Report Overview

See this presentation with graphs, data and geographical representations of the important residential market.

-

Cabinets are among the most popular features to upgrade as part of a kitchen or bathroom remodel

This Freedonia study analyzes the US residential cabinets industry.  It presents historical demand data (2011, 2016 and 2021) and forecasts (2026 and 2031) by product (base, wall, tall), market (single-family, multifamily, and manufactured housing), application (new and remodeling), and by region and subregion. Demand for all products is measured in unit terms and value terms. The study also evaluates factors that will influence residential cabinet demand and discusses key suppliers and market share.

It presents historical demand data (2011, 2016 and 2021) and forecasts (2026 and 2031) by product (base, wall, tall), market (single-family, multifamily, and manufactured housing), application (new and remodeling), and by region and subregion. Demand for all products is measured in unit terms and value terms. The study also evaluates factors that will influence residential cabinet demand and discusses key suppliers and market share.

Featuring 33 tables and 29 figures – available in Excel and Powerpoint! Learn More

This report includes data from 2011-2031 in 5 year intervals and tables featuring year-by-year data for 2018-2025.

Demand for residential cabinets in the US is forecast to rise 2.9% annually to $23 billion in 2026, a deceleration from the 2016-2021. Gains will be supported by:

- more intensive use of cabinets in homes; single-family housing will account for the largest share of cabinet demand in the US

- the older nature of the nation’s multifamily housing stock – building owners looking to rejuvenate their properties to attract tenants will do so by replacing older or worn cabinetry

- builder efforts to create more attractive and unique residences by installing cabinets in rooms where they were not traditionally installed, such as mudrooms and laundry rooms

Functionality Is a Key Factor for Cabinet Remodeling Projects

Remodeling continues to account for the majority of cabinet demand, as cabinets are one of the most frequently updated components of a kitchen or bathroom, particularly when a home is bought or sold. In addition to aesthetics, their ability to facilitate better usage of a particular room is important. For example:

- Homeowners often add islands or bar-style seating to kitchens to improve their functionality. This additional surface space is usually attached to base cabinets, which offer expanded kitchen storage.

- The construction of additional bathrooms to assist in making easier to age-in-place or to create multigenerational living spaces often involves installing cabinets to allow for the storage of a variety of items.

Entertainment Center Cabinets to Exhibit the Fastest Growth of Any Product Type

Cabinets installed outside of kitchens and bathrooms are forecast to see healthy demand growth. Entertainment centers are forecast to experience the fastest growth of any cabinet type. Demand gains for entertainment centers will be supported by:

- style trends that call for homes to have larger living room areas that increase the amount of space available for large, floor-to-ceiling entertainment centers

- aesthetic trends, such as turning the living room into a focal point by having large entertainment centers that are used to display and store various “tchotchkes”, personalizing the area

- the desire of consumers to turn the “dead” space around their TV into functional space by purchasing larger wall unit entertainment centers

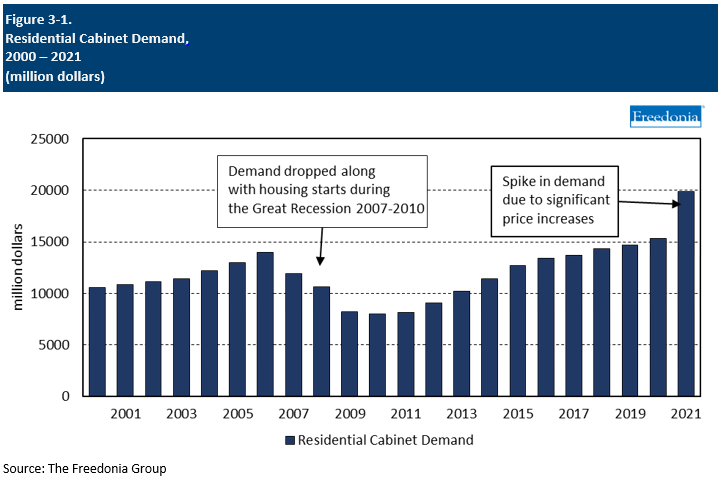

Historical Market Trends

In any given year, residential cabinet demand is driven by a number of factors, including:

- new housing construction levels

- single-family residential remodels, which often include the replacement of kitchen cabinets or the addition of more cabinets

- mortgage interest rates and the availability of financing for remodeling

- shifts in consumer tastes and focus, such as a change in preference toward cabinets with little or no formaldehyde, solid wood cabinets over composites, or concerns about indoor air quality

Demand grew every year over the historical period, as significant single-family housing remodeling activity in the US supports a steady level of demand for new residential cabinets. In 2021, a surge in market value was partly related to rapidly rising prices that resulted from increasing inflation and supply-chain issues.

