Report Overview

Key questions answered in this report:

Key questions answered in this report:

-

How are abrasives costs evolving as supply chains stabilize?

-

Will CMP applications remain a major growth area?

-

Which emerging markets hold the strongest opportunities?

This Freedonia industry study analyzes the $52.3 billion global abrasives industry. It presents historical demand data (2013, 2018, and 2023) and forecasts (2028 and 2033) by material (nonmetallic, metallic), product (coated, bonded, loose grains and powders, metallic), market (durable goods manufacturing, cleaning and maintenance, other markets), and region (North America, Central and South America, Western Europe, Eastern Europe, Asia/Pacific, Africa/Midesat). Abrasives raw materials demand is also addressed. The study also evaluates company market share and competitive analysis on industry competitors including Bosch, Entegris, Saint-Gobain, 3M, and Winoa Group.

Featuring 274 tables and 94 figures – available in Excel and Powerpoint! Learn More

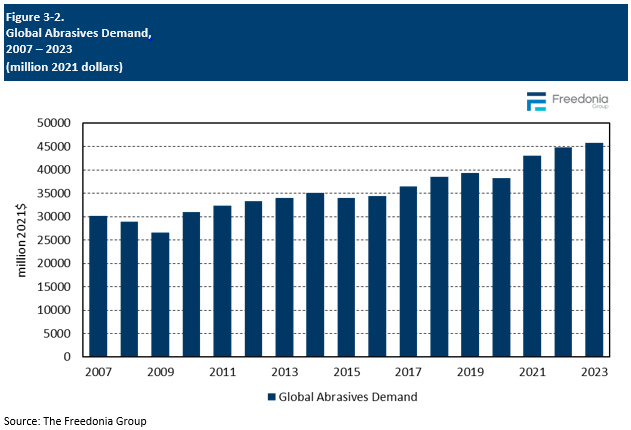

Global demand for abrasives is forecast to rise 5.2% per year to $67.3 billion in 2028, fueled by rising durable goods manufacturing activity worldwide. The pace of growth in inflation-adjusted terms will be similar to that in the 2018-2023 period. However, an expected moderation in pricing increases following a period of high inflation will lead to slower demand gains in nominal terms.

Healthy Growth in Semiconductor Manufacturing Drives Gains in Electronics Market

Electrical and electronic equipment manufacturing was the fastest growing market for abrasives from 2018 to 2023, and this trend will continue through 2028. Growth was especially rapid for electronics manufacturing. In particular, rising production of semiconductors led to rapid gains for abrasives used in the chemical mechanical planarization (CMP) process, and these applications led to fast growth in China and Taiwan.

In 2023, global semiconductor manufacturing declined from pandemic-era highs, and many producers of CMP abrasives saw their sales fall. However, the semiconductor industry showed signs of recovery in the fourth quarter of 2023, and global electronics manufacturing in the aggregate is expected to rise at a healthy rate going forward. Concerns about supply chain security and Taiwan’s fraught relationship with China also pose opportunities for growth in CMP abrasives demand in other countries, most notably the US.

Rapid Growth Expected Throughout Southeast Asia

Over the 2023-2028 period, China, India, Indonesia, Taiwan, and Thailand are all expected to be among the world’s fastest growing national markets for abrasives. In addition, a number of countries that are currently relatively minor abrasives markets – such as the Philippines and Vietnam – are also forecast to post rapid growth.

Gains will be driven by broad expansion of durable goods manufacturing industries throughout the area. These countries feature both fast growing domestic markets and expanding export-oriented manufacturing industries, with high levels of foreign investment from both Chinese and Japanese firms and Western multinationals. In addition, the attractiveness of manufacturing in the area will support sizable expansion of local abrasives industries to bolster rising demand.

Production Costs Stabilizing Following Period of Volatility

Beginning with the onset of the COVID-19 pandemic in 2020 and continuing into 2023, abrasives producers faced unusually high growth in manufacturing costs. Prices for key materials like iron and steel surged, while elevated energy costs contributed to rising prices for a wide variety of synthetic materials. Transportation costs spiked due to both high petroleum prices and strained capacity for international shipping. As a result, manufacturing costs for abrasives producers increased rapidly, leading to price increases and especially fast market expansion in dollar terms.

By 2024, prices for most raw materials had come down from pandemic-era highs, and logistics issues associated with the pandemic had mostly faded. As a result, stabilizing production costs are expected to lead to slower, more historically normal pricing increases, and abrasives producers will face a less volatile and uncertain logistics environment.

