Report Overview

Get an analysis of strengths, weaknesses, opportunities, and threats in the market.

-

Cabinets are among the most popular features to upgrade as part of a kitchen remodel

This Freedonia study analyzes the US kitchen cabinets industry.

It presents historical demand data (2011, 2016 and 2021) and forecasts (2026 and 2031) by product (base, wall, tall), market (residential, commercial, and vehicles and other markets), application (new and remodeling), and by region and subregion. Demand for all products is measured in unit terms and value terms. The study also evaluates factors that will influence kitchen cabinet demand and discusses key suppliers and market share.

Featuring 35 tables and 11 figures – available in Excel and Powerpoint! Learn More

This report includes data from 2011-2031 in 5 year intervals and tables featuring year-by-year data for 2018-2025.

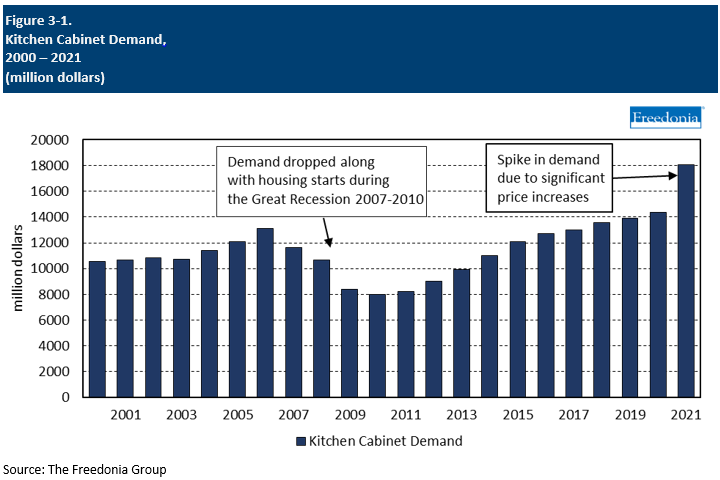

Demand for kitchen cabinets in the US is forecast to rise 2.9% annually to $20.9 billion in 2026, a deceleration from the 2016-2021 period as new housing construction and home remodeling normalizes following exceedingly high levels in 2021, and prices for materials used in the construction of cabinets (such as wood) recede from inflation- and supply chain-related highs in 2021 and 2022. Gain will be supported by primarily by homeowners investing more money into kitchen renovation projects and opting for more high-end materials, in conjunction with interest among homeowners in using cabinets as both aesthetic and functional elements of their kitchens.

Frameless Cabinets Growing in Popularity Due to Trends in Kitchen Cabinet Aesthetics

Frameless cabinets are gaining popularity as an alternative to face framed cabinets and are expected to grow more than twice as fast as face framed cabinet demand. Installations of frameless kitchen cabinets will be boosted by:

- modern design trends, which have gravitated toward more open kitchens with clean lines and minimalist appearances

- the stock of homes with existing frameless cabinets increasing over time, meaning that many homeowners will continue to have these cabinets installed in their kitchens

- their generally lower cost, which is an important consideration for budget-conscious consumers and home builders

Metal Kitchen Cabinets Expected to See Above Average Growth

While wood kitchen cabinets will continue to account for the vast majority of demand, cabinets made from metal and plastic will see above average growth. Demand for metal kitchen cabinets will be driven by a rebound in commercial building construction, especially educational, healthcare, office, and hospitality buildings. These structures often include cafeterias, restaurants, or other foodservice amenities that use metal kitchen cabinets.

Historical Market Trends

In any given year, kitchen cabinet demand is driven by a number of factors, including:

- new housing construction levels

- single-family residential remodels, which often include the replacement of kitchen cabinets or the addition of more cabinets

- mortgage interest rates and the availability of financing for remodeling

- commercial building construction trends

- shifts in consumer tastes and focus, such as a change in preference toward cabinets with little or no formaldehyde, solid wood cabinets over composites, or concerns about indoor air quality

- recreational vehicle, boat, and civilian aircraft production

During the 2011-2021 period, kitchen cabinet demand grew 8.2% per year, as significant single-family housing remodeling activity in the US supports a steady level of demand for new kitchen cabinets. However, with the onset of the COVID-19 pandemic, growth in value terms stemmed primarily from cabinet price increases as unit demand for these cabinets declined. Kitchen cabinet demand drastically increased in 2021 (26%), again due mostly to price increases stemming from COVID-19 related supply-chain issues and trade disputes with China.

Demand by Region

The South will remain the largest regional market for cabinets and will account for most demand gains, driven by strong growth in population and existing home sales. As more people move to the South and purchase homes, residential renovation demand for cabinets will rise as homeowners remodel kitchens either prior to the sale of a home – to make it more appealing to potential purchasers – or after a purchase – when the new homeowners personalize the house to their preferences.

The West, which is the second largest regional kitchen cabinet market, will record healthy demand gains. Kitchen cabinetry demand in both the Midwest and Northeast will grow at a slower pace over this period due to below average home sales and a stagnation in new housing construction.

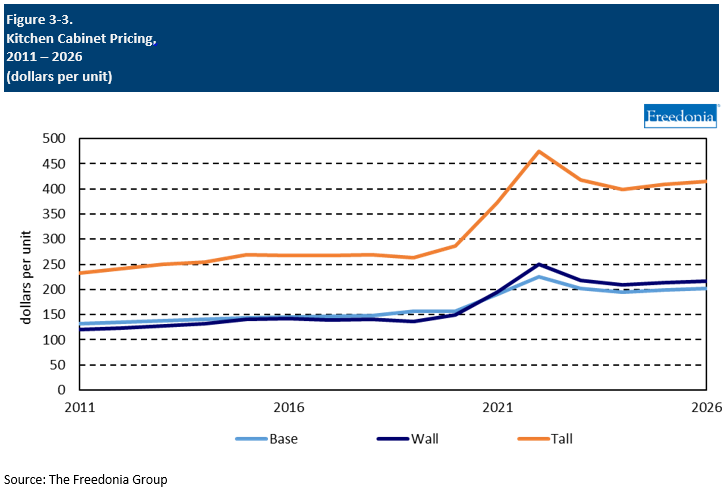

Pricing Trends

Kitchen cabinets are subject to inflationary pressures and commodity price fluctuations. Wood-based materials account for the largest share of materials consumed in kitchen cabinetry, therefore, fluctuations in the price and availability of lumber will have the greatest effect on the price of kitchen cabinets. Several factors can affect the price of lumber, key among them:

- the availability of cut timber that can be converted into lumber

- the output and production capacity of sawmills

- trade policies and the enactment of tariffs

- levels of building construction activity (particularly that of single-family housing)

Cabinet product pricing saw robust growth during the 2016-2021 period, although most of that growth occurred in mainly due to the tremendous growth in lumber prices as demand increased, in conjunction with supply chain disruptions caused by the COVID-19 pandemic.

Most price growth in 2021 and 2022 stemmed from inflation and supply chain disruptions. Although prices will moderate significantly in 2023 from pandemic-induced highs, they will remain well above pre-pandemic levels, as prices generally retreat more slowly than they rise. Additional price growth during the latter part of the forecast period will be supported by continuing consumer interest in larger cabinets with more features.