Report Overview

What are top drivers of power lawn equipment through 2027?

-

Both consumers and professionals will increasingly adopt battery-powered products.

-

Commercial demand will help maintain market size.

This Freedonia industry study analyzes the $15.2 billion US market for power lawn and garden equipment. It presents historical demand data (2012, 2017, and 2022) and forecasts (2027 and 2032) by product (lawn mowers; turf and grounds mowers; trimmers and edgers; garden tractors and tillers; chainsaws; blowers, vacuums, and sweepers; snow blowers; other power lawn and garden equipment; parts and attachments), power source (engine-driven, corded electric, cordless or battery-powered), market (consumer, commercial), and region (Northeast, Midwest, South, West). Annual data from 2019 – 2026 is also presented. The study also presents consumer survey data and evaluates company market share of key industry players such as Alamo Group, Ariens, Bad Boy Mowers, Briggs & Stratton, Chervon, Deere, Honda Motor, Husqvarna, Kubota, Stanley Black & Decker, STIHL, Techtronic Industries, Textron, Toro, and Yamabiko.

Featuring 185 tables and 57 figures – available in Excel and Powerpoint! Learn More

Check out our discussion on Outdoor Power Equipment

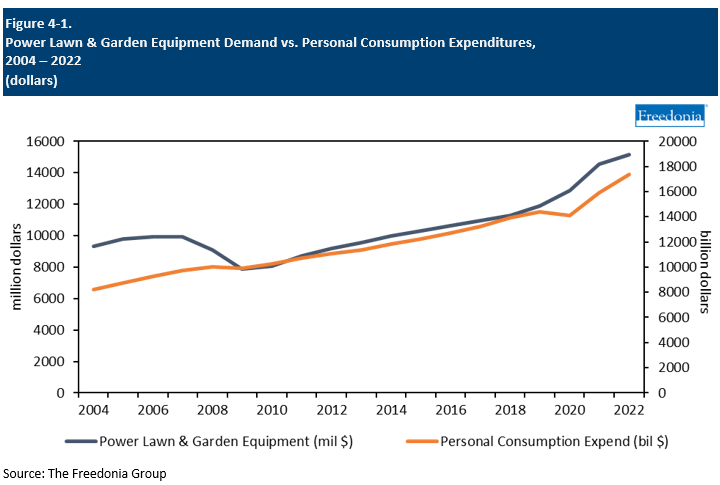

Demand for power lawn and garden equipment is expected to grow less than 1.0% per year through 2027, reaching $15.8 billion. Gains in market value will be restrained by a decline in unit demand following the pandemic-related surge in power lawn and garden equipment sales in 2020 and 2021. In addition, price growth will slow following inflation- and supply chain-related spikes in 2022. However, a continued shift to higher end equipment, such as those that are battery-powered, and a stronger outlook for the commercial market (which uses higher value equipment) will support growth.

Ongoing Development of Battery-Powered Models Key to Market Growth

Going forward, market value gains will result from the introduction of higher-value equipment to the US market. Suppliers of power lawn and garden equipment frequently release new and upgraded products to expand their lines. Most notably, battery-powered products continue to see innovation with better, longer-lasting batteries and more brands and equipment from which to choose. Furthermore, battery-powered equipment lines increasingly allow end users to interchange batteries with other lawn and garden equipment for added convenience, encouraging greater sales of these products.

Commercial Market Shows Better Sales Growth Through 2027

Prior to the pandemic, the commercial market had grown at a faster rate than the consumer market, as the trend toward “Do It For Me” (DIFM) landscaping increased. However, a shift to DIY lawn care occurred in 2020, causing consumer demand to surge. In 2021, while DIY activity remained strong, some consumers began to once again rely on professional landscaping services, supporting robust sales of power lawn and garden equipment to the commercial market. As a shift to pre-pandemic trends – with consumers opting to have professionals take care of some or all of their yard maintenance done by professionals –continues, demand in the commercial segment, specifically the landscaping establishment segment, will grow at a faster rate. While some US consumers will continue to perform yard maintenance themselves, an aging population and increasingly active lifestyles among consumers (which leaves less time for yard work at home) will converge to precipitate greater levels of professional service. Additionally, commercial users will benefit from gains in multifamily housing completions, as rental companies or homeowners’ associations often contract out lawn care and landscaping services for these buildings.

US Production & Trade Balance

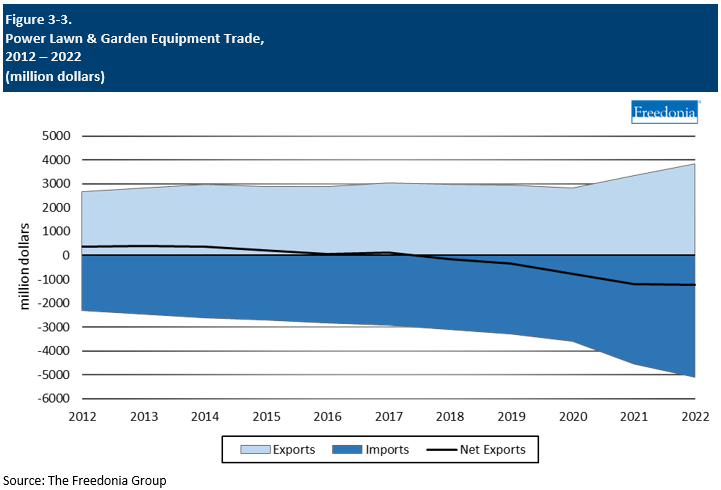

Shipments of power lawn and garden equipment from facilities in the US totaled $13.9 billion in 2022. While the US remains the largest producer of power lawn and garden equipment in the world, growth in US production continues to trail gains in demand. In 2022, the US had a trade deficit of over $1 billion. Historically, the US was a net exporter, but that has shifted since 2018 and has ballooned in the last few years leading into 2022.

