Report Overview

Packaged Facts found that parents seek out packaged foods with a health halo for their children.

Packaged Facts found that parents seek out packaged foods with a health halo for their children.

-

Plant-based

-

No artificial ingredients

-

Low sugar

-

High protein

When it comes to purchasing food, taste is the number one priority for most consumers. For parents, their children’s willingness to eat a given food is a close second. Compared to all consumers, parents are more likely to prioritize food characteristics that provide a health halo such as high protein, healthy fats, clean label, and non-GMO.

Read the Blog: 3 Noteworthy Trends in the Children’s Food and Beverage Market

Opportunities exist in offering products that have the taste that will get a child to accept the food and the health halo that will entice parents to buy it, given that parents tend to be more health-conscious and choosy about foods for their kids and themselves.

Products free from common allergens – such as nuts, dairy, eggs, and gluten/wheat – are also a high priority for parents, particularly those who have children with real or perceived allergies or intolerances. Some parents may also believe some allergens are generally unhealthy (especially gluten and soy) and seek out foods without these ingredients for their children.

Additionally, parents are concerned about allergy friendly foods even when their own children do not have food allergies, as their kids may have friends or peers with a food allergy that needs to be accommodated. Schools, sports teams, daycares, and other child-centric organizations sometimes restrict foods with certain allergens for all children to protect those with a food allergy. Thus, parents tend to have more reasons to avoid potential allergens (often for their kids, or for other children their kids come in contact with).

With a focus on “what’s next” and current consumer trends, Children’s Food and Beverage Market: Trends and Opportunities is packed with insights about parent trends, behavior, and motivations to help food producers, retailers, packaging companies, employers, and investors gauge consumer perspectives and find areas for growth in a competitive market.

Children’s Food and Beverage Market: Trends and Opportunities delivers actionable predictions and recommendations designed to guide producers, retailers, and investors in making business decisions by providing data and insights about parent behavior and what parents think about food.

Scope

Children’s Food and Beverage Market: Trends and Opportunities is the go-to source for a complete understanding of U.S. consumer trends regarding children’s food and beverage products. This report combines Packaged Facts’ extensive monitoring of the food and beverage market with proprietary surveys, and evaluates current trends and future directions for marketing and retailing, along with consumer patterns during the pandemic and inflation area and across the broader food and beverage market.

This Packaged Facts report analyses the market for children’s food and beverage products. Retail sales of food and beverages marketed for children are projected to grow at an average rate of 4.6% annually through 2028.

Parent demographics, perceptions, motivations, and behavior are examined as pertaining to food and diet choice and attitudes about health, since parents purchase the vast majority of food on behalf of their children. Food habits and preferences of children, as reported by their parents, are also examined. Effects of the COVID-19 pandemic on consumers are also analyzed in a broad sense as well as in the context of children’s food and beverages.

Retail sales of children’s food and beverage products are provided in billion dollars from 2018 to 2022, with expected sales estimated for 2023 and sales projected from 2024 to 2028.

Retail sales in this report are defined as sales of children’s food and beverage products from venues such as:

-

Grocery stores, supermarkets, and discount grocers (e.g., Kroger, Safeway, ALDI)

-

Mass merchandisers (e.g., Walmart, Target, Meijer) and warehouse clubs (e.g., Costco, Sam’s Club, BJ’s)

-

Convenience stores (e.g., Pilot/Flying J, Circle K, 7-Eleven) and dollar stores (e.g., Dollar General, Family Dollar)

-

Other retailers, such as co-ops, gift shops, and farmers markets

-

All online outlets, including online-based grocers (e.g., Amazon, Thrive Market, FreshDirect), third-party pack-and-deliver companies that use their own workforces to purchase groceries at various stores and deliver them to customers (e.g., Instacart), brands that sell their own food products direct-to-consumer via their websites, and online sales from websites or apps of retailers in the previous categories

The reasons for and implications of shifts in consumer perception and behavior are analyzed in the context of future market opportunities.

Additionally, Children’s Food and Beverage Market: Trends and Opportunities has dozens of tables highlighting numerical survey data on consumer demographics and psychographics as well as numerous marketing photographs. This report goes in-depth on COVID-19 and inflation trends that have affected the food and beverage market.

Report Methodology

The information contained in Children’s Food and Beverage Market: Trends and Opportunities was developed from primary and secondary research sources. Primary research includes interviews with food and beverage market experts; participation in and attendance at food industry events; and extensive internet canvassing.

Primary research also includes national online consumer polls of U.S. adult consumers (age 18+) conducted on an ongoing basis by Packaged Facts to analyze attitudes of consumers and their relevant food and beverage preferences.

Survey data from MRI-Simmons are used to analyze the demographics and psychographics of parents and age/number of children in the household.

Supplementing Packaged Facts’ exclusive surveys are analysis of the 2022 and 2023 Food & Health Surveys conducted by the International Food Information Council, which analyze consumer food purchase decisions, diet and lifestyle choices, snacking activity, and perception of health benefits in foods.

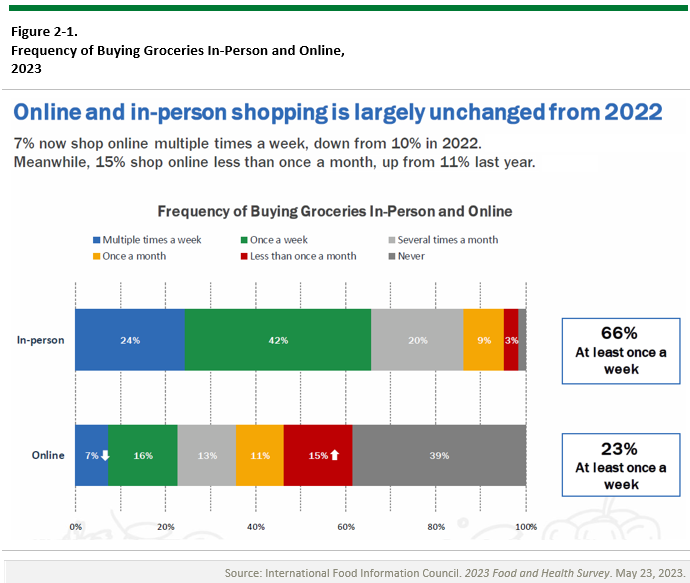

Frequency of Grocery Shopping in 2023: In-Person vs. Online

The International Food Information Council’s (IFIC) 2023 Food and Health Survey conducted in May 2023 indicated that online ordering frequency may be decreasing somewhat compared to 2022, though overall use of online shopping was largely unchanged. In the organization’s 2021 survey, 20% of consumers reported buying groceries online at least once per week; that number rose to 25% in 2022 and fell to 23% in 2023.

Online grocery shopping activity skyrocketed in 2020 as the pandemic prevented some people from getting out to shop. Concerns about COVID-19 were very high in 2020 because a vaccine was not yet available for the public. As concerns have waned, people are no longer shopping for groceries online because of the pandemic. Instead, online grocery shopping has become an established habit for some people, largely for convenience.

Consumers who have children are more likely to value online grocery shopping for its convenience since they are very busy and may not have much time to shop. Additionally, parents of young children may have to bring their kids on shopping trips and take them into a grocery store, which can be inconvenient. Online grocery shopping (either for delivery or curbside pickup) is much more convenient when parents have young children and reduces the amount of time spent on a shopping trip. It is also important to note that greater varieties of children’s food and beverage products are available for purchase online than in many local stores; this is particularly true of small startups that ship products directly to customers but lack traditional retail distribution.