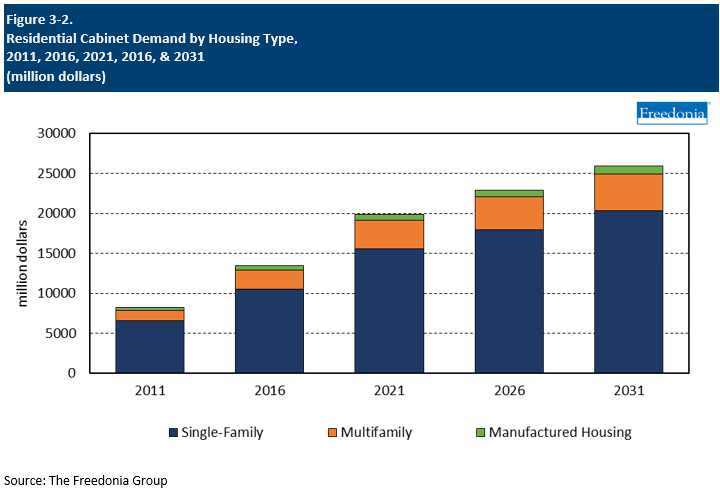

Demand by Housing Type

Demand by Housing Type

Single-family homes accounted for the vast majority of residential cabinet demand in 2021 and will continue to do so through 2026, supported by the:

- substantial number of single-family homes constructed in any given year

- large base of existing single-family homes, many of which are older and have smaller kitchens and only one bathroom

- bigger kitchens and bathrooms in single-family residences compared to those of multifamily housing units and manufactured homes

Demand for cabinets in manufactured housing will also rise. However, the smaller size of these housing units compared to those of single-family homes will serve as a check on gains, especially in key remodeling applications.

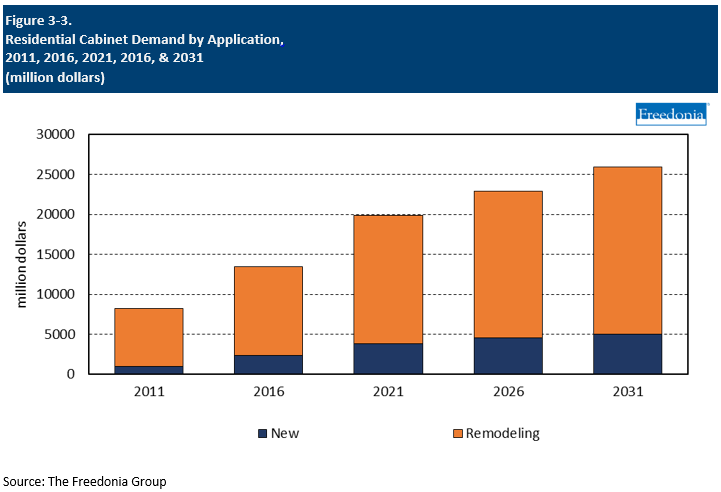

Demand by Application

Demand by Application

New vs Remodeling

Remodeling applications, which account for the much larger share of residential cabinet demand, will represent 80% of the market in 2026. Remodeling activity plays a more significant share in generating residential cabinet demand due:

- the more frequent use of costlier semicustom and custom cabinets in remodeling applications, while homebuilders more often specify less expensive stock cabinets

- homebuilders being more likely to install shelves or racks for storage space due to their lower cost and ease of installation

- homeowners more frequently adding to the number of cabinets in kitchens, bathrooms, and other rooms during renovation projects

Demand by Region

Demand by Region

The South will remain the largest regional market for cabinets and will account for most demand gains, driven by strong growth in population and existing home sales. As more people move to the South and purchase homes, residential renovation demand for cabinets will rise as homeowners remodel kitchens and bathrooms either prior to the sale of a home – to make it more appealing to potential purchasers – or after a purchase – when the new homeowners personalize the house to their preferences.

The West, which is the second largest regional kitchen cabinet market, will record healthy demand gains. Residential cabinetry demand in both the Midwest and Northeast will grow at a slower pace over this period due to below average home sales and a stagnation in new housing construction.