Report Overview

Services like Rappi, iFood and others have seen explosive user adoption rates as consumers embrace the convenience of having restaurant meals delivered.

Services like Rappi, iFood and others have seen explosive user adoption rates as consumers embrace the convenience of having restaurant meals delivered.

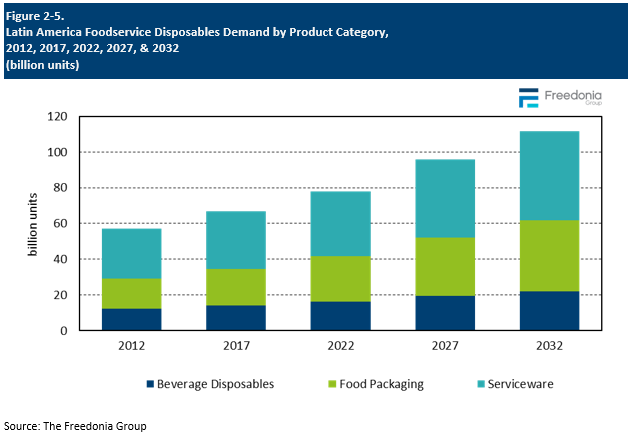

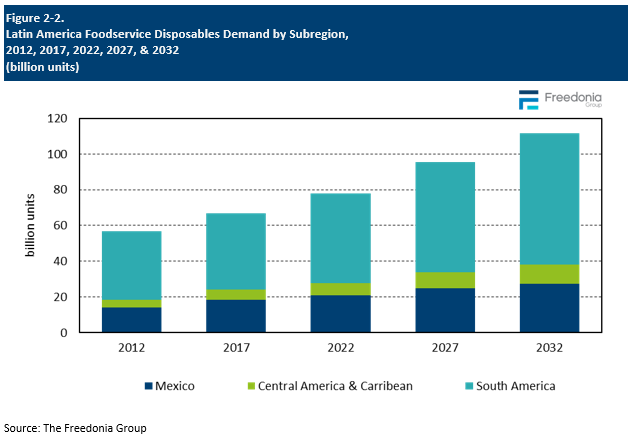

This Freedonia industry study analyzes the $2.4 billion single-use foodservice products (foodservice disposables) industry in Latin America. It presents historical demand data (2012, 2017, 2022) and forecasts (2027, 2032) by product (beverage disposables, food packaging, serviceware), material (plastic, paper and paperboard, other materials), market (fast food and casual, full-service restaurants, other limited service) and subregion (Mexico, Central America and Caribbean, Brazil, Other South America).

Featuring 59 tables and 20 figures – available in Excel and Powerpoint! Learn More

Demand for single-use foodservice products (foodservice disposables) in Latin America is forecast to increase 4.2% per year to 96 billion units in 2027. Growth will be driven by the overall development of the region’s foodservice sector, increasing personal incomes, expansion of the limited service market, and an increase in carryout and delivery orders. These drivers will be offset by sustainability initiatives and growing restrictions on single-use plastic products that are reducing the use of items such as straws, napkins, and lids.

Sustainability Efforts Battle Cost & Cultural Challenges

Consumer and government awareness of environmental issues is growing in Latin America, leading to increasing restrictions on single-use products, especially those made from plastic. This is especially the case in tourist areas, where natural beauty and pristine beaches are keys to attracting visitors and where tourism income is key to local economies.

However, cost remains the leading decider in the purchase of foodservice disposables in Latin America. Though on the rise, the region’s average personal incomes remain low, and a low cost street food sector is prominent. While an influx of large international restaurant chains is boosting the use of more sustainable products and materials, many local establishments are still resistant to moving away from products like plastic bags and foam clamshells.

Limited Service & Carryout/Delivery Orders Boost Growth in Most Countries

The COVID pandemic sharply expanded the number of carryout and delivery orders in most countries, a trend that seems to be durable, aided by expansion on online ordering apps. This expanded disposables use in all sectors, including full-service restaurants that traditionally used few disposable goods. Limited service options such as fast food, fast casual, coffee and snack shops, and convenience stores continue to take a greater share of the foodservice market in Latin America. This is a key driver of disposables demand in the region as these operations tend to use more and a greater variety of disposables than full-service operations.

Food Packaging Drives Gains while Beverage Disposables & Serviceware Trail Average

Food packaging demand will post the fastest gains due to growth in the limited service market. However, the market for beverage disposables will remain underdeveloped due to continued issues with water quality in the region and a reliance on prepackaged beverages. Efforts to reduce plastic straw use will further limit beverage disposables advances. Growth in the use of serviceware will be restricted by the dominance of napkins, which are seeing below average advances due to market maturity.

