Report Overview

Featuring 89 tables and 46 figures – available in Excel and Powerpoint! Learn More

This study examines the US market for food packaging,  defined as primary and secondary packaging materials sold to food manufacturers, primarily for products targeted at retail or foodservice markets. Historical data are provided for 2012, 2017, and 2022, with forecasts through 2027. Annual data is provided for 2019-2026. Data are provided in current dollar value and units. Also provided is an analysis of key industry players.

defined as primary and secondary packaging materials sold to food manufacturers, primarily for products targeted at retail or foodservice markets. Historical data are provided for 2012, 2017, and 2022, with forecasts through 2027. Annual data is provided for 2019-2026. Data are provided in current dollar value and units. Also provided is an analysis of key industry players.

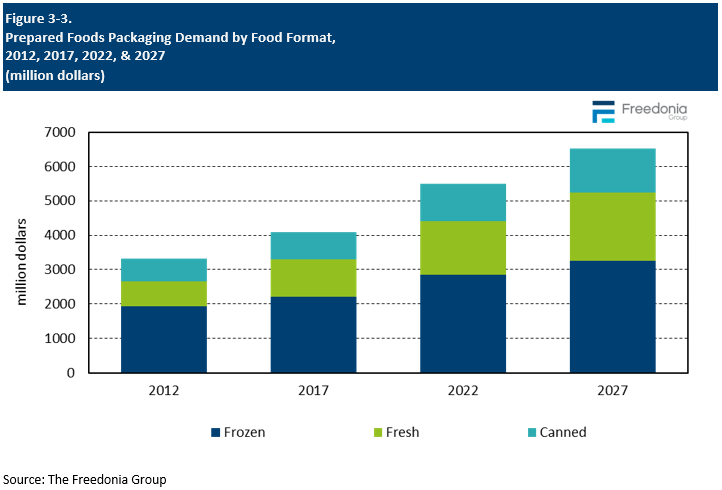

Demand for prepared food packaging is forecast to increase 3.5% per year to $6.5 billion in 2027, with real growth of 2.1% per year to 63 billion units. Gains will be supported by increased demand for fresh (refrigerated) prepared foods such as grab-and-go dinners, salads, and sandwiches at grocery and convenience stores. Market value will also be boosted by the shift to higher value packaging formats such as stand-up pouches, two-piece plastic containers, and molded fiber trays and bowls.

Plastic Remains Top Prepared Foods Packaging Material Despite Sustainability Concerns

While concerns over the sustainability of plastic packaging continue to rise, its performance and cost benefits and firmly established role in supply chains have maintained plastic’s dominance in the prepared food packaging market. In order to address sustainability concerns, plastic manufacturers continue to increase the use of recycled content in their products, reduce the amount of plastic used per packaging unit, and focus on improving the overall plastic recycling rate.

Strong Interest in Health & Convenience Driving Demand for Fresh/Refrigerated Foods

Fresh/refrigerated prepared foods represent the fastest growing format for prepared foods packaging. Consumers are increasingly looking for quick meal solutions and easy alternatives to restaurant meals, and this has led retailers to expand their offerings of fresh prepared food options throughout the store. With the resumption of normal activities and busier lifestyles following the COVID-19 pandemic, there is renewed demand for convenient on-the-go meal solutions that are perceived as being relatively healthy.

Packaging, such as clamshells and two-piece containers, have grown in popularity as they can effectively protect these foods while also making their contents visible, allowing consumers to confirm the freshness of the food.

Dinners Will Be the Largest Application for Prepared Foods Packaging

Dinners will account for the largest share of prepared foods packaging demand due to the convenience of these meals for a wide varitey of consumers. Prepared dinners allow consumers who are crunched for time to eat a meal without preparing it from scratch or enduring a lengthy cooking process. These meals can also reduce food waste by offering right-sized portions, which can be important for small-sized households or elderly consumers. Prepared dinners will continue to incorporate higher value packaging that either facilitates cooking (e.g. steamable packaging) or is more sustainable (e.g., molded fiber trays and bowls).

Historical Market Trends

Shifts in demand for prepared food packaging from year to year are determined by a few factors, primarily related to the production and marketing of food products. These activities in turn are influenced by:

-

demographic trends such as age, average household size, and levels of disposable income

-

consumer spending on food and the balance between at-home and away-from-home meals

-

food preferences (e.g., demand for enhanced convenience or for organic products)

-

restaurant and other foodservice industry revenues

In addition, several competitive variables determine the mix of packaging types used and their cost, including:

-

raw material and conversion costs

-

changes in the mix of foods being packaged, particularly in terms of food format (canned, frozen, fresh)

-

trends in packaging size and format, such as shifts toward smaller single-serving packages, family size units, or multipacks

-

the proportion of food that is sold via retail channels versus foodservice establishments

-

environmental and regulatory factors, including trends such as source reduction, the use of recycled content, and recyclability

