Report Overview

Featuring 30 tables and 11 figures – available in Excel and Powerpoint! Data Visualization Kit

This study analyzes the US market for residential and nonresidential countertops (also called benchtops or worktops in some parts of the world), including kitchen, bathroom,  and other (e.g., laundry and bar) areas of installation for the new construction and remodeling markets. In this study, countertops are defined as countertop surfaces, as well as edging and backsplash, but not countertop materials used as wall coverings. Historical data (2012, 2017, and 2022) and forecasts for 2027 and 2032 are provided for countertop demand by material, market, and area of installation in square meters. Demand by material is also provided in dollars. Demand, production, and prices for countertops are measured at the material level.

and other (e.g., laundry and bar) areas of installation for the new construction and remodeling markets. In this study, countertops are defined as countertop surfaces, as well as edging and backsplash, but not countertop materials used as wall coverings. Historical data (2012, 2017, and 2022) and forecasts for 2027 and 2032 are provided for countertop demand by material, market, and area of installation in square meters. Demand by material is also provided in dollars. Demand, production, and prices for countertops are measured at the material level.

Read our blog on Residential Remodels

Demand for countertops in the US is forecast to grow 3.8% per year to reach 104 million square meters, valued at $10.8 billion, in 2027. Market advances will be supported by:

-

increasing residential kitchen and bathroom remodeling

-

trends favoring larger kitchens and multiple bathrooms

-

growing interest in outdoor kitchens, islands, and wet bars

-

a rebound in new commercial building construction

Market value will be boosted by an ongoing shift in consumer preference for more durable and aesthetically pleasing countertop materials such as granite and engineered stone. Consumers have become more willing to opt for these higher value materials, which can improve home values.

Significant Growth Opportunities for Engineered Stone & Porcelain Slab

Engineered stone will continue to expand its market share to account for 36% of countertop demand in area terms. Engineered stone rapidly increased its share of the countertops market over the past decade due in part to a flood of low-cost slabs from foreign markets, particularly China, India, Turkey, and Vietnam, which made them more affordable for middle-class homeowners. Although prices are expected to rise, engineered stone countertops will remain in high demand because of their durability and their superior aesthetics, enhanced in recent years by a wider range of available colors.

Similar to the rapid advances seen for engineered stone during the past decade, porcelain slab has grown robustly since 2017 and is expected to be the fastest growing countertop material in the US through 2027. Porcelain slab is rapidly rising in popularity as consumers seek alternatives to engineered stone and granite. These consumers want to differentiate their homes but still install countertops with a natural appearance and favorable performance properties.

Single-Family Kitchen & Bathroom Remodeling Continues To Drive Countertops Market

Single-family kitchen and bathroom remodeling continues to drive market trends, with countertop replacement still one of the most popular home remodeling projects. Homeowners trade up from laminates and solid surface to more natural looking (and expensive) materials such as engineered stone, porcelain slab, and butcher block countertops as an effective way to quickly change the appearance of their homes to align with new trends.

Historical Market Trends

Countertop demand is driven by a number of factors, including:

-

new housing construction

-

single-family residential remodels, which often include the replacement of countertops or the addition of a bathroom, outdoor kitchen, or wet bar

-

commercial building construction

-

shifts in consumer tastes, such as a change in preference toward countertops with a more natural stone aesthetic and away from laminates, resulting in increased demand in the residential remodeling market

-

the popularity and use of competitive products such as furniture with integrated countertops

