new regulations or standards are enacted, which can prompt early and more widespread equipment replacement.

There are also a number of alternatives to purchasing new equipment available to building owners (all of which are excluded from coverage in this report) and this can have an impact on demand levels for new equipment, especially in lower-income countries. These include:

-

used equipment, which is often sold at lower prices than new equipment

-

portable equipment

-

rental equipment, which can provide an immediate short-term solution to equipment failure

HVAC equipment can be installed at the time of new construction, when an addition is made to the building, as part of an upgrade of the heating and cooling system, or when the existing system needs to be replaced. Demand is impacted by factors such as:

-

trends in building construction activity (e.g., new housing completions, nonresidential new construction, and residential and nonresidential renovation)

-

the relative cost of energy and fuel options

-

technological developments, replacement rates, and useful lifespans of different types of HVAC equipment

-

changes in regulations or standards related to energy efficiency or refrigerants use

-

incentives or government programs targeted at reducing energy use

Products Overview

Global demand for HVAC equipment is projected to rise 4.0% per year to $160 billion in 2027. In value terms, heat pumps are expected to achieve the strongest gains and account for the largest share of growth:

-

Sales of heat pump products will be supported by diverse incentives and initiatives promoting heat pumps as eco-friendly and efficient comfort cooling systems.

-

In particular, heat pumps have fastest growth in European countries, as adoption of these products will help EU member nations to meet climate protection targets.

Room air conditioners are forecast to account for the second largest share of growth in value terms, and these products will remain the most widely used HVAC equipment type in unit terms. Sales of room air conditioners will be bolstered by market expansion in emerging markets like India, where the low price point of these models continues to be a major advantage.

Product demand trends vary across region, with sales dependent on a region’s:

Heating equipment is generally viewed as a necessity, especially in colder climates, while comfort cooling is seen as more of a luxury or convenience in many nations.

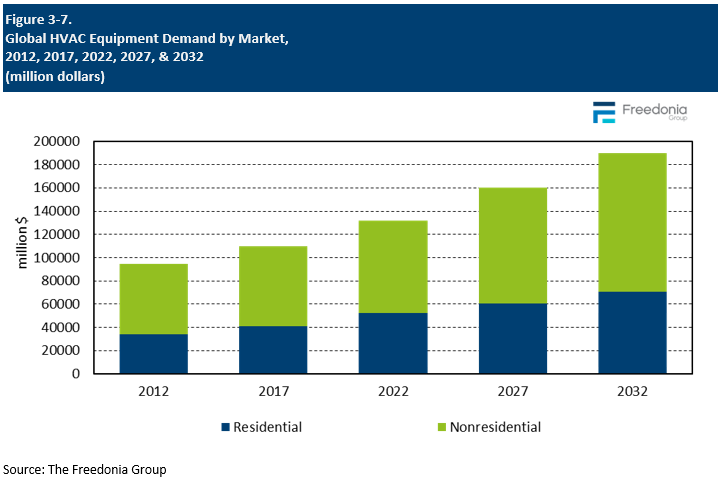

Markets Overview

HVAC equipment markets can be classified into two general segments: residential buildings and nonresidential buildings. The type of HVAC system required in each market depends on the type of building in which the unit will be installed:

-

Geothermal heat pumps, which have high initial costs, are more likely to be used in nonresidential buildings.

-

Chillers, which are high-capacity cooling systems, are also more likely to be installed in nonresidential settings because they are too large to be used in most residential applications.

-

Room air conditioners are more widely used in residential settings because their small size is too limited for use in many nonresidential applications.

Residential and nonresidential HVAC systems primarily differ in terms of heating and cooling capacity. Because residential buildings are generally smaller and have fewer occupants than nonresidential buildings, residential HVAC systems are typically not as large as nonresidential systems and have lower capacities. However, some light commercial applications, such as hotel rooms and small retail or office spaces, can use residential-size HVAC systems because their capacity requirements are similar to residential spaces.

Because of the large size of nonresidential buildings, the high price of commercial equipment, and the need for multiple units in each building, the nonresidential market for HVAC equipment generally accounts for the larger share of demand, representing 60% of total global sales in 2022. Through 2027, growth will be bolstered by a rebound in nonresidential building construction in the US, the second largest nonresidential HVAC market globally.

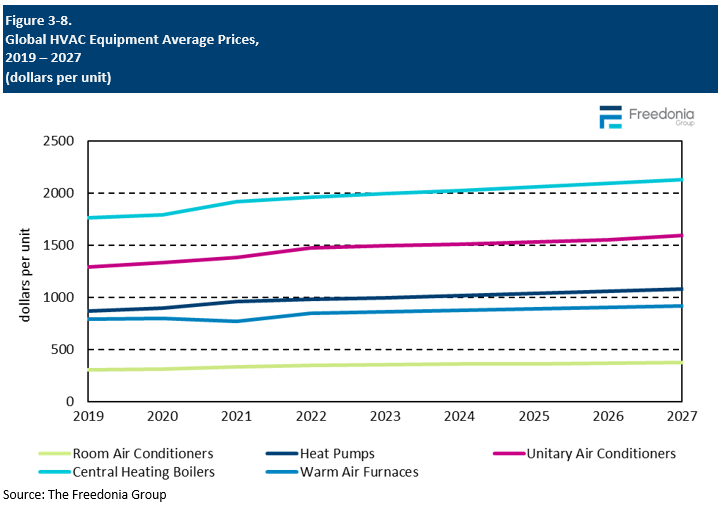

Pricing Patterns

Prices for HVAC equipment are influenced by:

-

the equipment’s size and complexity

-

raw material and labor costs

-

cost of included refrigerants

-

level of commoditization

Prices in a given country in US dollar terms are also impacted by trends in local inflation and currency values.

One of the major challenges facing the global HVAC market in 2021 and 2022 was the disruption of supply chains and the surge of price inflation. The COVID-19 pandemic, the semiconductor shortage, and extreme weather events all contributed to the scarcity of raw materials, components, and finished products. This resulted in higher costs for manufacturers, distributors, and consumers, as well as delays in delivery and installation.

Global average prices for HVAC equipment are expected to increase between 1.2% and 1.9% per year through 2027. Price growth will be supported by:

-

ongoing trends toward higher value products, such as energy-efficient or smart models incorporating advanced components or sensors

-

more stringent refrigerant regulations, which will result in the rising use of more environmentally friendly and typically more expensive refrigerants

However, growth in product prices will be moderated by continuing global competition and consolidation of distribution channels. In addition, relatively strong demand gains in emerging markets – where low-cost products tend to account for a larger share of demand – will restrain global average price growth.