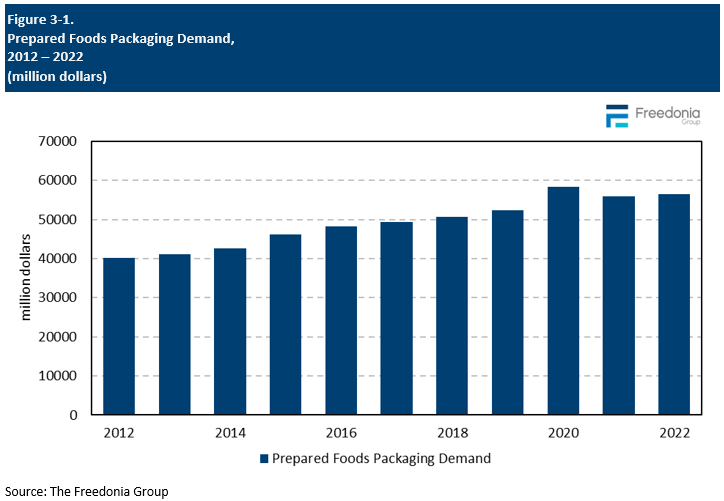

Prices for prepared food packaging experienced a strong acceleration compared to previous years due to the significant inflation following supply chain issues caused by the 2020 pandemic. However, unit demand in 2021 declined as consumers began to revert to their normal shopping habits. While unit demand rose at a relatively slow rate in 2022, market value grew significantly due to price hikes as supply chain issues continued to plague to industry.

Demand by Food Format

The types of packaging used in the prepared food industry rely heavily on what food is being packaged, especially the technologies used for food preservation. Different food formats require packaging with different performance characteristics based on how the food will be shipped and stored before and after purchase.

The most prevalent prepared food formats are frozen, fresh/refrigerated, and canned, respectively.

Frozen foods are the largest format for prepared foods packaging. Comprising over half of the prepared foods format demand in 2022, frozen foods will see its market share decline in 2027 due to their market maturity. This foods format’s demand share is due both to the large amount of frozen food produced as well as the need for high performing packaging to protect frozen food from damage and maintain food quality:

-

Packaging is important in providing shelf appeal for frozen food, including an image of how the food will look when prepared, which has a strong influence on consumer food purchasing decisions.

-

The best opportunities for packaging in frozen prepared food will continue to be in frozen dinners, as they remain the most popular type of frozen prepared foods.

Fresh/refrigerated is expected to grow at the fastest pace of any prepared food format, as consumers increasingly prefer more convenient fresh/refrigerated grab-and-go meals at groceries and convenience stores.

Demand for canned prepared foods will be supported by the increasing use of aseptic cartons for prepared foods such as soups. However, continued consumer preference for frozen and fresh/prepared foods will restrain any gains in canned’s share of prepared foods packaging demand.

Sustainability in Packaging

While environmental concerns have impacted the choice of packaging in the food industry to some degree for decades, sustainability has recently become one of the most important trends in the global manufacturing industry. Packaging is a high-profile target for those looking for sustainability improvements because it is used pervasively by most industries worldwide, is generally meant to be disposable, and often finds its way into the environment.

However, the pursuit of sustainability is not straightforward, as packaging must also continue to provide acceptable performance, especially in the food industry where it plays a key role in maintaining food quality and safety. In addition, for foods to remain affordable and food companies to remain profitable, packaging costs will remain a key variable in packaging choice.

To understand whether a specific type of packaging is truly sustainable, other factors must also be considered beyond the renewable nature of its raw materials and the final packaging’s levels of recyclability or compostability. These factors include:

At present, there is no one perfect packaging choice for all applications. Most packaging materials currently on the market have advantages and disadvantages, even the newer products are being introduced primarily for their sustainability merits. Packaging end users must choose the product that provides the best balance of cost, performance, and environmental impact and then find a way to help customers understand the benefits of that packaging choice.

Consumer Preferences

Demand for food packaging and the mix of packaging products used are influenced heavily by consumer preferences, which in turn are driven by issues such as convenience, food safety, sustainability, and cost.

With busier lifestyles, households of all sizes want food that is easy to purchase, prepare, and eat. This desire for convenience has increased the demand for ready-to-eat meals at retail locations like grocery stores, as well as the popularity of meal delivery kits and on-the-go snacking.

Previously, the push for convenience led to the popularity of processed foods that required minimal preparation. More recently, consumer preferences for convenience are combined with those for fresh and healthy foods, including fruits and vegetables, dairy, and prepared fresh foods.

Along with the nutritional facts printed on labels of their foods, more than ever, consumers are keenly interested in where their food is sourced and processed. Consumers, especially in younger generations, have shown a willingness to pay a premium for such attributes as:

-

organic

-

locally sourced

-

humanely raised

-

plant-based

-

fair-trade

-

non-GMO ingredients

Those interested in the above food characteristics also often show a preference for certain types of food packaging, especially packaging seen as more sustainable. Food producers and sellers who combine healthy and responsibly sourced and packaged foods with convenience and low cost will benefit the most.