Report Overview

Featuring 53 tables and 40 figures – available in Excel and Powerpoint! Learn More

This study analyzes US demand for plastic foodservice disposables by product, material, and market. Product segments include:

- beverage packaging, including cups, lids, fillable beverage pouches, and plastic bladders for bag-in-box

- clamshells

- food cups (including portion cups), tubs, pails, and their respective lids

- two-piece containers

- flexible and other food packaging

- carryout bags

- serviceware, including dinnerware, cutlery, straws and stirrers, trays and carriers, and other serviceware such as table covers, skewers, and steak markers

Materials include:

- rigid plastic

- plastic foam

- flexible plastic (film)

- bioplastics

Markets include eating and drinking places (limited service restaurants and full-service restaurants); and retail and non-commercial foodservice.

Historical data (2012, 2017, and 2022) and forecasts for 2027 are presented for plastic foodservice disposables demand in current US dollars (including inflation) and in units.

Demand for plastic foodservice single-use products is forecast to grow 3.5% annually to $14.3 billion in 2027. However, growth in market value will come primarily from a shift in product mix toward higher value packaging and carryout bags. In real terms, demand will decline overall but this hides several important underlying trends:

- Overall demand in units will decline slightly due to sustainability-driven efforts to reduce or eliminate the use of single-use plastics and this will be especially noticeable in small plastic serviceware like straws and cutlery.

- Above average growth is expected in disposables used in the fast growing takeout and delivery market, especially for full-service establishments that have historically not been large users of disposables.

Serviceware to Experience Slowest Growth Due to Sustainability Concerns

Serviceware – including dinnerware, trays, cutlery, and straws – has historically comprised a significant portion of plastic foodservice disposable demand due to the convenience and sanitary benefits proffered by these items compared to reusable options. However, smaller serviceware products such as straws and cutlery are often improperly disposed of and may negatively interfere with the environment. As such, many foodservice operators are electing to either switch to serviceware made of alternative, compostable materials, or outright stop offering these items, as they are often viewed as “excess” packaging and unnecessary.

Carryout & Off-Premises Dining Continues at High Levels

Limited service restaurants have long had a strong takeout business, but over the past decade there has been a marked shift in focus for all restaurants to off-premise sales. Shifts away from dining inside restaurants are significantly expanding the number of disposables needed per order, leading to the development of improved products designed to deliver food safely while retaining its quality and presentation.

Flexible Formats to See the Strongest Growth

Though the majority of plastic foodservice disposable are composed of rigid plastic or foam, flexible plastic continues to penetrate the market. This is especially true for newer packaging products such as fillable beverage pouches and bag-in-box formats, which will see the strongest growth among all disposables due to their lighter weight, increased product evacuation, and lower cost compared to traditional alternatives such as cups.

Suppliers Increase Use of Recycled Content & Bioplastic to Improve Sustainability

Though plastic remains a significant portion of single-use foodservice packaging, it suffers from a poor sustainability image and faces stiff competition from materials seen as more environmentally friendly such as molded fiber. In an effort combat this, many plastic manufacturers are increasingly incorporating post-consumer recycled content into their packaging, as well as offering products made of bioplastic and biodegradable foam, improving the materials’ sustainability. These newer materials are expected to experience strong gains and bolster value growth of plastic disposables overall.