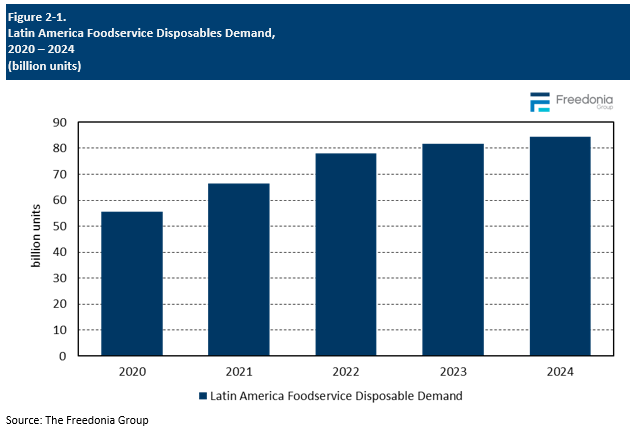

Short-Term Foodservice Disposables Trends

Demand for foodservice single-use items in Latin America reached nearly 80 billion units in 2022, registering over 17% growth in comparison to the previous year and surpassing pre-pandemic levels. Overall demand in units declined dramatically in 2020 due to restrictions related to the COVID-19 virus, although the market has rebounded considerably since then. While many of the impacts of the pandemic are waning, trends toward a much higher level of delivery and takeout orders and growth in the share of restaurant activity held by limited service establishments appear to be a more permanent change and have become main applications for foodservice disposables from all types of restaurants and retail stores with foodservice operations.

Growth in the market value of disposables used in Latin America has been boosted not only by strong rebounding unit growth in recent years but also by inflationary pressures brought on by both general raw material price inflation and supply chain issues. Value growth is also supported by sustainability pressures, which are increasingly driving demand for higher-value products, especially those made from paper and other materials used as alternatives to the foam disposables dominating much of the region’s market.

Regional Trends

Foodservice Disposables Demand by Subregion

Demand for single-use foodservice products (disposables) in Latin America is forecast to increase 4.2% per year to 96 billion units in 2027, valued at US$3.9 billion. Market gains will be driven by increasing consumer incomes and other demographic factors, which are in turn boosting growth in the region’s restaurant, lodging, and entertainment sectors.

Women’s increasing participation in the region’s labor force has boosted the number of dual income households in the region. With two streams of income, these households have more resources to spend on eating out and less time to cook at home, which together fuel demand for dining out or ordering food via delivery or takeout.

Latin America is characterized by the presence of large emerging markets, such as Brazil and Mexico, as well as a number of smaller but still fast developing economies, such as Chile, Colombia, and Peru. Growing urbanization across the region will drive demand as delivery and takeout levels are higher in urbanized areas. In addition, expansion of the foodservice industry in these countries as well as in countries with underdeveloped foodservice sectors will provide good opportunities for disposables suppliers.

Another key factor driving demand for disposables will be continuing active investment in the region by international chains. These global operations not only focus more on takeout and delivery orders but also tend to use greater levels of disposables than locally-owned restaurants and also may use higher-value disposables as well. International chains also are more likely to invest in restaurant water treatment equipment, which enables the use of soda fountains and, by extension, disposable cups.

Increasing concern with the recyclability and sustainability of single-use products has led to rising restrictions on plastic disposables, especially in more populous cities and areas with high levels of international tourism. These restrictions boost opportunities for higher-priced paper, bioplastic, and other alternative materials, which will further drive growth in market value. However, lack of enforcement, the cost effectiveness of plastic and foam products, and culturally-entrenched consumer preferences will maintain plastic’s leadership in many product categories for the foreseeable future.

Product Trends

Demand for single-use foodservice products (disposables) in Latin America is forecast to increase 4.2% per year to 96 billion units in 2027, valued at US$3.9 billion.

-

Growth in units will continue to be driven by the development of the region’s foodservice sector, increasing personal incomes, growth in the share of the market held by limited service establishments, and an increase in carryout and delivery orders. These drivers will be offset by sustainability initiatives and growing restrictions on single-use plastic products that are reducing the use of unnecessary items such as straws, napkins, and lids.

-

While cost pressures from general price inflation are moderating, market value will be boosted by a shift toward higher value disposables for both performance and sustainability reasons. The continued market penetration by international restaurant chains will also play an important role in moving the market toward higher value products.

Serviceware will continue to control the largest share of the regional market in unit terms. It holds this position due to the dominance of napkins in the region, with some parts of Latin America relying heavily on very low priced wax paper napkins.

Beverage disposables hold a much smaller share of the disposables market in Latin America compared to more developed countries despite the region’s high level of soft drink consumption. This results primarily from the very poor water quality found in many countries in Latin America and a related reliance on prepackaged beverages instead of fountain drinks. In addition, low constraints often limit the number of straws, stirrers, and lids that are given with beverage orders.

Food packaging will see the fastest increases in demand, boosted by expansion of the limited service restaurant sector and continued growth in large international and regional restaurant chains, which tend to use more and higher value disposables. In addition, the growing popularity of carryout and delivery orders will boost demand for food packaging even at restaurants that previously relied mostly on reusable items.