Report Overview

What is causing the rise of acoustic insulation?

What is causing the rise of acoustic insulation?

-

Reduce noise pollution

-

Improve worker safety

This Freedonia industry study analyzes the $19.2 billion global nonresidential insulation industry. It presents historical demand data (2011, 2016, and 2021) and forecasts (2026 and 2031) by material (foamed plastic, fiberglass, mineral wool, all other insulation materials) and project type (new construction and retrofit).

Featuring 100 tables and 68 figures – available in Excel and Powerpoint! Learn More

Global demand for nonresidential insulation is forecast to increase 3.6% per year to 10.8 billion square meters of R-1 value in 2026, driven by:

- growing manufacturing activity and rising income levels spurring gains in the construction of factories, retail buildings, and other nonresidential structures, most notably in China and the developing areas of the Africa/Mideast and Asia/Pacific regions

- efforts in the European Union, US, Canada, and the United Kingdom to greatly improve the energy efficiency of buildings

- rising use of acoustic insulation – largely intended to reduce noise pollution and improve worker safety in loud industrial environments – in many areas of the world

Significant Growth Opportunities in the Asia/Pacific & Africa/Mideast Regions

The developing nonresidential construction markets in the Asia/Pacific and Africa/Mideast regions will be the fastest growing outlets for nonresidential insulation:

- Market advances in both India and Indonesia will be driven by solid construction growth in the nonresidential markets; both countries continue to substantially increase their manufacturing bases, resulting in larger stocks of nonresidential buildings that require insulation.

- China will continue its dominance in the nonresidential insulation market, attributable to the continued construction of new nonresidential buildings and ongoing retrofit activity to improve the quality of its nonresidential building stock.

- Large-scale, high-end, nonresidential construction projects in Saudi Arabia and the United Arab Emirates – particularly in the tourism and office sectors – will support demand for nonresidential insulation because such projects use it intensively.

Gains Boosted by Efforts to Improve the Energy Efficiency of Buildings

Nonresidential buildings are the largest source of energy usage in the world; as such countries are making significant efforts to improve the energy efficiency of such buildings, with increased insulation often playing a key role. Western Europe and the US are leading the charge to retrofit existing buildings for greater energy efficiency and to combat climate change. However, countries throughout the world are recognizing the environmental impact of these structures and are taking steps to reduce their energy consumption.

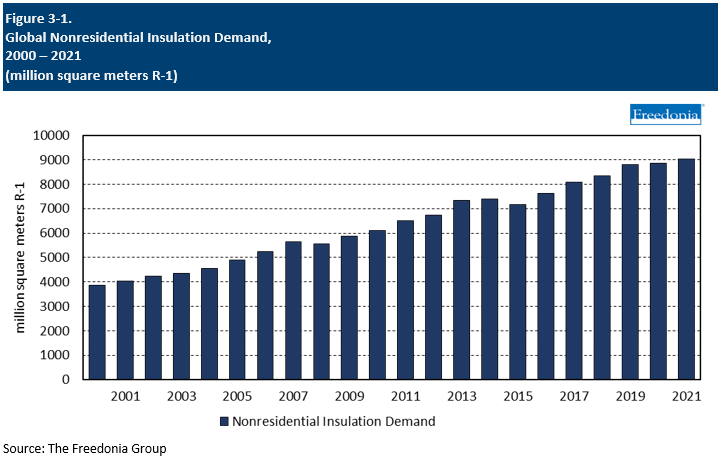

Historical Market Trends

In any given year, global demand for nonresidential insulation is impacted by a number of factors including:

- levels of nonresidential building construction spending

- the types of buildings being built, as the amount of insulation per office and institutional building is substantially higher than manufacturing facilities and warehouses

- changes to building codes

- energy efficiency regulations

Given the importance and widespread use of these products across all regions and building types, nonresidential insulation demand in volume terms does not experience high levels of volatility, even during times of economic crisis. Year-to-year volatility in dollar value terms is more significant, given the fluctuations in chemical prices for foamed plastic insulation, as well as currency effects relative to the US dollar. Additionally, widespread inflation in 2021 and 2022 had a major impact on average prices for all material types.

Demand by Region

Similar to residential construction, nonresidential construction experienced varying levels of performance from 2020 to 2021:

- Although residential construction surged in the US in 2020 and 2021, nonresidential construction declined in both years.

- Nonresidential construction declined in the Asia/Pacific region for the first time in over a decade in 2020, due primarily to shutdowns in China due to the country’s Zero-COVID policy, as well as a drastic decline in nonresidential building spending in India as the country was particularly hard hit by COVID-19 in that year. However, nonresidential construction bounced back in the region in 2021 as the effects of COVID-related shutdowns and postponed construction products began to wane.

