Report Overview

What is fueling video surveillance growth?

-

Strengthening IP camera capabilities

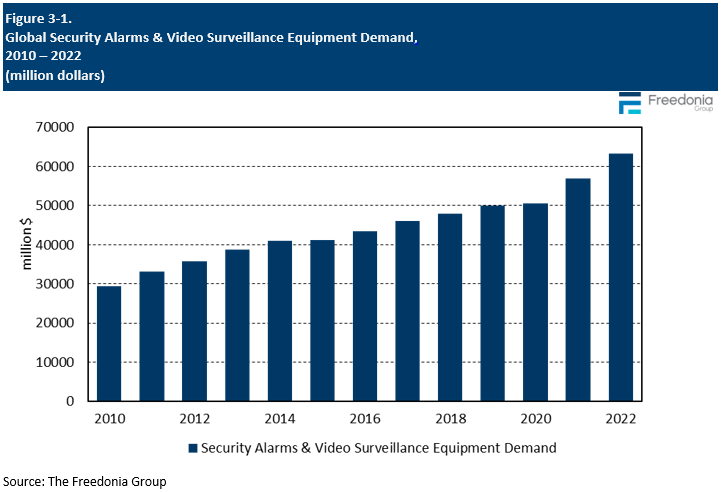

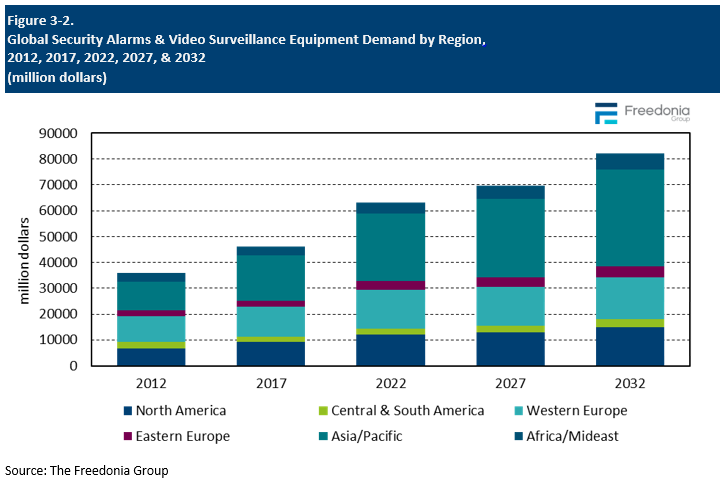

This Freedonia industry study analyzes the $63.3 billion global security alarm and video surveillance equipment industry. It presents historical demand data (2012, 2017, and 2022) and forecasts  (2027 and 2032) by product (life safety alarms, intrusion alarms, PERS alarms, video cameras, other video surveillance equipment) and region (North America, Central and South America, Western Europe, Eastern Europe, Asia/Pacific, Africa/Mideast). The study discusses the impact of the COVID-19 pandemic. The study also evaluates company market share and competitive analysis on industry competitors including Dahua Technology and Hangzhou Hikvision.

(2027 and 2032) by product (life safety alarms, intrusion alarms, PERS alarms, video cameras, other video surveillance equipment) and region (North America, Central and South America, Western Europe, Eastern Europe, Asia/Pacific, Africa/Mideast). The study discusses the impact of the COVID-19 pandemic. The study also evaluates company market share and competitive analysis on industry competitors including Dahua Technology and Hangzhou Hikvision.

Featuring 83 tables and 60 figures – available in Excel and Powerpoint! Learn More

This report includes data from 2011-2031 in 5 year intervals and tables featuring year-by-year data for 2018-2025.

Read the blog on Smart Home Security

Global demand for security alarms and video surveillance equipment is forecast to increase 2.0% per year to $69.7 billion in 2027; rising building construction spending will contribute to gains worldwide. Growth will be driven by rising sales of video surveillance cameras, which will achieve increased market penetration – particularly in industrializing countries – as costs fall. However, sales value growth will decelerate compared to the 2017-2022 period, which saw atypically high price increases.

Smart Technology Driving Gains for Video Surveillance Products

Demand for video surveillance cameras is expected to pick up particularly rapidly, boosted by the expanding capabilities of analytics features. Smart analytics technology can:

- preemptively flag suspicious activity

- minimize false alarms

- interface with building management and building automation systems

- provide valuable intelligence for optimizing layouts in retail and other building settings

These sorts of features are greatly expanding the value-added proposition of video surveillance systems, and they will remain key areas of development. However, technological advancements that make video cameras more useable may negatively impact sales of other video surveillance products. For example, use of cloud storage and the ability to interface with surveillance systems via standard smartphones and tablet computers will restrict the need for dedicated supplementary video surveillance equipment.

Residential Surveillance Market to Continue Rapid Development

Doorbell cameras (and similar products) targeted at residential users have been one of the fastest growing product categories in recent years, a trend that is expected to continue. These products are particularly popular in the US but are also projected to achieve strong market penetration in West European nations. Ongoing price reductions have greatly increased the potential for sales of video surveillance cameras to residential users, such that they tend to be very affordable for homeowners in high-income nations. As in nonresidential markets, technological advances allowing for integration of these products with smartphones have contributed to increased market penetration. While doorbell cameras dramatically rose in popularity in the US over the 2017-2022 period, they have substantial room for further market share growth – both in that country and elsewhere.

Market Saturation Restraining Growth for Security Alarms

While alarms were the leading product in 2022, they are projected to fall below video surveillance equipment by 2027. Markets for these products are particularly saturated in higher-income nations where basic products, like fire alarms and smoke detectors, have long been mandated in building codes. As a result, growth in these nations will require broader increases in building construction spending. However, construction industries in many applicable nations – particularly in Western Europe – are mature, so growth in developing nations will be necessary for more substantial gains. PERS alarms do represent a growth segment, reflecting aging populations in the US and Western Europe, where these products are most common. However, these still represent a small share of the total.

