Report Overview

What access control products are the best performing?

-

Card-based systems to remain most popular access control option

-

Electromechanical locks to achieve increased market penetration

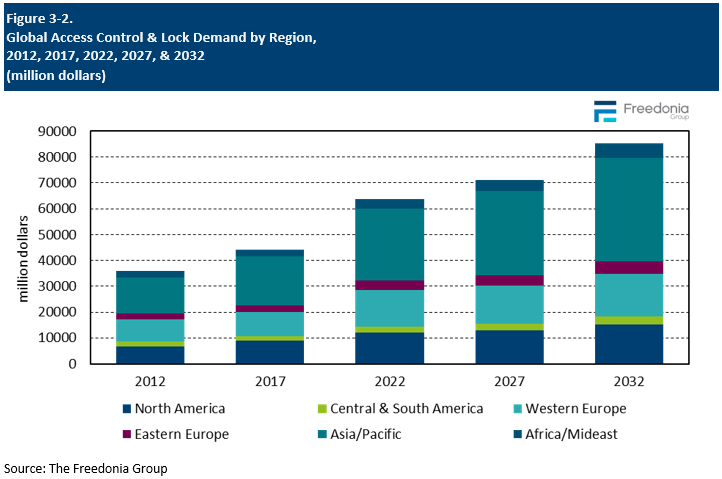

This Freedonia industry study analyzes the $63.6 billion global access control and lock industry.  It presents historical demand data (2012, 2017, and 2022) and forecasts (2027 and 2032) by product (door locks, padlocks and other locks, card-based access controls, biometric access controls, keypad/combination access controls) and region (North America, Central and South America, Western Europe, Eastern Europe, Asia/Pacific, Africa/Mideast). The study discusses the impact of the COVID-19 pandemic. The study also evaluates competitive analysis on industry competitors including Allegion, ASSA ABLOY, and, Dormakab.

It presents historical demand data (2012, 2017, and 2022) and forecasts (2027 and 2032) by product (door locks, padlocks and other locks, card-based access controls, biometric access controls, keypad/combination access controls) and region (North America, Central and South America, Western Europe, Eastern Europe, Asia/Pacific, Africa/Mideast). The study discusses the impact of the COVID-19 pandemic. The study also evaluates competitive analysis on industry competitors including Allegion, ASSA ABLOY, and, Dormakab.

Featuring 83 tables and 59 figures – available in Excel and Powerpoint! Learn More

This report includes data from 2011-2031 in 5 year intervals and tables featuring year-by-year data for 2018-2025.

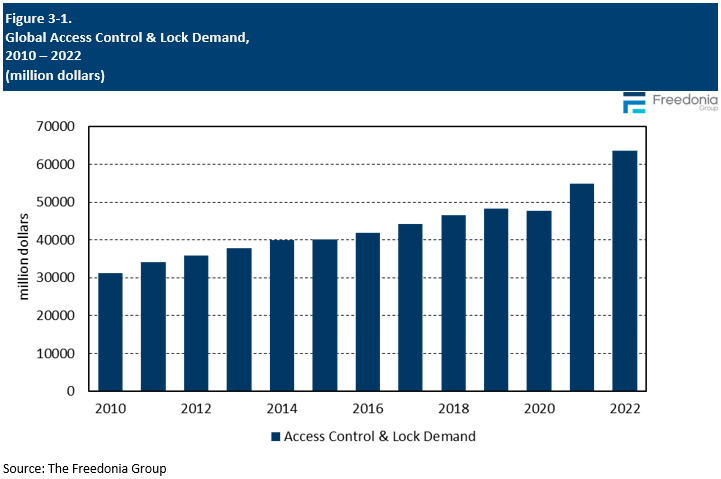

Global demand for access controls and locks is projected to increase 2.3% per year to $71.2 billion in 2027. Growth will be driven by rising building construction spending, particularly in industrializing countries, as most buildings require at least basic locks. Increased penetration of electromechanical locks will also boost the market size in dollar terms. Sales value growth will slow compared to the 2017-2022 period, when economic disruption associated with the COVID-19 pandemic contributed to elevated rates of price increases.

Electromechanical Locks & Access Controls to Grow in Tandem

Sales growth for electromechanical locks will be linked to trends in access controls, as these products are – at least to some extent – complementary. However, while many access control systems contain fully integrated electronic locks, electromechanical locks can also be sold as standalone products. Moreover, those kinds of installations can serve as a stepping stone to the eventual implementation of an access control systems. This will be a particularly important driver of growth in high-income nations where markets for conventional locks are mature.

Card-Based Access Controls to Remain Most Popular Option

Card-based access control systems are the most widely used worldwide, and therefore make up the largest share of sales in this segment. The popularity of these systems is attributable to both their cost-competitiveness and their usability for managing access. Key benefits of card-based systems are their ability to flexibly manage access – including setting temporary access periods or dealing with areas with multiple layers of access security – and the possibility to easily integrate these systems with smartphone apps.