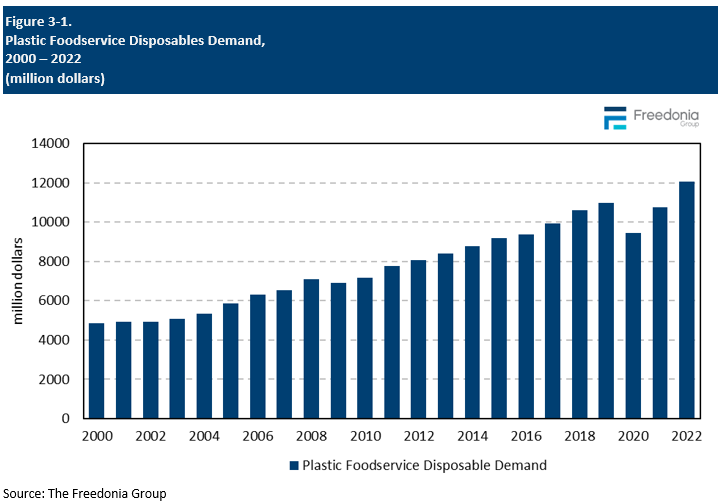

Historical Market Trends

At its broadest level, demand for single-use foodservice products is driven by trends in foodservice revenue, which is an indicator of the number of meals eaten away from home and the amount spent on those meals. Growth in foodservice activity in turn is dependent on a number of macroeconomic and demographic factors including:

- Trends in food consumption and the mix of food eaten at home versus away from home

- The health of the overall economy and levels of disposable income, which impact the ability of consumers to spend on more expensive restaurant meals (compared to home cooking)

- Changes in the population mix, especially in terms of age cohorts (such as young adults) that are likely to eat out more often

- Trends in consumer spending, including spending on travel and entertainment, which impact foodservice sales at hotels and sports and recreation venues

- Student enrollment levels and trends in school lunch programs

Beyond these basic macroeconomic indicators, other factors that can impact the foodservice industry and demand for plastic disposable products include:

- the mix of restaurants that are limited versus full-service, as limited service restaurants use a higher level and broader mix of disposables

- the share of total restaurant orders that are provided via drive-thru, curbside pickup, carryout, or delivery services

- the size and diversity of restaurant menus, as specific disposables are often used with specific menu items

- social factors such as health concerns, which not only influence the amount consumers eat out but the type of foods they purchase

- sustainability initiatives, which impact the overall level of disposables used as well as the types of products and materials used

- regulations, especially restrictions on specific materials or types of disposables

Markets Overview

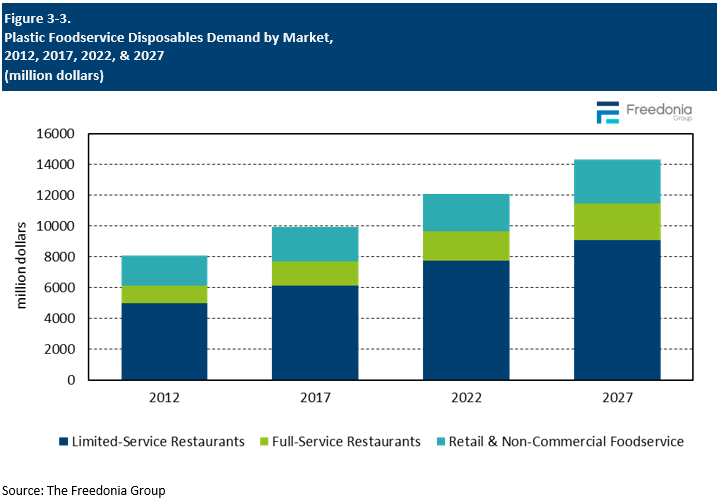

There are three primary markets for foodservice plastic disposables, each with its own mix of products used:

- commercial restaurants (eating and drinking places):

- Limited service restaurants include quick service (fast food and fast casual) restaurants and coffee and snack shops. Food trucks/street food vendors are also included here.

- Full-service restaurants include restaurants, bars, buffets, and cafeterias that offer table service.

- retail foodservice, such as in grocery stores and convenience stores

- non-commercial food service establishments including lodging, recreation (sports and entertainment) venues, educational establishments, and other markets, such as hospitals and prisons; also known as managed services

Demand for single-use plastic foodservice products is forecast to grow 3.5% annually to $14.3 billion in 2027, with growth boosted by continued recovery in the full-service restaurant, lodging, education, and recreation sectors. Furthermore, growth at retail stores will remain healthy due to the continued proliferation of fresh, ready-to-eat options available in-store.