Historical Market Trends

Spending on security alarms and video surveillance equipment varies over time, and often extensively, across markets and is influenced by factors such as the:

- real and perceived exposure to crime or potential losses

- level of expected losses

- nature of activities

- use of alternative security products and services

Historically, the security industry has been perceived as resistant to recession and thus relatively stable. Recessions are typically associated with increased risk of crime and/or the perception thereof – even when not actually reflected in official crime data. As a result, those who can afford it will often step-up security spending during times of economic instability.

However, security spending is still impacted by broader economic and demographic trends, including:

- capacity for discretionary spending among both consumers and commercial entities

- building construction activity, which impacts the stock of buildings that may require security

- changes in urbanization and population density

- relative costs of equipment and labor

The mix of security equipment used in a given geographic area is a function of the types of crimes and other security breaches most prevalent there, the number and affluence of potential end users, and the availability and relative sophistication of local private security resources.

Other important determinants of local product demand include the:

- level of development of the telecommunications infrastructure (for monitored alarms)

- stability of the electric grid (for all types of electronic security equipment)

- incentives relating to local insurance and building codes

- prevalence of competitive protective measures such as guard services, firearms, and structural security items (e.g., fences, lighting, walls, gates, window bars, and shutters)

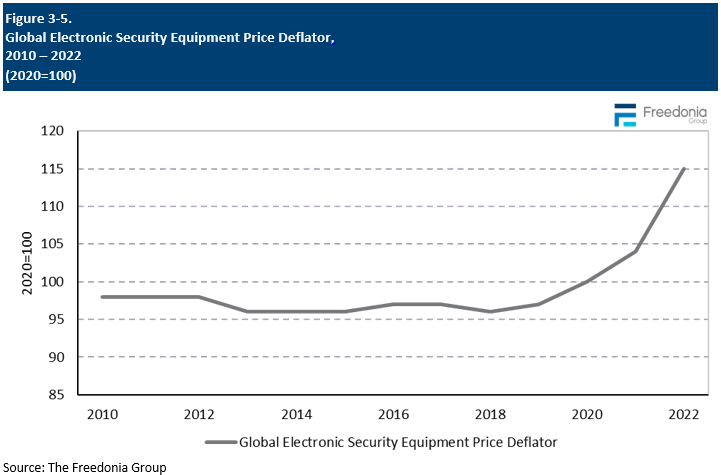

Between 2020 and 2022, the market for alarms and surveillance equipment entered into a period of considerable volatility. Demand growth slowed significantly in 2020 due to the impact of the COVID pandemic, as social distancing measures reduced spending on building construction and improvement in many segments of the commercial market, such as retail establishments. Sales growth in dollar terms in 2021 and 2022 was boosted by price increases, as supply chain issues and the inflationary environment surrounding the pandemic interrupted the long-term trend of falling prices for video surveillance equipment.

Demand by Region

Global demand for security alarms & video surveillance equipment is forecast to rise 2.0% per year to $69.7 billion in 2027. Market expansion in value terms will be restrained by falling prices, at least in the short term, as the market size in 2022 was elevated due to inflation and ongoing supply chain issues associated with the COVID-19 pandemic.

The Asia/Pacific region is projected to account for the largest share of demand gains, due primarily to solid growth in the massive Chinese market, where video surveillance systems will continue to be deployed in publicly trafficked places at a particularly high rate. The country’s government is also a particularly intensive segment for video surveillance. Increased industrialization and urbanization in India and various Southeast Asian countries will also fuel sales gains.

Economic development in lower and middle-income nations will likewise contribute to market growth in the Africa/Mideast region and in Central and South America. Solid growth in building construction activity is also expected in Eastern Europe, although population declines will temper the pace of gains in the region.

Markets for conventional security products in North America and Western Europe are highly saturated and tend to be mature. However, high income levels in these regions create opportunities for adoption of app-integrated and smart electronic security products targeted at the residential market, which still holds considerable potential for growth.

Pricing Trends

Pricing is an important consideration among buyers when selecting security equipment. Factors that impact the price of security equipment include:

- costs of raw materials and components

- labor, energy, and logistical costs

- the presence or absence of value-added features

- level of commoditization

Security product prices range from less than $10 at the manufacturers’ level for commodity-type items such as battery-powered smoke detectors to several hundred dollars for higher-end video surveillance cameras. Prices of complete security alarm or video surveillance systems for larger users can easily measure in the thousands of dollars when including installation costs.

For most of the 2010s, prices of electronic security equipment were flat-to-declining. Price declines for electronic security equipment were linked to improved production processes and increased competition – particularly from Chinese producers with lower production costs – as these products became more commoditized.

Prices for security equipment were significantly impacted by supply chain issues associated with the COVID-19 pandemic. Prices rose at an above average rate in 2021 before further spiking in 2022 as materials, components, energy, and logistical costs rose. As a result, manufacturing costs for video surveillance equipment reached their highest level since the early 2000s.

While it remains to be seen exactly how sticky pandemic-related inflation will be, as of late 2022 costs for energy and many raw materials appeared to be trending back toward historical norms after surging in 2021 and 2022. As conditions normalize, it is expected that prices of electronic security equipment will fall from their elevated 2022 levels. Price declines are projected to begin as soon as 2023, with prices forecast to fall overall between 2022 and 2027. Once the process of normalization is complete, it is expected that price trends will tend toward historical norms, with technological advances continuing to reduce the cost of manufacturing electronic security equipment.