Biometric access control systems are expected to gain market share because they offer all the benefits of card-based systems at a higher level of security. However, high costs will continue to limit the use of biometric systems to areas where security carries a particularly strong premium. Keypad and combination-based access control systems will continue to lose market share going forward, as managing these systems carries considerable logistical drawbacks.

Lock Prices Likely to Remain Volatile

Prices for locks increased considerably during the COVID-19 pandemic since their manner of construction makes them sensitive to changes in materials and energy costs. Surging metal costs in 2021 and 2022 challenged suppliers’ bottom lines and led to multiple rounds of price hikes.

By the end of 2022, prices of key raw materials – like steel – had fallen significantly from their peaks and appeared to have settled within range of pre-pandemic norms. As a result, it is likely that recent price increases – some of which were implemented as temporary surcharges – will be rolled back to an extent, resulting in a shrinking market value in 2023. However, this segment remains sensitive to developments in energy and materials markets.

Historical Market Trends

Spending on access controls and locks varies over time, and often extensively, across markets and is influenced by factors such as the:

- real and perceived exposure to crime or potential losses

- level of expected losses

- nature of activities

- use of alternative security products and services

Historically, the broader security industry has been perceived as resistant to recession and thus relatively stable. Recessions are typically associated with increased risk of crime and/or the perception thereof – even when not actually reflected in official crime data. As a result, those who can afford it will often step-up security spending during times of economic instability.

However, security spending is still impacted by broader economic and demographic trends, including:

- capacity for discretionary spending among both consumers and commercial entities

- building construction activity, which impacts the stock of buildings that may require security

- changes in urbanization and population density

- relative costs of equipment and labor

The market for door locks tends to be relatively tightly tied to building construction activity, as these products are a ubiquitous and standard component of buildings in most developed markets. As access controls are more of a discretionary, value-added product, markets for these products may not be as closely linked to building construction activity.

The mix of security equipment used in each geographic area is a function of the types of crimes and other security breaches most prevalent there, the number and affluence of potential end users, and the availability and relative sophistication of local private security resources.

Other important determinants of local product demand include the:

- stability of the electric grid (for all types of electronic security equipment)

- incentives relating to local insurance and building codes

- prevalence of competitive protective measures such as guard services, firearms, and structural security items (e.g., fences, lighting, walls, gates, window bars, and shutters)

Demand for access controls and locks fell in 2020 as building construction spending declined worldwide in the first year of the COVID-19 pandemic. However, sales achieved strong growth in both 2021 as recoveries in building construction industries were accompanied by high levels of price growth for access controls and locks.

Demand by Region

Global demand for access controls and locks is forecast to rise 2.3% per year to $71.2 billion in 2027. Market expansion in value terms will be restrained by falling prices, as the market size in 2022 was elevated due to inflation and ongoing supply chain issues associated with the COVID-19 pandemic.

The Asia/Pacific region is projected to account for the largest share of demand gains, supported by solid growth in the Chinese and Indian markets. Increased industrialization and urbanization throughout the region will also fuel sales gains, with a greater share of buildings featuring modern access control and lock systems. Increased industrialization and urbanization in India and various Southeast Asian countries will also fuel sales gains.

Economic development in lower and middle-income nations will likewise contribute to market growth in the Africa/Mideast region and in Central and South America. Solid growth in building construction activity is also expected in Eastern Europe, although population declines will temper the pace of gains in the region.

Markets for conventional security products in North America and Western Europe are highly saturated and tend to be mature. However, high income levels in these regions create opportunities for adoption of higher-value products like biometric access controls.

Pricing Trends

Pricing is an important consideration among buyers when selecting security equipment. Factors that impact the price of security equipment include:

- costs of raw materials and components

- labor, energy, and logistical costs

- the presence or absence of value-added features

- level of commoditization

Producer prices for locks range from under $10 for basic mechanical locks to several hundred dollars for more advanced electromechanical locks. Lock prices tend to be relatively volatile, as raw materials can account for a large share of production costs.

Access control system prices, which are typically quoted in terms of cost per door (or access point protected), can range from $300 to $600 per door for magnetic stripe card-based or proximity-based systems to several thousand dollars per door for biometric systems.

For most of the 2010s, prices of mechanical security equipment rose at a modest pace, while prices of electronic security equipment were flat to declining. Price declines for electronic security equipment were linked to improved production processes and increased competition – particularly from Chinese producers with lower production costs – as these products became more commoditized.

Prices for security equipment were significantly impacted by supply chain issues associated with the COVID-19 pandemic. Prices rose at an above average rate in 2021 before further spiking in 2022 as materials, components, energy, and logistical costs rose. The costs of producing locks reached all-time highs, reflecting a sensitivity to materials costs common to highly commoditized fabricated metal products. Manufacturing costs for electronic security products like video equipment reached their highest level since the early 2000s.