Report Overview

Learn more about benefits and challenges in the metal roofing market.

-

Metal roofing is used more evenly in residential and commercial applications.

-

Metal roofing is making high gains in the residential market.

This Freedonia industry study analyzes the $5.3 billion US market for metal roofing.

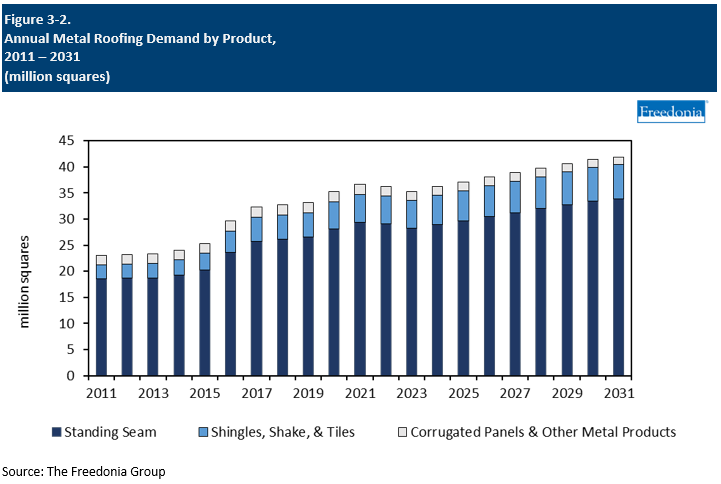

It presents historical demand data (2011, 2016, and 2021) and forecasts (2026 and 2031) as well as annual data for years 2018-2025. Unit demand and value demand data is shown for roofing by product type (standing seam, metal shingle, metal shake, metal tile, corrugated panel) and market (new and reroofing demand in both residential and commercial buildings). The study also evaluates company market share and competitive analysis on industry competitors including BlueScope Steel, Carlisle SynTec, Cornerstone, Elevate, Kingspan, and Nucor.

Featuring 124 tables and 26 figures – available in Excel and Powerpoint! Learn More

This report includes data from 2011-2031 in 5 year intervals and tables featuring year-by-year data for 2018-2025.

US demand for metal roofing is forecast to grow at an annual average rate of 0.7% to 38.07 million squares in 2026. Gains will be restrained by the high levels of metal roofing demand in 2020 and 2021 that were attributable to increased housing construction and home renovations and several severe weather events. Market value will have a more positive outlook because:

- metal prices will remain well above 2021 levels following a spike in 2022

- use of less expensive metal products – like corrugated panels – is either slowing or outright declining while metal roofing products with enhanced performance and aesthetics become increasingly popular

Standing Seam Will See Above Average Gains in the Residential Market

Standing seam roofing will continue to capture a growing share of metal roofing demand as more homeowners chose to replace their asphalt shingle roofs with metal. Standing seam metal roofing is becoming favored by homeowners due to its:

- resistance to uplift and leads, making it useful for homes located in storm-prone areas

- ability to improve energy efficiency either through its cool roofing properties or when attached to insulation

Metal Shingles, Shakes, & Tiles Will Grow at the Fastest Rate of Any Metal Roofing Product

In the commercial and residential markets alike, metal shingles, shakes, and tiles see the fastest rate of growth:

- In residential applications, growing demand for durable roofing products that are aesthetically pleasing and blend in with traditional home materials will be a driver.

- In the commercial market, the lower prices of metal shingles, shakes, and tiles (compared to slate) will drive gains, specifically among institutional buildings like religious and university facilities.

Severe Weather & Warm Climate Create Demand for Metal Roofing in the South

The South will offer the best opportunities for metal roofing of any region, due to:

- the frequency of severe weather, such as hurricanes, which produce strong winds in the region – homeowner demand for wind- and heavy rain-resistant roofing supports demand for metal roofing products, especially in coastal regions

- the region’s hot summer climate that creates demand for cool roofing products such as metal roofing, which reflects sun rays and lowers the amount of heat absorbed by the roof, thus reducing energy costs

Historical Market Trends

Demand shifts for metal roofing can vary from year to year and are determined by numerous factors, primarily those related to building construction activity. They include:

- levels of housing starts, particularly in the single-family housing segment

- the size and age of the US housing stock

- interest rates – low interest rates may encourage home and business owners to take out lines of credit often used to fund roof repair and replacement projects

- the number and types of commercial buildings erected or repaired in any given year

- the type of roof (e.g., steep-slope or low-slope) installed on a structure that will be repaired or replaced

- the types of roofing materials most often specified by contractors and other consumers in a particular region of the US

- the roofing materials originally installed on the structure

The US has a significant number of homes and businesses with roofs that are at or near the end of their life expectancies. Thus, age-related reroofing is the most significant driver of metal roofing demand in the US.

Metal roofing demand advanced at a healthy rate in 2020, a marked contrast to the weaker demand growth of 2018 and 2019. This growth was spurred by multiple outbreaks of severe weather across the US and an increase in residential roofing demand precipitated by the COVID-19 pandemic. Demand increased again in 2021 despite the continued restraint from supply chain issues and increased inflation.

Supply & Demand

Foreign Trade

Foreign trade plays a very minor role in the US metal roofing market; imports accounted for slightly more than 2% of US sales in 2021, and exports of metal roofing accounted for under 2% of US industry shipments that year.

Trade in metal roofing materials between the US and foreign countries is primarily limited the weight and bulk of metal roofing, which make shipment across long distances costly and impractical.

The US’ main trading partner in metal roofing is Canada, which accounts for about 65% of imports and exports in any given year because:

- Structures in the two countries share similar designs and are constructed in the same manner with similar materials.

- The weather and climate patterns in the two countries are similar in the northern half of the US and Canada – including harsh winters with heavy snowfalls, short but hot summers, and periodic instances of tornadoes, hailstorms, and other severe weather events.

- Roofing designed for use in the northern half of the US meets Canadian building code requirements, as do Canadian roofing materials marketed to US consumers.

- The proximity of the two countries means that it is sometimes a shorter distance to ship to Canada than to other parts of the US.

Other countries that supply metal roofing the US include China and South Korea.

Product Overview

Area Demand by Product

US demand for metal roofing is expected to rise at an average annual pace of 0.7% to 38.07 million squares in 2026, with growth restrained by:

- declining housing starts

- surging home repair and reroofing activity in 2020 and 2021, as these roofs will not need to be repaired or replaced over the next five years

However, metal roofing is one of the few major roofing materials that will increase in demand during the forecast period, supported by:

- continuing interest in the use of metal roofing as a weather-resistant alternative to such products as asphalt shingles and roofing membranes

- homeowner interest in installing metal roofing to create a more unique exterior appearance

- rising installations of prefabricated metal buildings in commercial construction applications

- the perception of metal roofing products as environmentally friendly materials:

- Metal roofing can serve as a cool roofing material that reduces a building’s energy consumption and lowers utility bills.

- Metal has a long product lifespan and can be recycled after its useful lifespan, diverting waste materials from landfills.

Standing seam roofing will continue accounting for the largest share of metal roofing demand, supported by its high performance in leak and wind protection and ability to be used as both low- and steep-slope roofing. However, metal shingles, shakes, and tiles will see faster growth going forward, boosted by their increasing residential use as homeowners seek more durable alternatives to asphalt shingles.