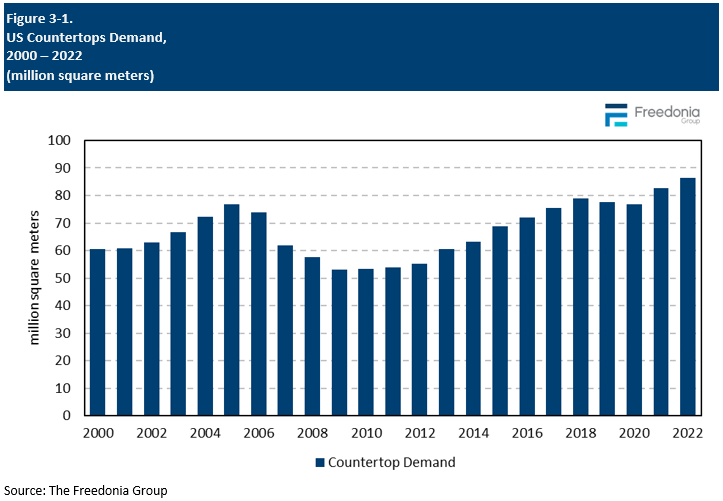

Other than slight drops in demand in 2019 and 2020, the US countertops market has experienced solid growth over the past decade, particularly in the residential remodeling market as US homeowners engaged in significant levels of home remodeling, with countertop replacement being among the most popular projects. During this time, engineered stone surged in popularity as consumers focused more on aesthetics in their kitchen, leading to a significant shift away from laminates.

Demand Trends

Demand in Square Meters

Countertop demand is projected to increase 3.8% annually to 104 million square meters in 2027. Following a surge in demand during the 2012-2022 period as the material’s popularity rose with middle-income consumers, demand for engineered stone countertops is projected to continue to grow at a strong pace, supported by:

Laminate countertops will continue to lose share to engineered and natural stone due to:

-

consumer preferences for more natural looking surfaces

-

natural and engineered stone’s resistance to scratching and burning

-

homeowners willing to upgrade to higher value countertops during kitchen renovations, as countertops remain the most popular kitchen remodeling project

However, laminates will remain popular, particularly among budget-conscious consumers in both the residential and commercial markets, due to their favorable performance characteristics at affordable price points. Product developments providing a more stone-like appearance, such as high-definition graphics and complex edges, will also help to maintain ongoing levels of demand, particularly in the residential market.

Demand in Value

Countertop demand is projected to increase 4.4% per year to $10.8 billion in 2027. Because of a competitive pricing environment, total market value gains will be driven by a continued shift away from lower value products, such as laminates, to engineered and natural stone countertops, which command much higher average prices.

Natural stone accounted for the largest share of the countertop market in 2022, totaling 42% in value terms. Engineered stone is forecast to take the leading position in value terms through 2027, promoted by strong volume growth.

Laminates are generally lower priced and thus account for a smaller share of demand in value terms than in volume.

Pricing Comparison & Outlook

Average prices for countertops are forecast to grow slowly to $104 per square meter in 2027, as price levels moderate, most notably for those of natural stone, from a period of high inflation in 2021 and 2022.

Advances in average prices will also be restrained by:

-

intense inter-material competition among both material suppliers and countertop fabricators

-

a significant market for low budget remodeling, which encourages the use of lower cost materials

Supporting continued growth in average prices will be:

-

ongoing market share losses for low-cost laminates and cast polymers

-

increasing volume demand for higher cost materials, such as engineered stone, marble, granite, and porcelain slab

Installation Costs

Installation costs have a major impact on the final price of countertops, as DIY activity in the countertop industry is rare due to the difficulty of removing countertops and then properly cutting and fitting the replacement countertop materials.

Installation costs vary based on the countertop material and can greatly inflate the overall price of a countertop installation. If countertops with lower material costs are expensive to install, they can become less competitive with both higher priced and lower priced materials that have lower installation costs.

For example, laminate sheets can be purchased at the lowest price of all major countertop materials. However, the final installation cost of laminate countertops is just slightly below that of the more expensive solid surface material, which makes solid surface a more attractive option as consumers can trade up to a higher quality product for only a few dollars more per square foot when installation costs are taken into account.

Among the materials with the highest average installation costs are:

-

engineered stone

-

granite

-

marble

-

porcelain slab