Historical Market Trends

Global demand for abrasives is linked to several broad economic indicators, including:

-

manufacturing of durable goods, such as machinery, transportation equipment, and fabricated metal products

-

consumer spending levels

-

construction activity

Durable goods manufacturing applications account for the bulk of abrasives sales and are the largest driver of variation in demand. Durable goods applications for abrasives tend to be broad and mature, with these products finding widespread use throughout a variety of manufacturing processes. As a result, demand for abrasives tends to be linked to variation in the overall level of durable goods manufacturing. No particular durable goods manufacturing industry predominates, and the intensity of abrasives use in manufacturing processes sees little year-to-year variation.

Among smaller markets for abrasives, construction represents a relatively volatile segment, potentially subject to large fluctuations. Consumer spending impacts abrasives demand primarily two separate segments:

In general, spending on abrasives for cleaning and maintenance applications is tied to the broad level of economic development in a country, with rising income levels both directly stimulating consumer sales and raising expectations for cleanliness in public spaces. As a result, this market tends to steadily expand globally as economic conditions improve in lower-income countries.

The size of the abrasives market in value terms is also influenced by pricing pressures, including raw materials costs, labor costs, and energy costs. Periods of high inflation – like that which occurred from 2021 to 2023, in the wake of the COVID-19 pandemic – can lead to especially fast market expansion in value terms.

Production by Region

Global abrasives production is forecast to increase 5.2% per year to $67.3 billion in 2028. Production is regionally concentrated to an even greater extent than demand, and the Asia/Pacific region, North America, and Western Europe are collectively expected to account for 93% of global growth in abrasives production between 2023 and 2028.

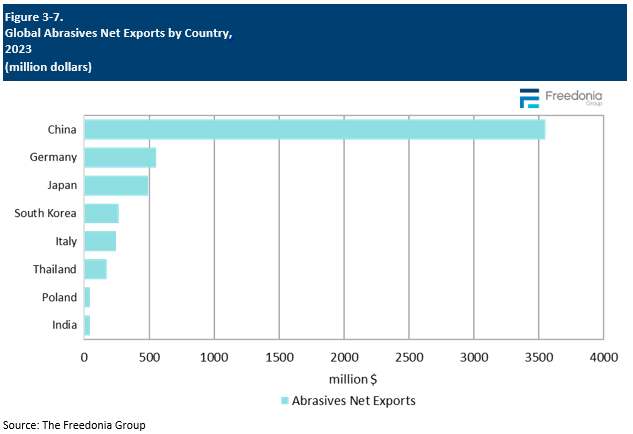

The Asia/Pacific region is projected to post the fastest growth through 2028, fueled by both strong gains in local demand in industrializing nations in the region and greater production for export to other global regions. China is by far the world’s largest abrasives producer, and Japan, India, and South Korea all rank among the top six globally as well. While production growth will generally be stronger among lower- and middle-income countries in the region, Japan and South Korea will still remain leading suppliers of higher-value abrasive products.

North America is forecast to post solid growth, mainly due to growth in the massive US market. Production growth in Western Europe is expected to be subpar, reflecting both weak outlooks for local demand and high production costs that will pose challenges for West European producers looking to compete in international markets.

Abrasives production in the Africa/Mideast region and Central and South America will remain underdeveloped, with most production capacity dedicated to meeting local market needs. Growth in Eastern Europe will be supported by growing domestic markets, with East European producers also seeing some opportunities for increased export to Western Europe.

International Trade

Foreign trade in abrasives products is extensive, with as much as 30% of world abrasives output being traded internationally in any given year. However, several factors limit the intensity of abrasives trade:

-

widespread availability of raw materials

-

the commodity-grade nature of many abrasive products

-

high weight of many products, which makes them expensive to ship

Through 2028, the Asia/Pacific region’s trade surplus in abrasives is expected to widen. Chinese exports will continue to capture a sizable share of demand growth in both higher-income and developing markets worldwide, while offshoring efforts by Chinese producers will also contribute to greater exports from Southeast Asian nations. India is also expected to build an expanded trade surplus after fluctuating between net imports and net exports of abrasives during the 2010’s.

Western Europe’s trade surplus in abrasives contracted between 2013 and 2023, and this trend is expected to continue going forward. West European producers face a challenging competitive environment due to the region’s combination of high labor costs and high energy costs. Due to this, abrasives imports into the region are expected to increase rapidly, and export growth from Western Europe is projected to be sluggish.

North America held the largest trade deficit in abrasives in 2023, and this is expected to widen through 2028. However, high import levels are mainly due to the massive size of the US market. The US is still a significant exporter of abrasives, as the local industry has particularly strong capabilities in the manufacture of higher end products.

Eastern Europe’s trade deficit in abrasives is forecast to widen through 2028, albeit not particularly quickly. Growth in domestic markets will lead to strong growth in imports, but this will be offset to an extent by rising manufacturing of abrasives for export, particularly to higher-income West European markets.

The Africa/Mideast region and Central and South America will both see their trade deficits widen going forward. Investment in these regions by foreign multinationals has historically been limited, restricting local manufacturing capabilities.