The nonresidential building insulation market is expected to grow 3.6% annually to 10.8 billion square meters R-1, fueled by:

- advances in nonresidential building construction, most notably in China and the Asia/Pacific region as a whole

- increasingly stringent building codes in many parts of the world, often calling for increased insulation usage and improved fire safety

- government efforts to improve the energy efficiency of nonresidential buildings in many developed countries

- rising use of rigid urethane and polystyrene boards because of their high R-values

Market value is expected to grow 1.8% per year through 2026, reaching $21.0 billion. Growth will decelerate from the rate of 2016-2021 period due to the high inflation- and supply chain-related prices of 2021.

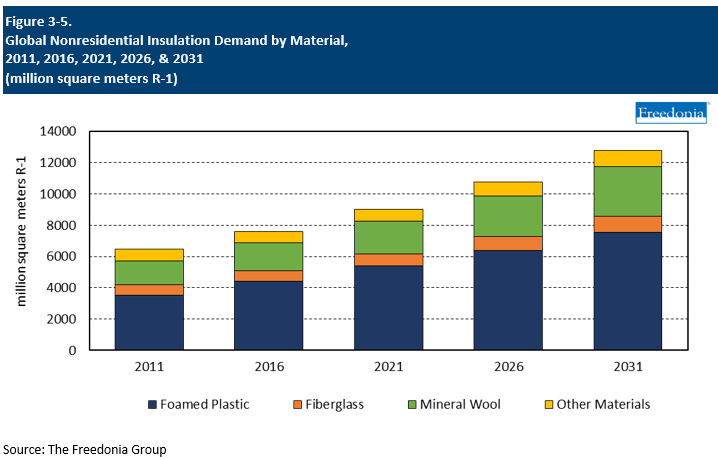

Demand by Material

Foamed plastic – particularly polystyrene, spray polyurethane, and rigid polyurethane/polyiso boards – is by far the most popular material in the nonresidential market. Foamed plastic maintain its large share, as low-cost EPS is widely used in the quickly developing nonresidential markets in the Asia/Pacific and Africa/Mideast regions.

Mineral wool and fiberglass also see use in the nonresidential market, supported by their lower cost relative to foamed plastic, as well as their excellent fire resistance and soundproofing properties.

Nonresidential Building Construction Outlook

Trends in nonresidential construction expenditures have a profound impact on insulation demand:

- As new buildings and structures are built and old ones are improved and repaired, a country’s insulation needs grow.

- New projects, such as industrial buildings require insulation for both thermal and acoustic purposes.

Increases in nonresidential construction tend to most benefit all types of foamed plastic, as well as mineral wool insulation.

Global real (i.e., inflation-adjusted) nonresidential construction expenditures are forecast to increase 3.0% annually during the 2021-2026 period. Gains will be bolstered by:

- solid growth in the Africa/Mideast region and in many of the lower- and middle-income counties in Asia

- rebounds in construction activity in North America and Central and South America from declines posted over the 2016-2021 period

Building Codes & Energy Efficiency

The goal of most building codes related to insulation is energy efficiency. In many parts of the world – especially developed countries – these codes have become increasingly stringent, requiring the installation of higher R-value insulation products, which increases the thermal value and energy efficiency of a building.

For nonresidential buildings in the US, participation in the US Green Building Council’s (USGBC) Leadership in Energy and Environmental Design (LEED) program encourages the use of insulation that is environmentally friendly (e.g., does not degrade and release particulates into building airflows) and improves the energy efficiency of the structure (e.g., installing significantly more insulation than required by existing building codes).

In other developed countries, building codes that support energy efficiency are also common:

- Programs similar to LEED can be found in a number of countries, including BREEAM (UK), GSBC (Germany), and CASBEE (Japan).

- The EU has a number of directives that promote the use of insulation to make buildings more energy efficient, the most recent being the revised Energy Performance of Buildings Directive that went into effect in 2018.

Buildings codes in developing parts of the world vary greatly, although some of the largest and most economically significant countries have taken steps to improve their regulatory systems:

- China’s building codes for energy efficiency – which are fairly robust for a developing country – are regulated by provinces and municipalities, but are set by its federal government and tied into the country’s Five-Year Plans for its economy.

- In Brazil, the Associação Brasileira de Normas Técnicas has set insulation standards for the country’s bioclimatic zones, with minimum thermal insulating requirements for each season.

- In 2017, India revised its Energy Conservation Building Code in order to reduce energy consumption and improve ventilation and insulation in residential and nonresidential buildings.