The growing trade deficit is a result of strong gains in the imports of electric power lawn and garden equipment. Imports of products such as electric lawn mowers and chainsaws have shown substantial growth. These gains indicate the shift from ICE to electric-powered equipment, as there is a strong foreign manufacturing base for electrically powered outdoor power equipment.

It is expected that US producers of power lawn and garden equipment will continue to face competition from foreign producers, hindering the success of US firms in both the domestic market and export markets. By 2027, the country is expected to have an even larger gap between imports and exports, with imports continuing to outpace exports.

Nonetheless, the US continues to be a strong producer and exporter of higher power riding lawn mowers, as domestic lawn mower manufacturers have widely recognized brands and strong reputations for quality.

Markets Overview

The main outlets for power lawn and garden equipment are consumer users, which represented 62% of sales in 2022. However, that share is expected to slowly shrink through the forecast as the commercial market typically outperforms the consumer market year over year. In 2020, that trend shifted as an increase in DIY projects resulted from the COVID-19 pandemic, but it has now reverted back to the historical norm.

Despite this shift, the commercial market is expected to see growth through 2027, rising 2.4% per year. Although a strong market for DIY landscaping remains, a return to the DIFM trend will benefit landscaping and lawn care companies. Gains will also be supported by product improvements like upgrades to battery-powered as well as connected products. However, the golf industry is expected to limit further gains for the commercial market as the number of operating golf courses is expected to continue to decline.

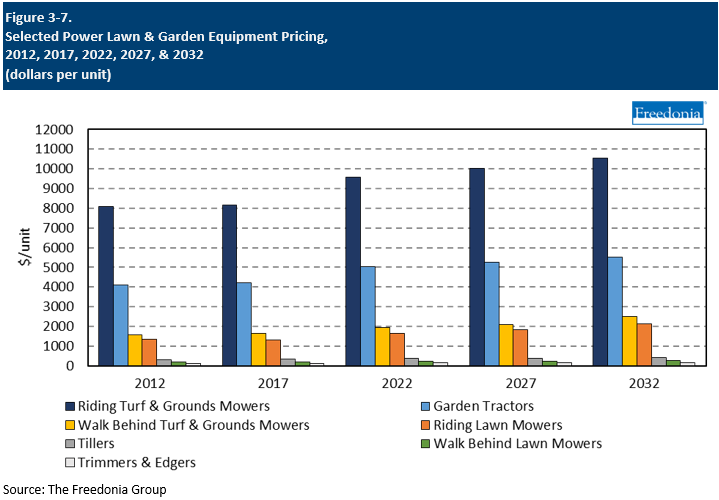

Pricing Patterns

Power lawn and garden equipment prices differ by market segment and product type based primarily on the size, features, and relative performance of the equipment. For example, a high-end commercial turf and grounds mower can cost over $20,000, while a consumer handheld electric trimmer can sell for a little less than $50.

The overall price of equipment in general depends on a variety of factors including the cost of manufacturing and raw materials and the mix of products being used.

In 2022, prices rose substantially in all product categories as high demand for products, including power lawn and garden equipment, led to supply chain issues and bottlenecks, causing price inflation to spread throughout the economy. Riding power lawn and garden equipment was particularly hit by price gains as well as commercial products. While price growth is expected to moderate in 2023, gains will continue year over year through the forecast.

The average price for power lawn and garden equipment is expected to increase 2.2% per year through 2027. Gains will primarily derive from the shift in product mix toward higher-value equipment, as more expensive, better performing battery-powered versions continue to be developed and there is further adoption of robotic mowers.

However, further pricing growth will be restrained by competition from low-cost imports. For instance, foreign-produced electric trimmers and edgers are popular in the US due to their cost advantages compared to domestically manufactured products, hampering average price growth for these products.

Consumer Disposable Income & Spending Patterns

The market for power lawn and garden equipment is highly dependent on the financial health and outlook for US consumers. US consumer spending and disposables incomes directly and indirectly affect the power lawn and garden industry. Consumers purchase new equipment for their own use or landscaping services from professionals who purchase upgrades or replacement parts and attachments for their business.

Personal consumption expenditures are expected to rise 4.2% per year through 2027. While this rate is only slightly slower than the previous period, much of that is a result of a steep deceleration in durable goods spending. The subpar outlook for durable goods is due in part to a stagnant price outlook for the overall category, but also indicative of the strong growth seen in the historical period. Much like power lawn and garden products themselves, overall durable goods rose rapidly in both 2021 and 2022. Personal consumption expenditures of durable goods will see a relative reset following this spike. Likewise, the market gains for power lawn and garden equipment will show an outlook that is below the 2012-2022 compound annual growth rate.

Meanwhile, consumer disposable incomes will continue to grow at relatively the same pace as the historical five-year period. This trend is optimistic for the power lawn and garden industry as it will gradually add to the buying power of consumers and allow opportunities for future sales.