Limited service restaurants account for the largest share of foodservice disposables demand, accounting for 64% of the total, due to the reliance of quick service restaurants on single-use products for both on and off premises dining, as well as their general popularity.

In addition, disposables usage will see above average growth in the fast casual sector as these establishments continue to gain market share in the restaurant industry. Fast casual outlets are increasing their focus on carryout and delivery sales and are also seeing a greater than average shift to higher value and more sustainable packaging, which helps gives customers a sense that these restaurants serve fresher, healthier foods.

Pricing Patterns

The foodservice disposables industry is competitive, and product pricing is a significant factor in customer purchasing decisions. Factors influencing prices for foodservice disposable products include:

- raw material and labor costs

- shipping and transportation costs

- supply and demand balances

- customization, design, and printing costs

- changes in the material mix for various products

- increasing participation in and corresponding competition from products made of newer and more innovative materials

- import competition

Raw material price fluctuations tend to have the greatest effect on pricing although product mix can also be important. The price of plastic goods such as foam and rigid plastic cups, dinnerware, and plastic containers is largely determined by the price of polystyrene, polypropylene, polyethylene, and PET resins, which, in turn, are affected by crude oil and natural gas prices.

Despite the significance of raw material costs as a base influence on disposables prices, pricing for single-use foodservice products does not always track raw material costs, as manufacturers tend to absorb raw material price increases as much as possible to maintain competitiveness. In addition, foodservice establishments can switch from one type of disposable to another if cost becomes an issue and this limits the ability of disposables producers to pass on increasing materials costs as well.

Demand by Material

Plastic single-use foodservice products include disposable goods made from rigid plastic, flexible plastic (plastic film), and foamed plastic. The plastic used can be either conventional plastic, derived from petroleum or natural gas, or bioplastics, which are derived from renewable resources.

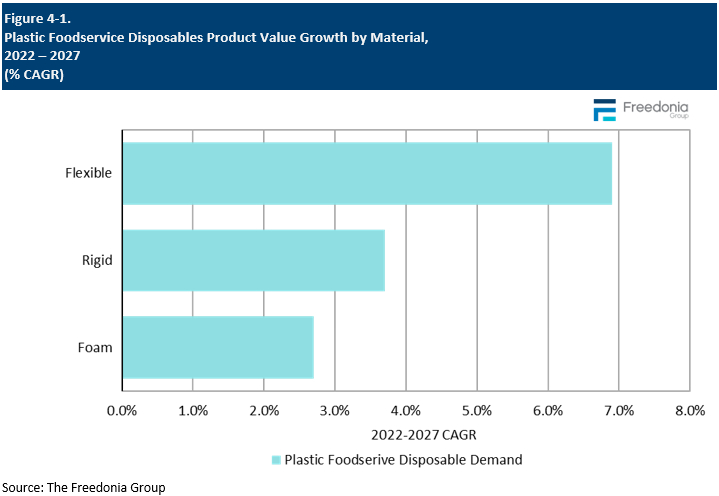

Demand for single-use foodservice products made from plastic is expected to grow 3.5% annually to $14.3 billion in 2027:

- Rigid items account for by far the largest share of the single-use plastic foodservice product market – 62% in 2022 – and will see good growth in demand. Cups, clamshells, and other containers made from plastic are ubiquitous and continue to enjoy healthy demand because of their favorable performance properties.

- Demand for plastic foam foodservice single-use products will register the slowest growth, due to the material’s slow decomposition rate and inability to be easily recycled, which have made it the target of consumer, business, and municipal restrictions meant to increase sustainability.

- Flexible plastic demand will benefit from strong growth in beverage packaging applications.

Bioplastics, which historically have played a minor role in the foodservice industry, are expected to see strong growth in demand going forward as new products with better performance and sustainability profiles enter the market and prices become more competitive.